FEATURED ARTICLE

Three Things Coronavirus Has Taught Us About Money

Rebekah May

July 16, 2020 •3 min read

TABLE OF CONTENTS

1. Start An Emergency Fund

2. Review Your Spending

3. Be Cautious Of The Loans You Take Out

Coronavirus Money Lessons

There are lots of things the coronavirus has taught us about money.

When we packed up our desks in March, few of us thought it would be the last time we'd see our office for months. Even fewer thought it’d be the last time we'd see our office, ever.

But, with the pandemic, has come an unfortunate loss of jobs.

Job security is a phrase that not many can now confidently use, and as a result, financial security is becoming even less certain.

To make matters worse, there’s now talk of a global recession. Which has led us to think... What has the Coronavirus taught us about money, and what can we do now to put us in the best position for a recession?

1. Start An Emergency Fund

An emergency fund is an amount of money that’s been set aside specifically for use in an emergency.

Previously, reasons for having an emergency fund have been described as things like your car breaking down. Needing new appliances. Or even needing emergency dental work. But now, the focus is more about covering yourself in the case of job loss.

A recent report from YouGov showed that “Two-thirds of furloughed workers are either fairly (38%) or very (27%) worried about losing their job”. So we can see why emergency funds are getting some attention.

There’s no right or wrong amount to have in an emergency fund. But financial advisors suggest you should have 3-6 months' worth of expenses. This money should be kept in an easy-to-access location, where there’s no chance of losing your money.

When we broached this subject with the users on our community page, we saw similar views.

“My current goal is 6 months salary saved just in case. I have always kept a little aside just in case. But Covid-19 despite not affecting the company I work for, got me worrying about “what if” suddenly I wasn’t able to work or was furloughed”

Starting an emergency fund is just one thing Coronavirus has taught us about money. If you'd like to read more about starting an emergency fund, read our article here.

2. Review Your Spending

With over 9M people furloughed in the UK, many people are now living in the UK on a reduced wage. It’s, therefore, no surprise that people are completing a financial health check.

People are sitting with their finances, and prioritizing what they should now be spending their money on. Taking time to budget, track their spending, and complete “no-spend” days have been critical in helping people decide which areas of their spending are now most essential.

A report from Raisin, about lockdown spending habits, found that a third of people questioned said they "now wouldn’t spend as much on things they didn’t need in the future".

When we asked people on Twitter how lockdown had changed their spending habits we found a similar response. TV subscriptions and online shopping were amongst the first areas to be cut. Those that had stopped commuting, told us how they'd purchased a bike - to keep costs down when returning to work. When we asked if people had missed spending money on takeaway coffees, 65% of people said they hadn't.

These small spends can make a surprisingly big difference to your yearly outgoings. Even if the monthly cost is low.

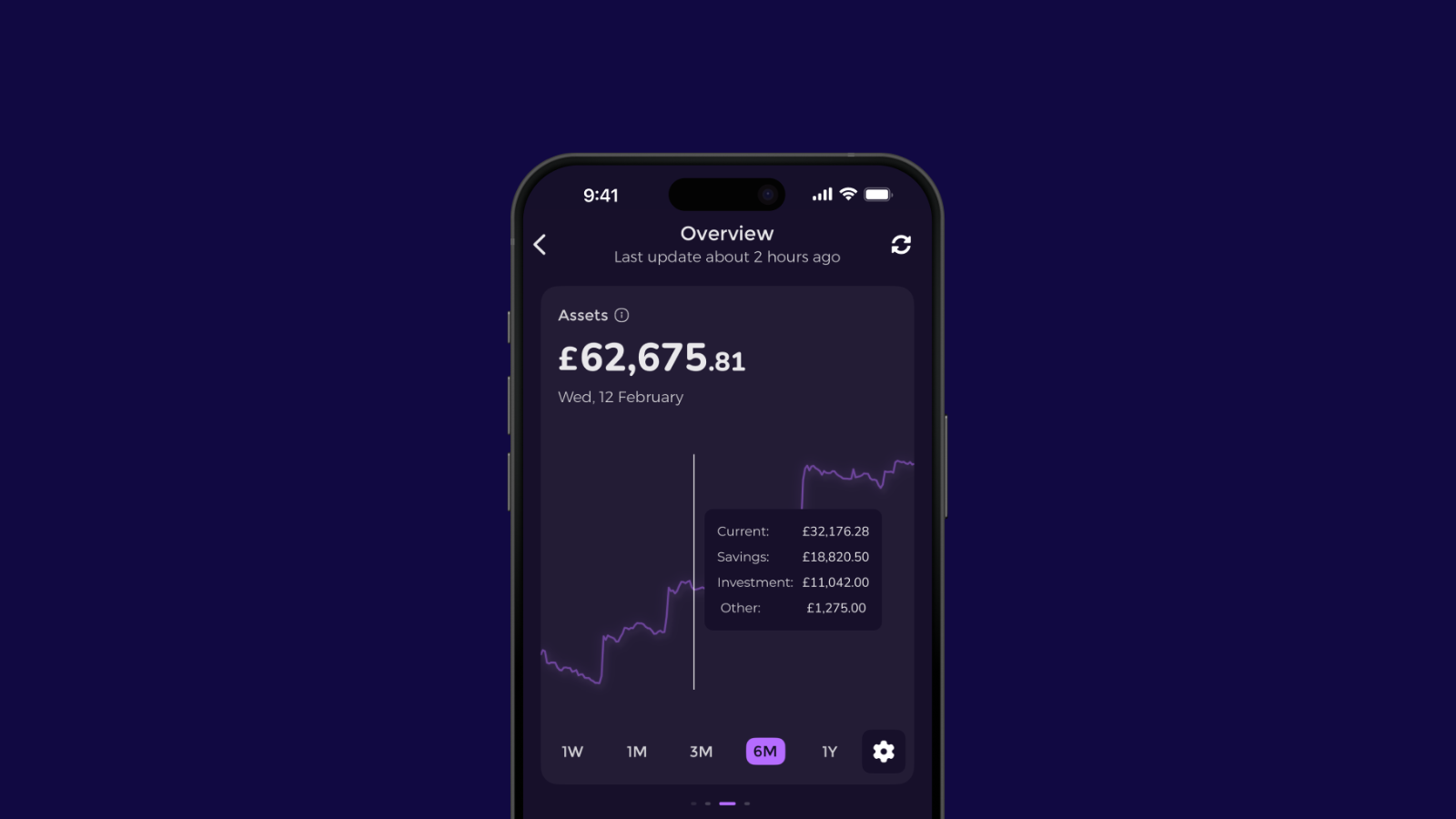

We know that reviewing your bills isn't the most fun thing to do, but we also know it can save you money. That's why we have a feature on the Emma app which highlights how much you’re spending on bills and subscriptions. We'll even help you switch to a cheaper plan.

If you haven’t already, download the Emma app and once all your accounts are connected visit the “save money” tab to see how you could cut the cost of your energy, broadband, and phone bills.

3. Be Cautious Of The Loans You Take Out

Loans come in many different forms, and often there is a whole range of reasons why you may need to take one out. Whether it’s to cover a big financial purchase or to cover debt, you should always be a lil’ cautious about the type of loans you take out.

With the impact of coronavirus, it’s more important than ever to think about what will happen if you can no longer afford your repayments. Consider whether it’s better to wait until you can buy something in full, rather than using loans to pay for it.

If you don’t have the luxury of waiting, make sure you have a backup plan that will let you repay in full, in time.

Coronavirus Money Lessons

The pandemic has certainly turned lives upside down, but there are things we can learn from it. I for one, think the Coronavirus has taught us a lot about money!

By following these three money lessons, we can make sure that our money is in the best place possible.

Follow the convo on Twitter, or on the community pages here.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.