Continuing on from our recent blog post comparing the personal finance apps Chip and Plum we have turned our sights to now comparing Snoop with Money Dashboard. Both apps offer a comprehensive way to manage your personal finances but the two have several different features and benefits so this blog post will break down their features so you can find what works best for you!

Managing your personal finances looks different for everyone as every person has a unique situation and different financial goals. In order to best meet your own goals you need to manage your finances in the way that works best for you. With so many of us turning to money apps to help us with this journey it is important to find the app that works best for you.

Before we break down the specific offerings of each personal finance app it is important to note that Snoop offers both a free and paid subscription plan while Money Dashboard is completely free.

Savings

Both apps are geared towards helping customers to save money by compiling their finances into one central location so users can have a complete picture of their money and spending habits. The way in which they do this is similar but there are a few key differences in their features.

Snoop offers customers the ability to connect their bank accounts, and credit cards so you can see your money all in one place. From here customers can track their transactions, set up a budget, and cut their bills to save more money. Unlike competitor apps like Money Dashboard, Snoop focuses its savings efforts on finding customers better rates on subscriptions, and bills.

The app notifies customers when their bills increase and suggests competitors that offer a better market rate to reduce spending. This focus is very different from other personal finance apps like Emma which offer their own savings accounts within the platform to save their money in the app and earn interest directly.

The Snoop platform is a way to help you save money off of your expenses rather than a place for you to save.

Snoop can help you save money on:

- Broadband

- Car insurance

- Mobile phone

- Insurance

- Credit cards

- Loans

It also helps you save by monitoring price hikes, tracking refunds, spotlighting recurring payments and subscriptions, as well as, finding vouchers and sales for where you shop.

Most Snoop’s savings tools are available on their free plan however there are a few features that are behind a paywall.

For paying subscribers Snoop offers the ability to

- Create unlimited custom spending categories

- Add offline accounts manually

- Track your total net worth

- Track spending from payday to payday

- Create unlimited custom spending reports

- Create unlimited spending & refund alerts

- Track your bills by pay cycle

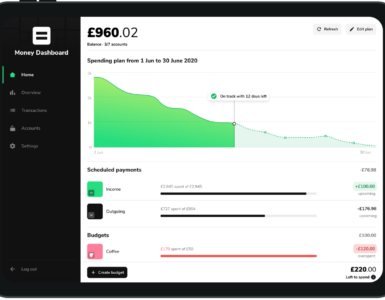

Money Dashboard works in a similar way by utilizing open banking technology to compile your financial accounts into one place. Like Snoop, Money Dashboard does not offer the ability to save within the app itself which competitors like Emma offer.

The goal of Money Dashboard is to be able to help people save money by cutting back on their spending after seeing a detailed overview of their expenditures categorically.

By compiling the data from past months and creating analytics on spending habits from one month to the next, as well as, the ability to set and monitor a budget and recurring charges, Money Dashboard aims to help you save money.

Based on your spending, budget and income, Money Dashboard will create a custom spending plan for you to help you manage your money effectively with the goal of saving more each month.

Money Dashboard’s motto is “spend less, save more” which sums up how they help customers save compared to Snoop which does this while also seeking out better deals.

By creating custom insights based on your income, spending and budget, the app is able to tell you how much you will be able to save that month based on your spending habits. This feature is great for people looking to learn more about their spending habits so they can make adjustments and save more over time.

Budgeting & Analytics

Many consumers turn to personal finance apps for their ability to track spending and income in real-time. These real-time analytics and transaction tracking allows for accurate and automated budgeting to see where your money is going and make more informed decisions.

Snoop focuses on this with its analytics, categorical spend breakdown, budgeting tools, and automatic alerts in the app. Snoop offers a suite of budgeting tools and analytics to help customers manage their money effectively and efficiently.

As part of Snoop’s free plan users can:

- track both monthly and all-time spending

- view spending by merchant or category

- get a weekly spending report

- set and track a monthly budget

- as well as budgets for different categories

When you pay for Snoop Plus you have the additional ability to track spending from payday to payday, create custom spending reports as well as create unlimited spending alerts and refund alerts.

Creating comprehensive insights and budgeting tools is also a major focus of Money Dashboard. Unlike Snoop, all of Money Dashboard’s features are available at no additional cost to users.

With Money Dashboard users can:

- Track spending categorically

- Set a custom budget in the app

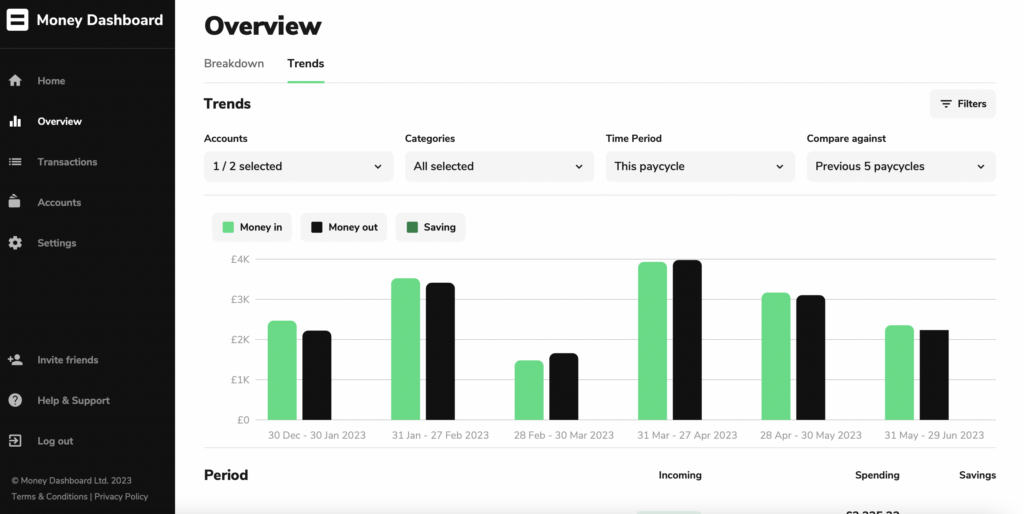

- View the trends of your income, spending, and saving each month

- View spending by merchant or category

Money Dashboard offers the ability to see your spending habits as trends over time whether that be from one account or multiple connected in the app.

Users can further distinguish between all categories or specific categories, as well as, set the time period for which they want to view the trends from the last week, two weeks, pay cycle, month, year or custom dates. You can further decide what time frame you want to compare this data against whether that be compared to other pay cycles, months, weeks or years.

One difference between Snoop and Money Dashboard is that Money Dashboard also compiles your recurring charges from subscriptions into one place so you can keep track of these and hopefully eliminate any that you no longer use.

Additionally, Money Dashboard is able to create a custom spending plan for you based on your balance, scheduled spend, and budget. This plan has the ability to inform consumers when they are going over budget or alternatively coming in under budget and therefore will be left with more money saved this budgeting cycle.

This feature that shows your balance after bills is very similar to Emma’s true balance technology which helps users to know their true spending power. For user’s convenience you can choose the pay cycle that works best for you whether that means starting from the first day of the month, the last working day, or having your budget reset on a weekly, bi-weekly or every 4-week cycle.

For those who like seeing their spending broken down by each transaction, Money Dashboard allows you to export a CSV of your transactions compiled across your accounts for your desired time period. Whether that be the transactions from one week, one month, the whole year or a custom duration Money Dashboard is able to create this report to be exported.

You can even see the transactions from each category if you want it broken down further. For any transactions that may have been mislabelled or miscategorized, you can even rename the transaction to ensure it ends up in the right category.

Integration & compatibility

Another important aspect to consider when choosing a personal finance app that is right for you is ensuring it is compatible with your bank and credit cards. Both Money Dashboard and Snoop connect to major banks and credit cards in the UK. Snoop has 61 integrations in their app, more than their competitors Chip & Plum. Money Dashboard offers 54 connections in the app so it is very similar to Snoop with just a few exceptions.

Overall, both Snoop and Money Dashboard are great financial tools to help take control of your finances. How these apps do so are very similar with a few notable differences.

Depending on your goals and what you are looking to get out of your personal finance app Snoop and Money Dashboard offer great tools. For those looking to aggregate their accounts to one place and save on bills, Snoop may be the app for them. For those looking to gain comprehensive insights into their spending Money Dashboard is a great option.

For those looking for a personal finance app that allows them to both manage the day-to-day and plan for the future, Emma offers both budgeting and spending tools as well as the ability to save and invest in the platform. When choosing a financial app it is important to evaluate what app works best for your financial goals and decide accordingly.

Comparison Table

For quick comparison we took the free and paid plans

| Snoop | Snoop Plus | Money Dashboard | |

| Fees | Free | £4.99 monthly | Free |

| Savings tools | -Finds best deals on the market to save you money -Reduce your bills -Manage subscriptions -See all your bank accounts in one place | Same features as free | -Connect your accounts in one place -Manage subscriptions |

| Analytics | -Monthly and all -Time spend analysis -Weekly spending report -View spending by category & merchant | -Track your net worth -Track spending from payday to payday -Create custom spending report -Create spending and refund alert | -Balance warning notifications -Review how your spending habits have changed -Balance after bills |

| Budgeting Tools | -Daily balance updates -Automatic spending categorization -Set & track monthly budgeting -Set & track budgets for category spend | -Create custom spending categories | -Split transactions for accurate tracking -Creates a custom spending plan for you -Create custom categories |

| Compatibility | 61 bank connections | -Manually add offline accounts | 54 bank connections -Add offline accounts manually |

| Additional | Make bank transfers within the app |

** All facts and figures are accurate at the time of writing June 22nd, 2023.

References:

Add comment