FEATURED ARTICLE

The Benefits of Renting vs Owning

Ainsley Bilton

June 27, 2023 •5 min read

Buying a home is traditionally an earmark of success and is regarded as the greatest investment you can make. Homeownership is a dream for many people, one that they work towards for many, many years to achieve and view renting as a means to this end.

All you need to do is painstakingly pinch your pennies to save for a 20% downpayment, take out as large of a mortgage as you can get, and get cracking on paying it off for the next 25 years. After this, you’ll be set! Easy! Or at least that’s what is often peddled.

For many people, the path to homeownership is clear but many people are questioning whether or not it is the right choice for them. More and more people are choosing to continue to rent as opposed to buying as the market becomes increasingly more expensive, interest rates rise, and competition increases. Whether or not you are choosing to rent out of necessity or by choice, there are a number of reasons why this could be the right path for you.

Renting often receives a bad rep as throwing away your money and a pointless expense because “why would you pay someone else’s mortgage when you could just pay your own''.

These are the kinds of things you often hear from older generations who entered the market at a very different time than the state of the market currently. Depending on your financial circumstances renting can be a better option than buying and has several advantages that homeownership does not have. If you are on the fence about whether or not homeownership is for you, consider the following when making your decision.

Ability to Move Frequently

Renters have far more flexibility in terms of how frequently they can move houses and the areas in which they can live. For many people buying in major cities like London or New York are completely out of the question due to soaring real estate prices but they can still afford to live in these cities as a renter.

Oftentimes renters are able to live in a more desirable area even if the rent is expensive as they don’t have to worry about the additional costs that are associated with home ownership such as a down payment. Renters also have a great deal more flexibility in their freedom to move house.

Although a rental tenancy agreement often has a minimum duration this is rarely more than 1-2 years and you can negotiate the terms of your rental agreement that work with your lifestyle. For people who move around frequently for work, or simply enjoy change and like changing their environment renting is a far better option. The process of selling your home and buying another is not only time-consuming but also expensive with broker fees, lawyer costs, and land transfer taxes to name a few associated costs.

Financial Flexibility

Purchasing a home is no small feat and requires a great deal of capital. Most people need to plan far in advance and save for a deposit for years before buying. A down payment on a home is typically 20% of the purchase price and in a city like London where the average home price is £740,000 that would require a deposit of £150,000.

For many people putting aside the required 20% for a deposit is simply out of reach due to the rising cost of living. Although renters typically have the upfront cost of one month's rent when signing their lease agreement, this pales in comparison to the high cost of a down payment.

A renters deposit is also given back at the end of the tenancy provided they haven’t damaged the property. Although owners of course have the opportunity to make money on their home when they sell it is not guaranteed even if the home is in the same condition due to changing market conditions. Those who are unable to come up with the required down payment may be better off renting.

Minimal Responsibility

One of the best perks of being a renter rather than a homeowner is that you are not liable for repairs, maintenance, or improvements to the property. If renters experience an issue with a leaky roof they simply need to report this to their landlord who will be responsible for setting up the repair / replacement and take care of the associated costs.

Even on a smaller scale if there is a minor leak from a tap tenants are not required to fix this themselves whereas Landlords are liable and are required by law to keep the property in good condition and so they will need to quickly get that sorted.

Ability to Build Credit Renting

Buying a home is often seen as the only way to build credit based on paying your monthly home fees. By paying your mortgage in full and on time over the course of your contract you demonstrate a history of consistently paying off debts which in turn can improve your credit score.

We all know it is important to build strong credit to be able to be approved for future loans, and credit cards, and hopefully obtain them with more favorable terms and rates. Did you know that this perk is not exclusive to home ownership and you can still reap the rewards of paying your rent on time and in full with rent reporting?

Rent reporting is when your rent payments are reported to major credit unions like Equifax and Experian. This in turn can have a positive impact on your credit position and overall creditworthiness.

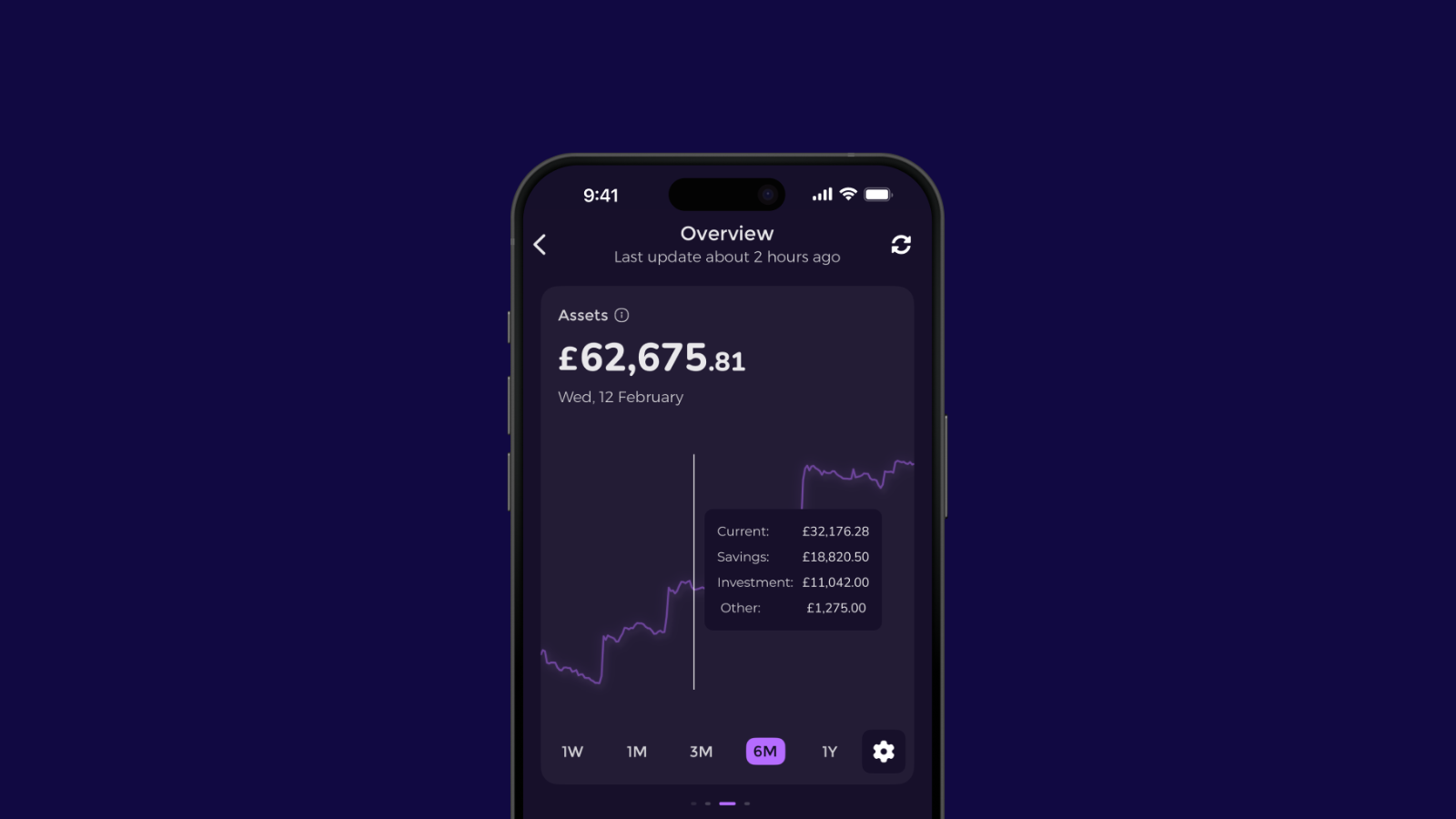

You can start rent reporting directly in Emma. Simply turn on rent reporting in the app directly from your feed and select your rent payment from your transactions and Emma will start reporting your rent payment to all three major credit bureaus Equifax, Experian and TransUnion! It’s that simple!

Unlike a mortgage which can have a negative impact on your credit score if you are late or miss a payment, rent reporting has no downside and will have no negative impact on your credit score even if you miss a payment.

Save on Taxes & Bills

Homeownership is expensive for several reasons that extend beyond simply saving for a down payment. There are a number of associated fees that homeowners are responsible for that renters simply do not need to worry about.

One of these fees is property taxes that owners have to pay each year they own their home. These fees are variable and can increase year over year making it difficult to anticipate just how much you will be paying throughout your home ownership.

For many people property taxes amount to thousands of dollars each year which is a fee renters are not subject to paying. Oftentimes homeowners pay more in utilities than renters do, especially if they have utilities included in their rent.

For renters that have things like hydro and electric included in their rental price, they are less incentivized to minimize these costs by taking shorter showers or running a load of laundry during off-peak hours to save. One other way that renters save compared to homeowners is with the cost of insurance. The cost to insure a home and the contents inside it is far more than renters insurance which is a fraction of the price.

Decrease in Property Value Has Little Impact

Homeowners have made a significant investment in their home and most do so with the hope that they will make more money back in the long run. This however is not guaranteed and you can still lose money as a homeowner as a result of the changing market value.

When you are a renter you don’t need to worry about the property's value decreasing & losing money on your investment. Most people see a home as a great long-term investment but due to unforeseen circumstances, they may end up needing to sell before they can see a return or during a downtime in the market where their home may be worth less than they paid for it.

If you are considering purchasing a home these are all important factors that you will need to consider when making your decision. Although there is the potential for great return on a home in the long term it is not always as sound of an investment as it is made out to be. For many people, the path to homeownership is either out of reach or simply unappealing, and for several reasons renting could be the better option for them and their financial situation.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.