FEATURED ARTICLE

Emma Launches One of the UK's First Savings Pots with Up to £255,000 FSCS Protection

Giuliano Fabbri

April 17, 2025 •3 min read

TABLE OF CONTENTS

A New Era for Savings Protection

How Does Emma Super Pot Work?

Why This Matters for Your Savings

Who Can Use Emma Super Pot?

More Savings Options with Emma

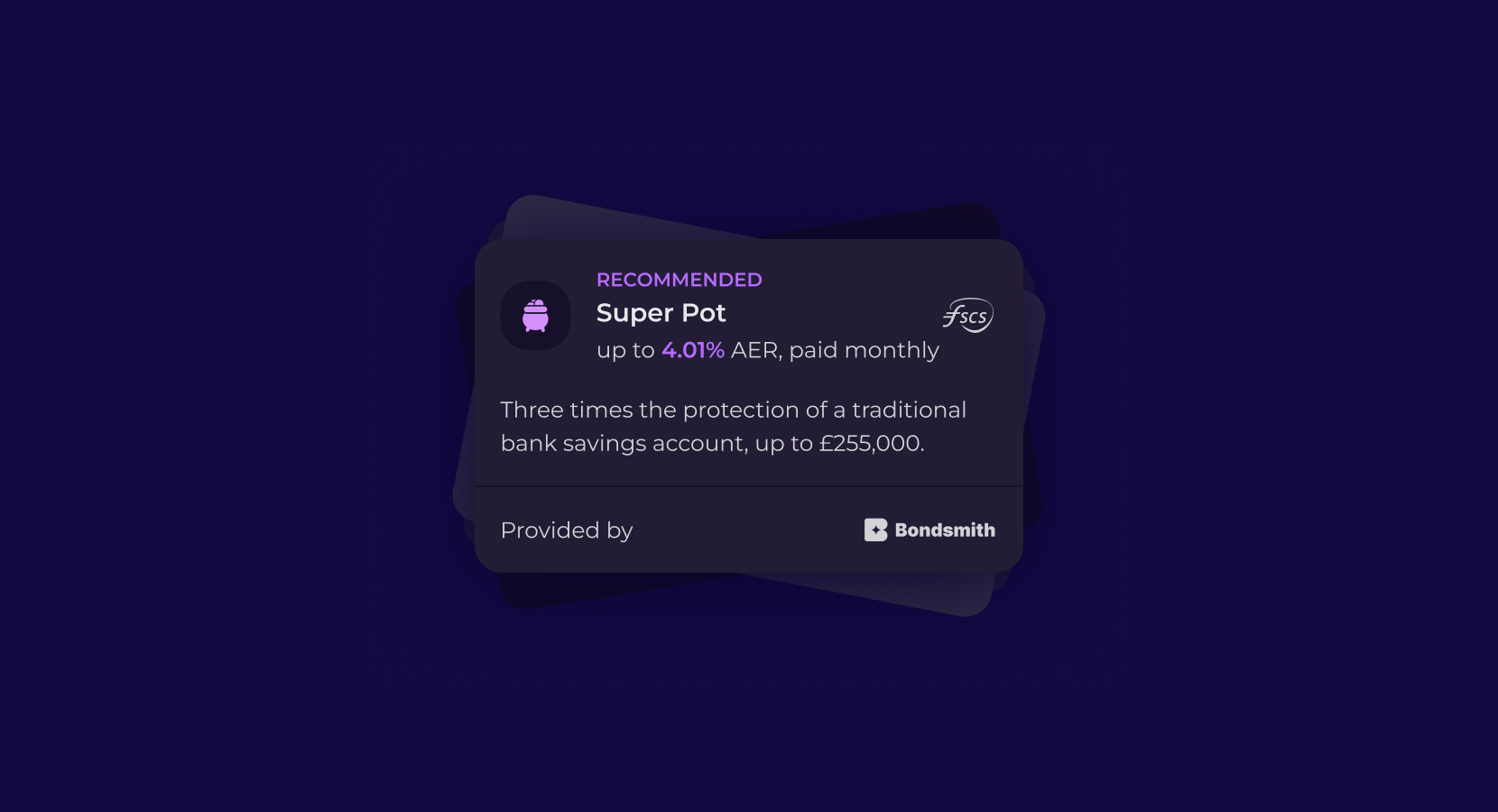

We're incredibly excited to announce the launch of our brand new feature - Emma Super Pot: a savings pot that offers FSCS protection of up to £255,000 - by spreading your money across multiple partner banks, each covered by the Financial Services Compensation Scheme.

A New Era for Savings Protection

Traditionally, savings in a UK bank are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person, per bank. But with Emma's new Super Pot, we're doing things differently.

We're using a sweep network of multiple partner banks to optimise both your interest and FSCS protection - so you can save with confidence and peace of mind. This makes Emma one of the first personal finance apps in the UK to offer a feature like this. It's simple, safe, and designed to work hard for you in the background.

"At Emma, our mission has always been to give people more control and visibility over their finances. This new savings pot does exactly that - helping people make the most of their money without compromising on safety. We're incredibly proud to be one of the first in the UK to offer this kind of protection in a consumer savings product."

— Edoardo Moreni, CEO & Co-founder of Emma

How Does Emma Super Pot Work?

Emma's new Super Pot is powered by Bondsmith's Bank Deposit Sweep, which automatically distributes your funds across a network of regulated UK banks - each of which is covered by the FSCS.

Key Features:

- Enhanced Protection: Eligible for up to £85,000 protection per person, per institution, combining to £255,000 in total coverage

- Competitive Interest: Currently offering up to 4.01% AER, although rates vary depending on the underlying partner banks and are subject to change.

- Easy Access: Next business day withdrawals;

- Simple Management: View all your savings in one place within the Emma app.

Important Notes About Protection:

FSCS protection is subject to eligibility. This protection is offered through a trust structure, which differs from directly depositing your money with a single bank. One key difference is that FSCS compensation may take longer to be paid out in the unlikely event of a failure (typically up to 3 months compared to the standard 7 days).

Money deposited through a trust structure will be protected by the FSCS. The same compensation limits - up to £85,000 per bank - will apply. The process of returning your money is automatic, though timing may vary.

Why This Matters for Your Savings

In today's economic climate, getting the most from your savings while keeping them secure is more important than ever. With Emma Super Pot, you get:

- Better protection: 3x the standard FSCS coverage

- Competitive returns: Rates that compete with traditional banks

- Complete transparency: See all your savings in one place

- Innovative technology: Automatic distribution across our partner bank network

We've built this feature to give you peace of mind while helping your money work harder for you. Whether you're saving for a rainy day, a big purchase, or just want to optimise your finances, Emma Super Pot provides a smart new way to protect and grow your savings.

Who Can Use Emma Super Pot?

The savings pot is now available to all Emma users in the UK.

- Existing users: Simply head to the Save section in the app to get started

- New users: Download the Emma app on iOS or Android and join over a million people already taking control of their financial future

More Savings Options with Emma

In addition to our new Super Pot, Emma offers:

- Easy Access Pot:

- Up to 3.98% AER

- Flexible withdrawals

- 45-Day Notice Pot:

- Up to 4.45% AER

- Higher interest for planned savings

This range of options gives you even more choice when it comes to growing your savings in the way that best suits your financial goals. Emma’s new savings pots are available with our Emma Plus, Emma Pro, and Emma Ultimate plans. A free trial is available for new users — charges apply after the trial unless cancelled.

For full pricing information and terms, visit here.

You may also like

Check out these related blog posts for more tips

© 2026 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd (Company Registration Number 10578464). Registered office: Verse Building, 1st Floor, 18 Brunswick Place, London, N1 6DZ, United Kingdom.

Emma Technologies Ltd is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 (FRN 794952). Emma Technologies Ltd is authorised and regulated by the Financial Conduct Authority (FRN 1042167) for investment services and consumer credit activities, including credit broking and credit information services. Emma Technologies Ltd acts as a credit broker, not a lender, and may receive a commission from lenders for introducing you to them.

Payment and e-money services (Non MIFID related products) are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: 1 Sheldon Square, London, W2 6TT, United Kingdom. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199).

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.