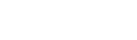

Following ClearScore’s recent decision to shut down Money Dashboard after acquiring the company last year, many Money Dashboard customers are left to find an alternative. Although there are many personal finance apps on the market, many offer different features from Money Dashboard.

One feature in particular was a favourite among Money Dashboard customers and that was the Forecast feature. Money Dashboard’s Forecast function was a valuable tool for financial planning and predicting future balances.

With this, customers were able to determine how much they could spend after bills and discover trends in their spending over time.

What is the Forecast Feature?

Money Dashboard describes the feature as a way to “forecast your balance into the future” by seeing all of your upcoming payments displayed in front of you. The feature allows customers to see how much they will have left after any bills and recurring payments like subscriptions have been taken out.

This helps customers to make educated spending decisions and avoid running out of money at the end of their pay cycle. This feature also looks at the rate of spending to help customers stay on track with their budget and avoid potentially going into overdraft.

What is the best alternative to the forecast feature?

Emma can deliver the same experience.

The app does this with a combination of features like budgeting, true balance and everyday spending.

Emma’s budgeting functionality

With Emma’s budgeting, you can track what is left to spend within your designated budgeting period as Emma subtracts both your spending as well as your committed spending from your total budget.

If you set your budgeting period to start on the day you get paid, you can easily monitor what’s left from your total budget to make sure you are always on track with what you have planned to spend.

The budgeting feature will also notify you when your spending is going too fast and you need to slow down to stay within your budget and when, unfortunately, you have gone over your budget.

Emma’s true balance

Emma’s true balance feature shows customers how much money they have left to spend from each of their bank accounts. This functionality works in conjunction with the budgeting period you have chosen in Emma’s budgeting and shows your available balance minus all the committed spend on that account for the period.

For example, if you have £1,200 available in your account but have an upcoming bill payment in 1 week for £1000, Emma can tell you that your true balance is £200. This is particularly useful for spotting potential overdrafts and for better planning.

Emma’s everyday balance

Another way to keep track of your spending power is to use Emma’s Everyday balance. This is available at the top of the Feed, on your home screen.

This balance is the result of the sum of all your available balances minus all your credit card balances. If you are an active credit card user, you should be able to know what your real available balance is and anticipate any issues.

These features in tandem with Emma’s Analytics can provide customers with a similar experience to that of the Forecast feature from Money Dashboard.

What other features does Emma offer?

Money Dashboard customers use the platform for its ability to connect multiple accounts in one place, manage bills and subscriptions, use the app’s analytics to gain insights across multiple categories and timeframes, as well as set budgets that fit your lifestyle.

The app also allowed customers to split transactions, transfer between accounts, create custom categories, get notifications about their balance and see their spending history. All of these features are important to managing your finances effectively which is why Emma offers all of the features discussed above as well as a handful of other tools to help user’s reach their financial goals.

Additional Emma Features

Emma offers all of the same core features as Money Dashboard as well as a host of others that are unique to the app!

In addition to the features discussed above Emma also features:

Emma Invest

Money Dashboard had no capabilities to allow customers to Invest directly in the app. With Emma, you can invest in more than 2,000+ international stocks!

Whether you are an experienced trader or not Emma you can get started investing with Emma with as little as £1. Doesn’t matter if you want to make a one-off purchase or set a recurring order you can find the investments that work for you and start building your portfolio right in the Emma app! Remember, when investing, your capital is at risk.

Save

Emma is all about helping you save more, whether that be from our high-interest savings pots, or from cancelling a forgotten subscription, Emma wants to help you on your quest to save. This is why we even offer exclusive cashback offers within the app so you can earn money while shopping or save more with exclusive deals and discounts!

Rent reporting

One of our newer features in the app is our rent reporting feature allows customers to build their credit history with their rent payments! Rent reporting allows you to improve your credit position by simply reporting your rent payments to major credit bureaus.

Simply turn on rent reporting in the app directly from your feed, select your rent payment from your transactions and Emma will start reporting your rent payment to the 3 major credit

bureaus – Equifax, Experian and TransUnion every month.

Fraud protection

With Emma, you can protect your online identity. Emma diligently scans the web for any data breaches and shares your personal information so you can protect yourself from fraud! Emma will cross-check the email address and phone number you have provided with a comprehensive database of previously reported data breaches.

If there is a match found, the details of the breach will be displayed under the corresponding phone number or email address, so that you can take necessary actions to secure your account.

Shared accounts with Emma Spaces

Emma Spaces feature allows you to group your accounts to help you organise your financial life in a way that works best for your unique needs. With Emma Spaces you can create different budgets and see analytics for different accounts connected in Emma as opposed to the standard format where they are shown together.

With Spaces, you can create a separate budget and category budgets for each Space you create. Spaces is perfect for those customers who have a joint account with a partner, to keep track of your family’s spending or your business accounts.

Networth

Monitor your net worth by connecting your accounts to Emma and adding in any unlisted assets, savings, or loans like your home or car. From here Emma tracks and updates your net worth so you can have a full overview of your financial health.

It is important to track your net worth to make informed financial decisions, set & achieve financial goals and have a better understanding of your financial health.

The demise of Money Dashboard marks the end of an era for the personal finance management space. The platform served as a trusted companion for countless customers, helping them gain control over their financial lives. For Money Dashboard customers looking to replace the gap in their financial management Emma is the perfect alternative.