FEATURED ARTICLE

How to Maximize Your Finances During COVID-19: 3 Easy Tips

Edouard Daunizeau

April 29, 2020 •3 min read

TABLE OF CONTENTS

Tips to Make the Most of Your Money During the COVID-19 Disaster

Make Your Finances a Top Priority

As the COVID-19 pandemic proves to be unpredictable and ongoing, it’s important to think about how to maximize your finances.

Nobody knows what is going to come of the COVID-19 pandemic. This confusing and uncertain time has the entire world on edge and with that comes panic and hysteria; a lot of which has to do with one’s finances.

With social distancing being enforced by governments across the globe, many people are already being laid off due to the inability to go to work and businesses are struggling to pay their employees.

In this climate of uncertainty, it’s important for people, employed or unemployed, to maximize their finances in the most efficient way possible.

Tips to Make the Most of Your Money During the COVID-19 Disaster

As panic and hysteria persist during this uncertain time, it’s important for everyone to try and be practical and calm when it comes to dealing with their money. Here are some tips to help you make the most of your money during the COVID-19 disaster.

Limit Spending and Begin to Prioritize

This seems obvious, however, this is perhaps the most important tip of them all. The timeline for the COVID-19 virus is unpredictable, therefore it is crucial that people limit spending to what is necessary rather than frivolously online shopping, an action many people will be tempted to do while self-quarantining.

As you limit your spending to what is necessary, consider writing a physical list in order to help you prioritize. Do you need to buy that new piece of furniture right now, or can it wait? Is getting a new spring wardrobe imperative, or can that be put off for a while? Make sure that you have the appropriate finances to provide shelter, food, and medical care for you and your loved ones, everything else can wait.

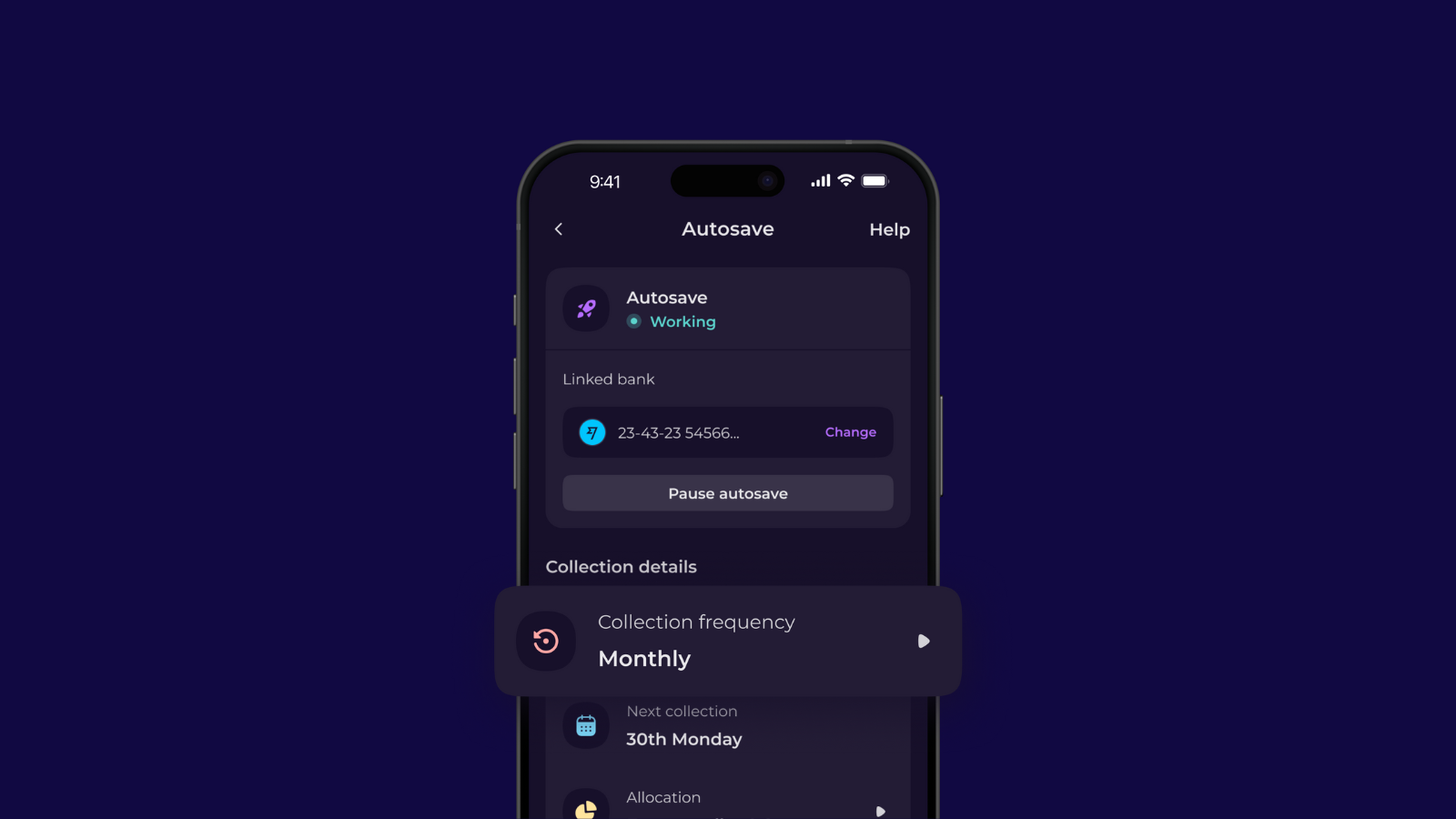

If you need help understanding your finances and spending by category, try an app like Emma to see where your money is going.

Cancel Unnecessary Memberships and Subscriptions

Cancel memberships to places you won’t be able to go and cancel subscriptions that may not be necessary. Though this will impact many businesses, this is particularly important for people at risk of being laid off.

For example, if you belong to a group fitness facility, such as a yoga studio or a personal training gym, consider freezing your account; this means that you aren't terminating the membership, instead, you are putting it on hold until your financial situation is more secure.

Similarly, if you are subscribed to something that you don’t use every day, consider canceling it for the time being. Subscriptions that may be unnecessary could include subscriptions to apps, streaming services, newspapers and magazines, and even online training.

You can find a directory of popular subscriptions and instructions on how to cancel them here.

Pay Attention to Your Investments

Investments can make or break a person's financial situation during the COVID-19 disaster. Stocks have already fallen and risen a few times and this is expected to happen many more times until the COVID-19 pandemic becomes less threatening. It’s important to pay attention to all of your investments, not just stocks during this global issue.

A life insurance attorney pointed out that a majority of people’s retirement and life insurance money comes from various investments. He recommended that all people, but especially those that are around retirement age, should pay special attention to their investments in order to take the necessary precautions in order to avoid losing too much money.

Make Your Finances a Top Priority

Besides your health, your finances should be your top priority during the COVID-19 pandemic. As this global illness demonstrates its unpredictability, it's crucial that people are prepared for the worst. Though the entire world is hopeful for an end to this disaster, everyone must do what they can to stay healthy and provide a comfortable life for themselves and their family. Maximizing your finances will allow one to do just that.

About the Author: Veronica Baxter is a blogger and legal assistant living and working in the great city of Philadelphia. She frequently works with Chad Boonswang, Esq., a busy life insurance beneficiary attorney.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.