The ability to distinguish between essential and unnecessary expenses is a crucial skill. Unwanted expenses, often sneaking into our daily lives, can hinder our financial progress and chip away at our hard-earned money.

The silver lining? By adopting a strategic approach and arming yourself with effective techniques, you can take charge of your expenses and pave the way for a more prosperous future.

Track and Analyse Your Spending

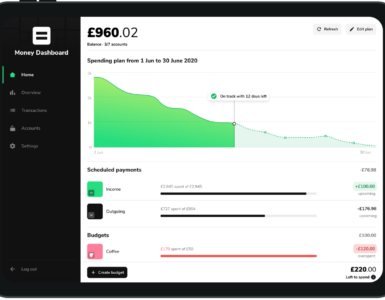

Before embarking on the journey to trim unwanted expenses, it’s essential to shine a light on your financial landscape. Utilise cutting-edge budgeting apps, such as the Emma app, or create a personalised spreadsheet to meticulously track each and every expenditure over a month.

This revealing exercise will illuminate patterns, allowing you to pinpoint areas where overspending occurs – think dining out, entertainment, or impulse shopping.

Set Priorities and Goals

With a clear grasp of your financial flows, it’s time to articulate your aspirations. Short-term and long-term goals act as guiding stars, steering you towards effective expense reduction.

Whether it’s building an emergency fund, eliminating debt, or realising that dream vacation, well-defined objectives help you allocate resources with precision.

Create a Realistic Budget

Armed with insights from your spending analysis and aligned with your goals, construct a budget that reflects your priorities.

Assign specific allocations to various expense categories, leaving ample room for both savings and unforeseen expenses. Think of your budget as a roadmap guiding you to fiscal empowerment.

Trim Unnecessary Subscriptions

In the era of subscriptions, it’s easy to become entangled in an ever-growing list of memberships. Take a discerning look at your monthly subscriptions – streaming services, gyms, magazines – and critically assess their value. Trim the excess, retaining only those that genuinely enhance your life.

Cook at Home and Brown Bag It

While dining out has its allure, it can drain your wallet over time. Transform your culinary habits by embracing the kitchen and preparing meals at home. Challenge yourself to bring lunch to work – this dual approach not only boosts savings but nurtures your well-being.

Cut Back on Impulse Buys

Ever caught yourself succumbing to impulsive purchases? Give yourself a cooling-off period before any non-essential acquisition.

This delay tactic allows you to distinguish between fleeting whims and genuine needs, curbing the impulse buying cycle.

Reduce Energy Consumption

Small yet significant changes in energy consumption habits can yield substantial dividends. Embrace the power of turning off lights when exiting a room, unplugging electronics, and investing in energy-efficient appliances.

These collective efforts lead to both ecological stewardship and financial gain.

Shop Smart

When it comes to shopping, a savvy approach can yield substantial benefits. Hunt for sales, capitalise on discounts, and wield coupons with precision. Opt for bulk purchases on non-perishables, reaping the rewards of lower unit costs.

Venture into the realm of second-hand shopping for clothing, furniture, and electronics, breathing new life into the concept of mindful consumption.

Negotiate Bills and Services

Challenge the status quo by negotiating bills and services. Contact providers – be it cable, internet, or insurance companies – and unlock potential discounts.

Loyalty doesn’t equate to the best deals, so proactively explore alternatives and take the reins of your financial destiny.

Practice the 30-Day Rule

For substantial expenses, adopt the time-tested 30-day rule. Temporarily defer purchases for a month. You might discover that your fervor wanes, revealing whether the expense is truly necessary. This mindful practice safeguards against impulse-driven financial decisions.

In the grand symphony of personal finance, orchestrating a harmonious balance between spending and saving is an art worth mastering. By embarking on the transformative journey of curbing unwanted expenses, you unlock the doors to financial liberation and elevate your relationship with money.

Every conscious choice you make in curbing unwanted expenses today lays the foundation for a more prosperous and fulfilling tomorrow. Embrace the challenge, wield these tried-and-true strategies, and witness the empowering metamorphosis of your financial landscape.

Remember, you possess the power to rewrite your financial narrative – one prudent expense cut at a time.