We think that creating a budget is one of the best ways to take control of your finances!

Emma can help you set up one and reach your financial goals faster. In this guide, we are going to illustrate the steps you need to take to set up a budget correctly in Emma.

Step 1: Understand why a budget is important

A lot of people are put off from creating a budget because they think it will restrict them from spending their money on the things they love. In reality, having a budget gives you more freedom to spend on things that matter to you.

For starters, setting a budget makes you think about how you’re spending your own money, and means you really assess what’s important to you.

Following a monthly budget also helps you spend within your limits, and can keep you out of debt. It also highlights any opportunities to cut costs, and can therefore help you prioritize adding more money into your saving or investment accounts.

Plus, creating a budget is actually a lot more straightforward than you might think, especially when you use money management apps like Emma.

Follow the steps below to find out how to budget using the Emma app.

Step 2: Find out your monthly income

For most people, you will already know your income after tax, but if you have multiple income sources and want to know how much money you can spend every month, you’re going to need to know how much money comes in every month.

Connect the account that your salary is paid into, and we’ll be able to work out your monthly income.

To find out how much you get paid each month, head to the Analytics section in the Feed tab and check the graph to see your Income, you can also swipe right on the graph to check previous periods.

If you then scroll down and select the “Income” category, you will also see your average monthly income.

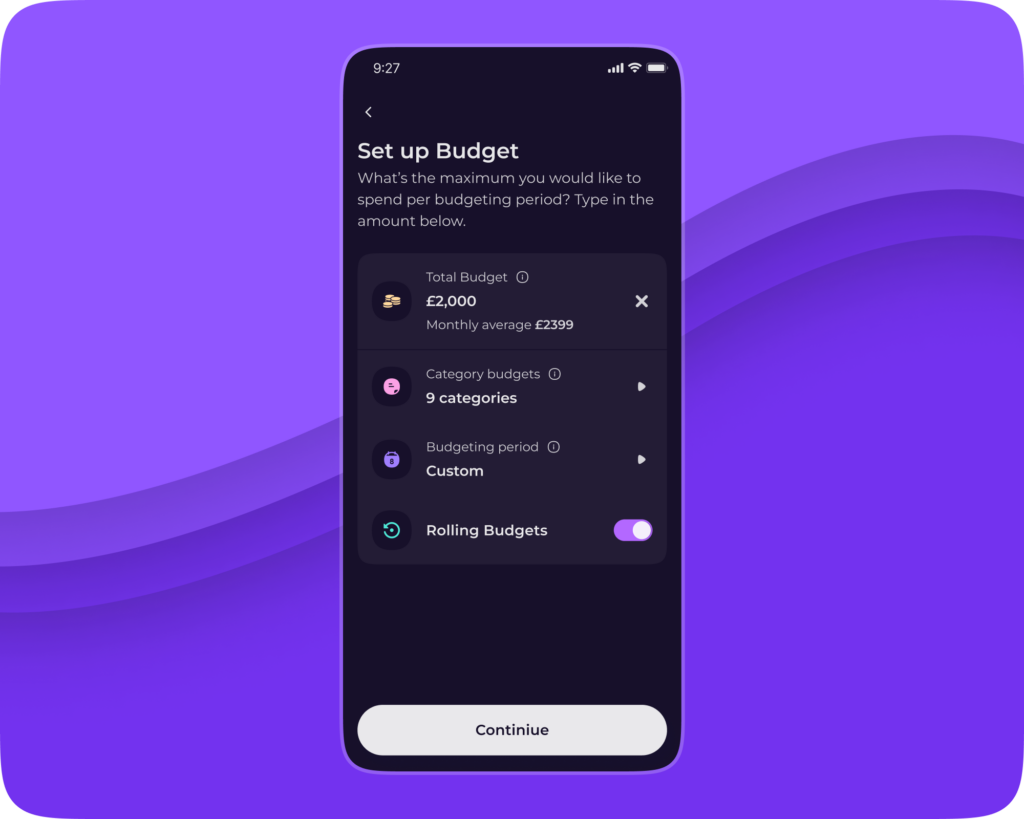

Step 3: Set Your Total Budget

What’s my total budget? The total budget is what you can afford to spend every month and there are two ways we suggest for how you may want to work out your total budget.

If you want to budget for a certain amount so you have funds remaining to save or pay off debts you can calculate your budget like this:

- To keep things simple let’s say you earn £1000 per month after tax and want to save £100 each month. You can set your total budget as £900 so you aim to stick to only spending this amount which leaves you with £100 to use for your savings or paying off debts.

- Alternatively, you can sum the total of your recurring payments to your expected variable spending, that’s your total budget. You might wonder how to find this information? That’s easy, if you open the Emma app, you will see all your recurring payments listed at the bottom of the Feed. This can give you an idea of how much you are spending per month. If you visit the Analytics section, you can also track your variable spending and check the previous months. If your recurring payments add up to £200, you know you have £800 to spend on other expenses which you can allocate accordingly for a total budget of £1000.

It is a good idea to budget for your recurring payments as these are usually payments that you have committed to, for example, bills or subscriptions so you will be required to make these payments each month.

These are also a crucial aspect of your budgeting that you will see displayed as “Committed Spending” once you have fully set up your budgeting.

Step 4: Set Your Budgeting Period

What is a budgeting period? This is the period you want to use to run your budget.

The default period is monthly, which means your budget will be computed from the first of the month till the last day. This is the simplest format and it’s what we suggest to use for people who have irregular incomes.

On the other hand, if you are paid only once, Emma offers the ability to select the start of the period on that date. These are the currently supported budgeting period options in Emma:

- Last working day of the month

- Fixed monthly date

- Variable monthly date

- Twice a month

- Every 4 weeks

- Every 2 weeks

- Every week

We encourage you to explore all the options in the app to see which one works the best for you.

Why is it important to follow payday? If you set your budgeting period in this way, it will start on the first day you get paid. This means you have the opportunity to think about how to allocate your income in the appropriate categories and better manage your period.

The goal here is to save and planning makes it perfect. 😉

Step 5: Set Your Budget By Category

Setting a total budget and budgeting period is a great first step, but if you want to have a more detailed budget, then consider setting a budget by category.

This is where you take your total budget, and divide the money between different areas of spending.

In order to divide your budget by category, you might want to think about what you want to spend your money on, and what your financial goals are, i.e. is adding money to a savings account more important to you than spending money in restaurants?

Next to each category, you’ll see your average spending history. You can use this information to influence how you set your budget by each individual category.

You can also look at your past spending which can help you decide how much money to allocate to each category. To do this, head to the Analytics section, from here you can swipe right on the graphs to view your past spending.

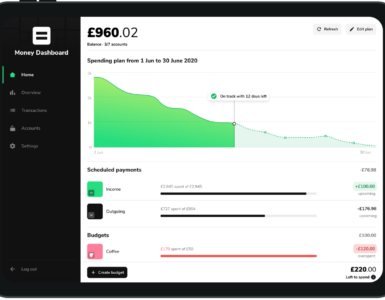

Step 6: Track Your Spending

Now that you’ve set your budget, we’ll help you keep track of your spending by grouping any transactions into your budgeted categories.

Throughout the month you can then check how much of your budget you’ve already spent by opening the Budgeting section and viewing your budget categories and the graph.

If we think you’re likely to go over budget, we’ll drop you a friendly reminder so you can become more mindful of how you spend your remaining money.

Step 7: Review Your Budget

It’s good practice to review your budget every couple of months. Your priorities might have changed, your salary could be different, or your current budget just might not be working.

Head to the Budgeting section, swipe right on the circle chart and you can now view your past budgets and previous pay periods!

Spend some time going back over your past budgets and reviewing how well you’ve stuck to them. If you notice that you are continually going over budget in one area, then make the necessary adjustments.

For example, spending more on groceries than you have budgeted for every month? Either figure out a way to cut the cost of your monthly food shop, or allocate money from another category to spend on groceries.

Reviewing your budget is perhaps one of the most important steps in how to budget using the Emma app, so make sure you use these two new features to review how well your budget is working.

Step 8: Take your Budgeting to the Next Level

If you want to budget like a Pro and get access to more functionality, you might want to consider upgrading to Emma Pro.

This comes with Rolling Budgets, which are useful to allocate the money you have not spent in a budgeting period to the next, and Custom Categories, which can help you track better your money rather than using Emma’s default categories.

Emma Pro also includes Merchant Budgets. These can help you track spending at a specific merchant like Amazon or your favourite supermarket.

[…] See also: How To Budget Using The Emma App […]

[…] I decided that the best way for me to reduce this debt was to keep track of all my accounts and create a strict budget that I had to stick […]