FEATURED ARTICLE

Personal finance interview with Emma Drew

Edoardo Moreni

January 16, 2018 •3 min read

As part of our personal finance interviews, we are having a chat with Emma Drew. She blogs about how to make and save money to live the life we want.

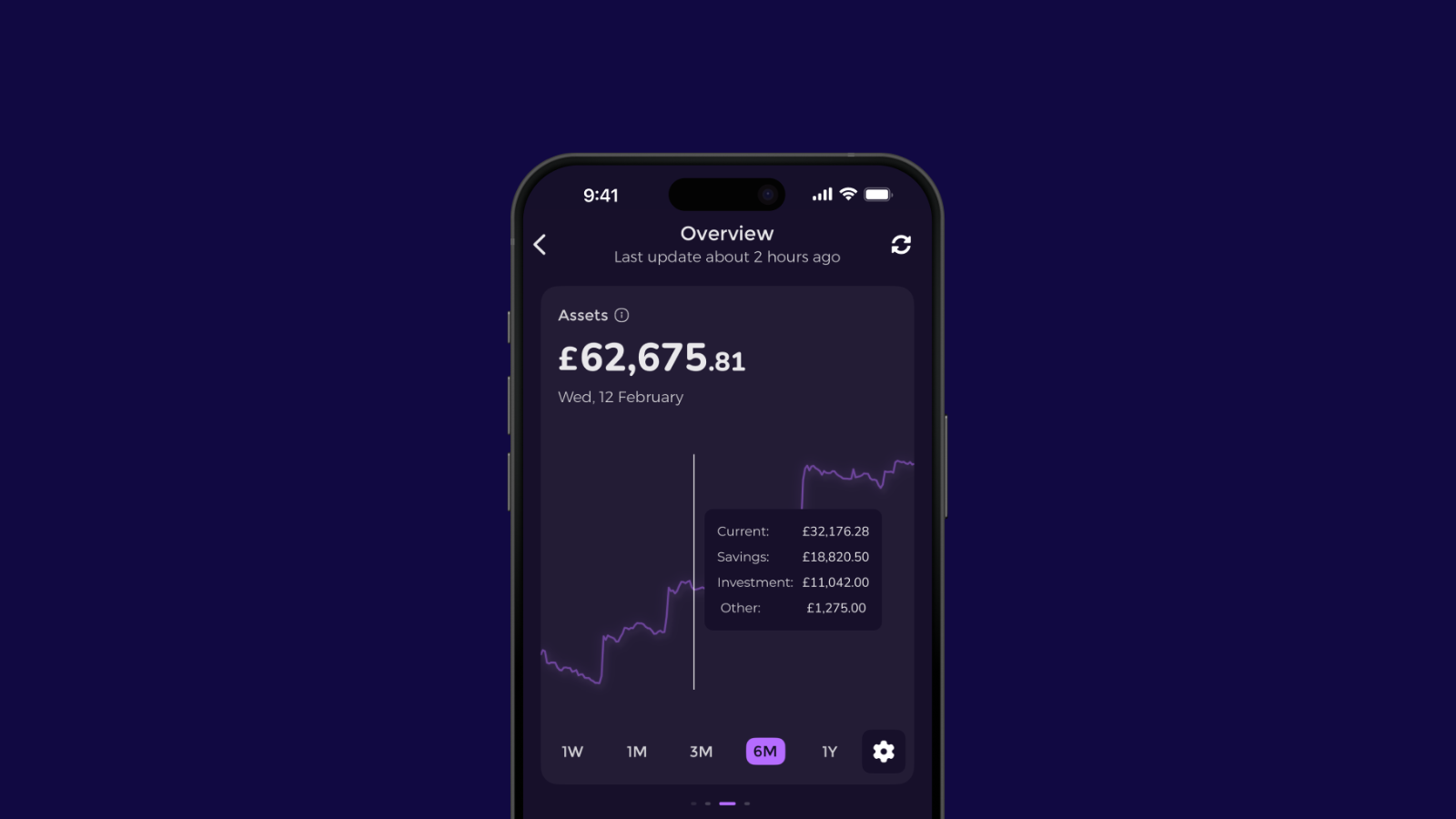

We got in touch with her because we were really impressed by her income reports and how she managed to hire her own husband! It's not also a coincidence she shares the name of our iOS and Android app. ;)

Hi Emma, thanks for joining us today. What’s your story? How did you get from 0 to actually having a profitable blog that has now become an actual job? What was the best moment of this journey?

I graduated into the recession and couldn’t find any work, not just related to what I studied. I had to make money, so I turned online and started completing surveys and other side hustles like that.

I started my blog to document my journey and hold me accountable. Over the years I started to see some money coming in from my blog, from advertising, affiliates and brands wanting to work with me.

The best part was getting to leave my full time job in November 2015 and my husband even left his job a few months later. Since then we have grown the business and love getting to help people with their finances, whether it is making more money or saving money.

You have been writing about savings for years now. What’s the biggest money leak you have seen in other people’s lives? You can also mention yours. ;)

I think that most of us waste food from overbuying or following best before dates too closely. Meal planning is a really simple yet effective way to combat this!

Meal planning doesn’t have to be boring and rigid. Instead of planning exactly what I am going to have for dinner next Wednesday, I plan out 7 meals and only buy ingredients for those 7 meals.This helps us to save so much money on our groceries, as well as reducing waste.

Do you have any advice on how to generate a passive income? What worked best when you actually started having one?

We usually think of passive income as things like property rental or writing a book, but these days anyone can earn a passive income. My favourite methods come from blogging, with affiliate marketing and adverts.

With affiliate marketing, content creators like myself make a commission when a reader clicks through an affiliate link and makes a purchase or signs up for something.

With blogging you create the blog post once, and apart from promoting it via social media (which can be automated) you don’t need to do much else to earn a passive income from it.

I see you are also a match better! Can you explain us what match betting is and how it works?

Matched betting is a legal way to make a profit from the offers that bookmakers give to new customers (and sometimes existing customers to entice them back).

It has been a great tax free source of income - I earned over £20,000 in my first year. Despite the name it isn’t gambling at all, and I feel very fortunate to have found this side hustle.

We are building an app named Emma. It’s probably not a coincidence we are interviewing another Emma! Ahah Do you use any finance tools? If so, is there anything in particular that you look for?

I am pretty traditional and love my bank’s own online banking app. I’ve been trying out a few personal finance apps through my blog and I am amazed at the technology that they have. I love tools that let you set savings goals because I think we could all do with saving more.

How often do you check your finances?

Every single day! This might sound like overkill, but years ago my bank account had some fraudulent activity on it. The fraudsters not only used my available balance, but all of my overdraft and beyond. Not only was this money missing, but my bank were also issuing me with charges.

It was eventually sorted out, but every morning I take about 30 seconds to log into my online banking and just check that everything is as it should be. For other things like my investments, I check in on them once a month just because I’m nosy.

You can visit Emma's blog just by clicking here.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.