FEATURED ARTICLE

How do I open a bank account with Barclays UK?

Edoardo Moreni

July 21, 2023 •2 min read

Opening a bank account with Barclays UK is a straightforward process that can be completed online or in person. Here's a step-by-step guide to help you open a bank account with Barclays UK:

- Research Account Options: Visit the Barclays UK website or visit a local branch to explore the different types of accounts they offer. Consider factors such as account features, fees, and benefits to choose the account that best suits your needs.

- Gather Required Documents: Before starting the application process, make sure you have the necessary documents ready. Typically, you'll need proof of identity (passport, driving license, etc.), proof of address (utility bill, bank statement), and proof of income (payslips, tax documents) if applicable.

- Apply Online or In Person: You can apply for a Barclays account online through their website. Alternatively, if you prefer a face-to-face interaction, you can visit a local Barclays branch to complete the application process with the help of a bank representative.

- Fill Out the Application: Whether you apply online or in person, you'll need to fill out an application form. Provide accurate personal information and details as required.

- Verify Your Identity: Barclays will verify your identity based on the documents you provide. In some cases, you may need to provide additional information or documents for verification.

- Complete the Necessary Checks: Barclays will perform various checks, including credit checks, to assess your eligibility for the account you've applied for.

- Receive Your Account Details: Once your application is approved, you'll receive your account details, including your account number and sort code.

- Activate Your Account: If you applied online, you may need to activate your account through a designated process. If you applied in person, the bank representative may help you with this step.

- Fund Your Account: Deposit funds into your new Barclays account to start using it for your financial transactions.

- Set Up Additional Services (Optional): Depending on the type of account you've opened, you may want to set up additional services such as online banking, mobile banking, direct debits, and standing orders.

Remember, it's essential to read and understand the terms and conditions associated with your chosen Barclays account. Additionally, compare different account options from various banks to ensure you select the account that best meets your financial needs and preferences. If you have any questions during the application process, don't hesitate to reach out to Barclays customer service for assistance.

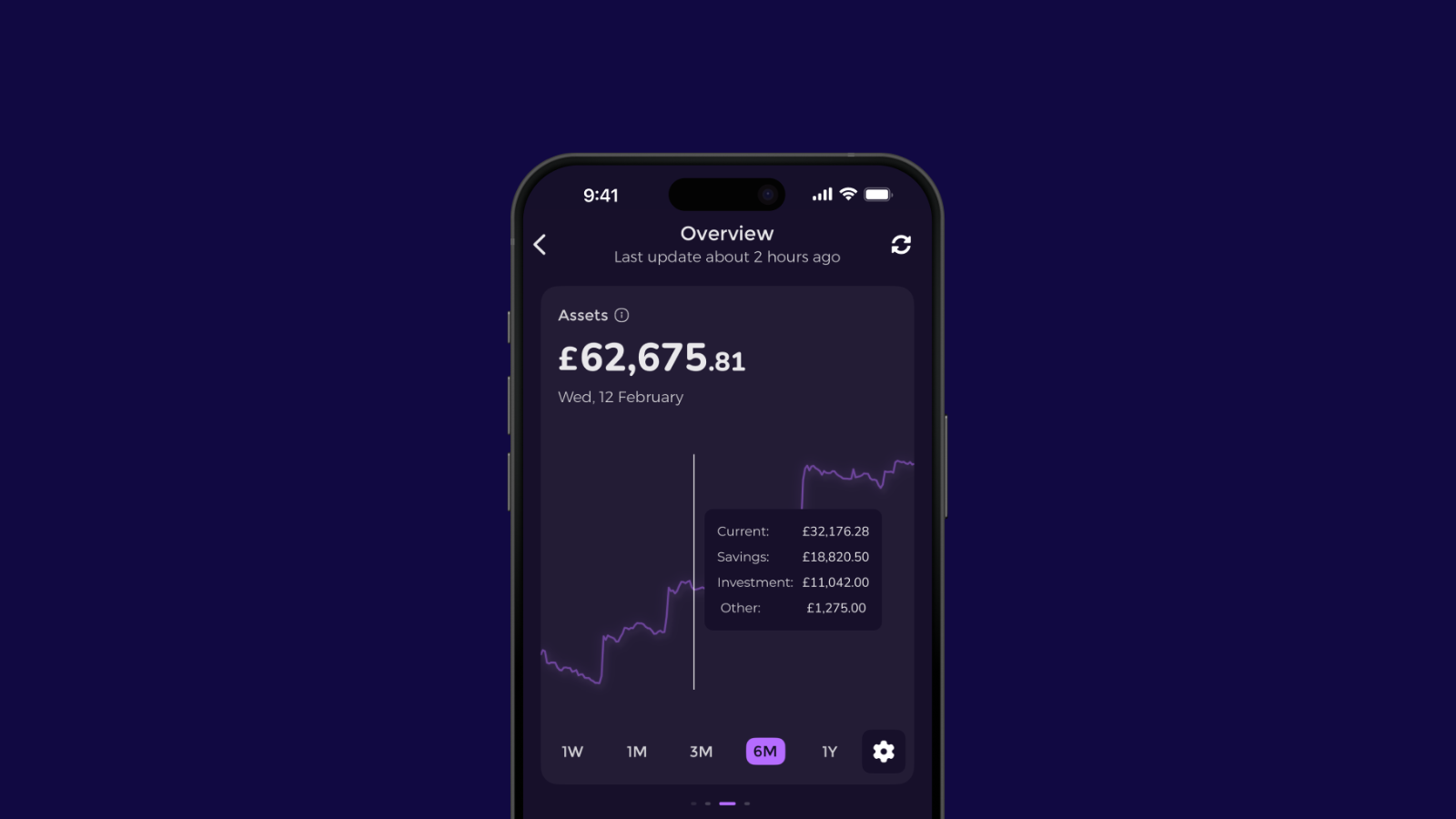

If you're looking to take charge of your finances and make well-informed money decisions, the Emma app is here to help. Seamlessly integrated with Barclays accounts, Emma offers an intuitive and comprehensive platform for tracking transactions, setting budgets, and gaining real-time insights into your financial health.

By combining the power of the Emma app with your newly opened Barclays account, you can effortlessly manage your spending, boost your savings, and work towards long-term financial goals. Don't miss this chance to embark on a journey towards financial empowerment and security. Take control of your finances today with the Emma app and start building a brighter financial future.

Happy budgeting!

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.