FEATURED ARTICLE

Personal Finance Interview With Making Money Simple

Rebekah May

October 15, 2020 •3 min read

TABLE OF CONTENTS

1) Hey Ryan. Can you give us a little introduction?

2) What inspired you to start Making Money Simple?

3) You have a free e-book all about investing. What kind of things do you cover?

4) What one piece of advice would you give to someone thinking about starting their investment journey?

5) Investing isn't always plain sailing. Do you have any investing highs/ lows?

6) With Emma you can see all your investments alongside your everyday accounts/ savings/ loans. What other features do you like within Emma?

7) And lastly, if you had to describe your finances using one emoji - what would it be?

Next up in our series of personal finance interviews, we speak to Ryan from Making Money Simple.

Ryan has created an incredible financial education platform that covers all things investing and property. We wanted to find out a little more about Ryan, why he started Making Money Simple, as well as which features in Emma he uses the most.

Read on to find out more!

1) Hey Ryan. Can you give us a little introduction?

Hello! My name is Ryan or @makingmoneysimple.

I’m 23 years old and am currently working and living in London.

On the side, I make content about finance in the form of blog posts, Instagram graphics, and (as of recently) TikTok videos.

2) What inspired you to start Making Money Simple?

The main inspiration was that I always thought that the UK was underrepresented when it came to ‘finance-y’ pages on social media, particularly on Instagram and Youtube.

Combine this with a passion for talking about money-related topics, and Making Money Simple was born!

https://www.instagram.com/p/CGNiuRFHWo5/

3) You have a free e-book all about investing. What kind of things do you cover?

I cover quite a lot in the ebook!

Starting with the basics of investing - why you need to invest, why investing isn’t risky, how to set goals, followed by the basics of the stock market - how the stock market works, what causes stock prices to move, active investing vs passive investing, and so on.

I touch on having an 'investor's mindset' because at the end of the day investing is 90% emotion. Often the less you do, the better results you will get! 'Don't do anything, just stand there' is a quote I regularly think of when it comes to investing.

The ebook then goes into a lot of detail on minimising fees and taxes, how to choose the right broker, investing through index funds and ETFs, and then looks at the most important concepts in investing - diversification, compound interest, and dollar-cost averaging.

4) What one piece of advice would you give to someone thinking about starting their investment journey?

Firstly I would just say, just start! You won’t regret it.

The best advice is honestly ‘invest early and invest often’. The earlier you invest, the more you can take advantage of compound interest - where your money is making money. And by investing often - for example, every month - you are able to ride out the ups and downs of the market and minimise the issue of market timing.

In terms of advice, the main thing I would say is beware of high fees and taxes. One thing you can get right from the very beginning is minimising your fees and taxes.

If you can reduce these by 1%, you will save tens to hundreds of thousands of pounds over your lifetime. Reduce your fees by using a low-cost broker. Reduce the taxes you will pay by investing inside of a stocks and shares ISA.

https://emma-app.com/blog/2020/09/10/seven-types-of-investments/

5) Investing isn't always plain sailing. Do you have any investing highs/ lows?

Right now would have to be a high. Due to all of the money printing from global governments, the stock market is soaring. Of course this won't last forever, but right now is the best my portfolio has ever looked.

I’ve also made a lot of mistakes! I actually keep a list so I don't make the same ones again, haha!

A few notable ones are:

- Buying a stock because someone recommended it to you. In my case it was a Youtube video I had seen... never do this!

- Investing in something you don't understand. Did someone say Bitcoin? That was in 2017. Since then I've read a number of books on cryptocurrency and now understand it, so am more confident in what I am investing in!

- Investing in a fund with high fees. The first fund I invested in charged 0.78%. Now I use a global index fund which costs 0.23%!

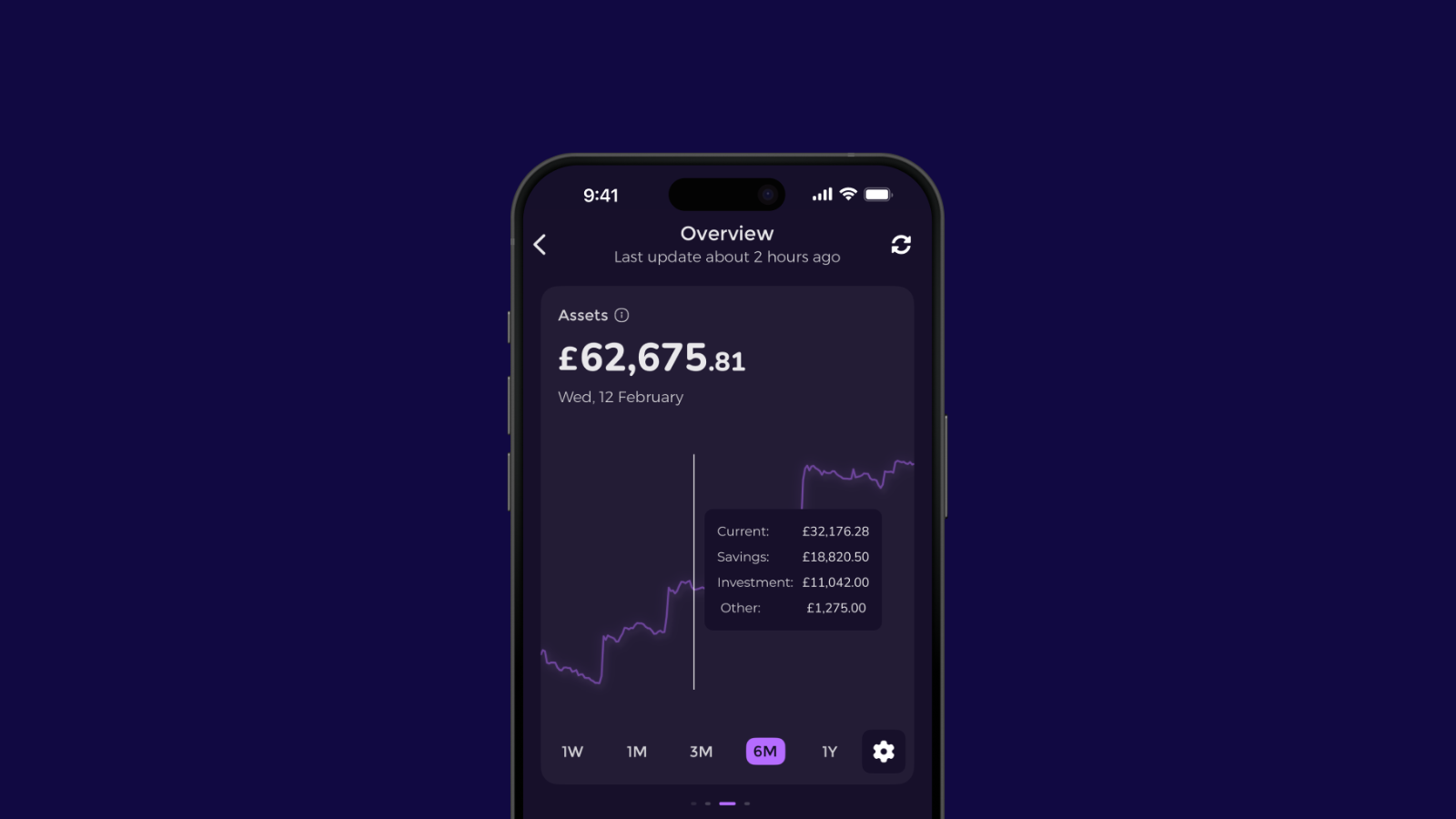

6) With Emma you can see all your investments alongside your everyday accounts/ savings/ loans. What other features do you like within Emma?

I really like the range of banks and accounts that Emma supports.

Personally, as I invest in cryptocurrency, I particularly like that Emma supports a whole range of crypto exchanges (and wallets).

Of course, Emma also supports the debit and credit cards I have too!

I know this list will only grow as time goes on, but it's something that definitely attracts me to the platform.

7) And lastly, if you had to describe your finances using one emoji - what would it be?

📈

Thanks so much to Ryan for chatting with us this week. If you want to see more from Ryan, then make sure you follow him on Instagram at Making Money Simple or visit him out on Tik Tok @makingmoneysimple

Emma is a money management app that connects all your bank accounts to track your monthly spending and subscriptions. Emma will help you visualise and take control of your finances. Make sure you aren’t overspending and show you practical steps to start budgeting effectively. Download Emma today.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.