No matter what you are looking for today there is a subscription service that can fulfill your needs. From streaming platforms and meal kits to software subscriptions and beauty boxes, these services provide unparalleled access to products and content tailored to our interests.

However, amidst the allure of these subscriptions, it’s easy to overlook the potential impact they can have on our finances. While some offer the ability to save on the cost of goods and services it is important to be mindful of how much you are spending on subscriptions and where you could be saving.

Without proper management, these seemingly affordable services can accumulate and strain our budgets, leading to unnecessary expenses. But fear not, for in this blog post, we’ll uncover the essential do’s and don’ts that will empower you to harness the full potential of subscription services while keeping your hard-earned money intact.

Let’s explore how you can make informed choices, discover cost-saving strategies, and enjoy the best that subscription services have to offer without breaking the bank.

1. Assess Your Needs:

Before subscribing to any service, take the time to evaluate whether it aligns with your needs and lifestyle. Ask yourself questions like:

- How often will I use this service?

- Does it provide features or content that I can’t access elsewhere?

- Will it genuinely add value to my life or enhance my productivity?

- Can I afford it within my budget?

Avoid subscribing to multiple services that offer similar features or content, as this can lead to unnecessary duplication and increased costs.

2. Take Advantage of Free Trials:

Most subscription services offer free trials to entice potential customers. These trials are a great opportunity to test the service’s offerings and evaluate whether it meets your expectations. During the trial period, thoroughly explore the service and its features to ensure it aligns with your needs.

However, remember to set a reminder to cancel before the trial period ends if you decide not to continue with the subscription. This prevents you from being charged for a service you don’t want.

3. Opt for Annual Plans:

When you find a subscription service you love and intend to use regularly, consider opting for an annual payment plan instead of monthly. Annual subscriptions often come at a discounted rate, effectively reducing the cost per month. This can lead to significant savings over time.

However, before committing to an annual plan, ensure that you genuinely intend to use the service throughout the entire year to make the most of the cost savings.

4. Bundle Services Smartly:

Some companies offer bundle deals that combine multiple services at a reduced price. Bundling can be cost-effective if you use most, if not all, of the included services. For instance:

- A streaming platform might bundle together video streaming, music streaming, and cloud storage services.

- A software subscription might include multiple tools and features in one package.

Carefully assess each bundled service to determine if it aligns with your needs. Avoid getting lured into bundles with unnecessary add-ons that you won’t use, as this can end up costing more than individual subscriptions.

5. Share with Family and Friends:

Many streaming platforms and software subscriptions allow multiple users per account. Sharing the cost of a subscription with family or friends can significantly reduce your individual expenses. For instance:

- On a streaming platform, multiple users can have their profiles and access the content simultaneously.

- For software subscriptions, some companies offer family plans with multiple user licenses.

Make sure to choose sharing partners who have similar interests and preferences for the service to maximise the benefits.

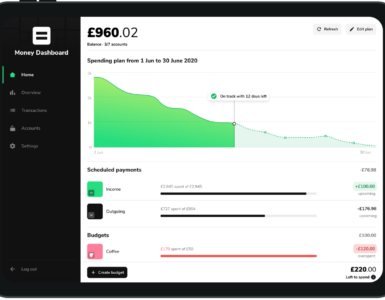

6. Monitor Your Subscriptions:

Subscription services can quickly accumulate, leading to financial waste on services you no longer use or need. Regularly review your subscriptions to ensure you’re getting value from each one. Keep these tips in mind:

- Create a list of all your subscriptions and their respective costs.

- Set reminders to review and evaluate your subscriptions periodically, like once every three or six months.

- If you find a service that you rarely use or no longer need, promptly cancel it to avoid further charges.

Using subscription management apps or financial budgeting tools can be beneficial for keeping track of your subscriptions effortlessly.

The Don’ts:

1. Neglect Cancellation Policies:

Subscription services often have specific cancellation policies. Some may require you to cancel before a certain date or within a specific timeframe. Neglecting to cancel a subscription before the next billing cycle can result in unnecessary charges, wasting your money that you could be saving!

Make sure to understand the cancellation policy of each service and set reminders accordingly to avoid unexpected costs.

2. Ignore Price Increases:

Companies may increase subscription fees over time due to various reasons, such as inflation or expanded content or features. When you receive notifications about price increases, take the time to reevaluate whether the service still justifies the new cost.

If the value no longer matches the price, consider exploring alternatives or canceling the service to save money.

3. Overlook Introductory Offers:

Introductory offers and discounts are common ways for subscription services to attract new customers. While these deals can be tempting, be cautious about subscribing to a service solely because of a temporary discount.

Before committing, assess the regular subscription price and evaluate whether the service is worth it without the discounted rate.

4. Subscribe to Every Discount:

Similar to the point above, avoid subscribing to every discount or promotional offer that comes your way is another great way to maximise saving. While a limited-time deal might appear tempting, it’s essential to consider whether you genuinely need or want the service. Subscribing impulsively to discounted services can lead to financial waste and clutter.

5. Disregard Automatic Renewals:

Automatic renewal is a convenient feature offered by many subscription services. However, it can lead to unexpected charges if you forget to cancel a subscription before the renewal date.

Always read the fine print and be mindful of automatic renewals. Adjust your settings or set reminders to cancel if you no longer require the service.

6. Underestimate Total Costs:

Many people underestimate the total cost of their subscriptions, especially when they accumulate over time. To avoid financial surprises, keep a tally of all your subscriptions and calculate the total amount you’re spending each month.

This holistic view of your subscription expenses will help you make informed decisions about which services to keep, which to cancel, and where you can potentially be saving money.

Subscription services can be a convenient and cost-effective way to access various products and content. At Emma we offer a number of different subscription options so you can find the package and features that suit you best in your personal finance journey.

Whether you are a beginner and opt for the free plan or are a real master of your money utilising our Ultimate plan there is something for everyone with the Emma subscriptions. By carefully assessing your needs, taking advantage of free trials, opting for annual plans, bundling services wisely, sharing costs, and regularly monitoring your subscriptions, you can maximise the savings benefits while keeping your expenses in check.

Avoid common pitfalls like neglecting cancellation policies, ignoring price increases, and subscribing to every discount. With a mindful approach, you can make the most of subscription services while saving money in the process.

Happy subscribing and saving!