FEATURED ARTICLE

The Ultimate Guide to Savings Rules

Edoardo Moreni

July 21, 2023 •6 min read

TABLE OF CONTENTS

The 50/30/20 Rule

The 20/4/10 Rule for Car Buying

The 30-Day Rule for Impulse Purchases

The 4% Rule for Retirement Withdrawals

The Emergency Fund Rule

The Windfall Rule

The "Pay Yourself First" Rule

The 80/20 Rule

The envelope system

The Rule of 72

The 10% Rule

The No-Spend Challenge

The Penny-A-Day Challenge

The 52-week challenge

The 3-month rule

The 6-month rule

The Rule of Thirds for Budgeting

The 60% Rule for Retirement Savings

Saving money is a crucial step toward achieving financial stability and realising your financial goals. To build a strong savings habit, many financial experts recommend following savings rules.

These rules provide simple and effective guidelines for setting aside money regularly.

The 50/30/20 Rule

The 50/30/20 rule is a popular budgeting and savings guideline. It suggests allocating 50% of your after-tax income to essential needs (such as housing, utilities, and groceries), 30% to discretionary spending (entertainment, dining out), and 20% to savings and debt repayment. This rule strikes a balance between meeting current expenses and building savings for the future.

The 20/4/10 Rule for Car Buying

When purchasing a car, follow the 20/4/10 rule. Aim to make a down payment of at least 20% of the car's purchase price, finance the car for a maximum of 4 years, and ensure that the total monthly cost of the car (loan payment and insurance) does not exceed 10% of your monthly income. This rule helps prevent excessive car-related debt and keeps your transportation costs manageable.

The 30-Day Rule for Impulse Purchases

To curb impulse spending, apply the 30-day rule. When considering a non-essential purchase, wait for 30 days before buying it. This waiting period helps you evaluate whether the purchase is truly necessary or just an impulsive desire. If you still feel the item is worth buying after the waiting period, go ahead, but more often than not, the impulse may pass, leading to valuable savings.

The 4% Rule for Retirement Withdrawals

In retirement planning, the 4% rule is widely used. It suggests withdrawing 4% of your retirement savings annually during retirement. This rule aims to provide a steady income stream while preserving the longevity of your retirement savings. Remember to adjust this percentage based on your individual circumstances, market conditions, and expected lifespan.

The Emergency Fund Rule

Building an emergency fund is essential for financial security. The rule of thumb is to save three to six months' worth of living expenses in a separate, easily accessible account. This fund acts as a safety net during unexpected events like job loss or medical emergencies, helping you avoid resorting to high-interest debt.

The Windfall Rule

Receiving a financial windfall, such as a bonus, inheritance, or tax refund, can be exciting. The windfall rule suggests allocating a portion of unexpected funds to splurge on something enjoyable while directing the rest toward savings, debt reduction, or investment. This approach allows you to enjoy the windfall responsibly while still benefiting your long-term financial goals.

The "Pay Yourself First" Rule

The "pay yourself first" rule is a fundamental savings principle. Treat your savings as a priority by setting aside a portion of your income for savings before paying other bills or expenses. Automate the process by scheduling automatic transfers to your savings account each time you receive your paycheck. This way, you prioritise saving and build a healthy savings habit.

The 80/20 Rule

The 80/20 Rule in personal finance states that 80% of results come from 20% of efforts. By identifying the most impactful areas like core income sources, essential expenses, and strategic savings goals, and minimizing inefficiencies, we can streamline our financial efforts and achieve better outcomes with less. Prioritising key elements empowers us to boost savings and work towards our long-term goals, leading to greater financial well-being and success.

The envelope system

The envelope system is a simple budgeting method that involves allocating cash into envelopes for specific spending categories. Each envelope represents a designated expense, such as groceries, entertainment, or transportation.

By using cash from these envelopes for their intended purposes, individuals can effectively manage their spending and limit overspending. This tangible approach helps individuals stay within their budgetary limits and provides a clear visual representation of their available funds for each category.

The envelope system encourages mindful spending, prevents impulsive purchases, and fosters better financial discipline, ultimately leading to improved financial management and greater control over one's finances.

The Rule of 72

The Rule of 72 is a powerful financial rule of thumb that provides a quick estimation of how long it takes for an investment or debt to double at a fixed annual rate of return or interest. By dividing 72 by the annual rate of return, one can determine the approximate number of years required for the initial amount to double.

This simple yet effective tool highlights the concept of compound interest, showcasing the potential impact of long-term investments. Whether you are saving for retirement, planning investments, or managing debt, the Rule of 72 offers valuable insights into the time value of money, aiding in making more informed financial decisions.

The 10% Rule

The 10% Rule is a fundamental financial principle that encourages individuals to set aside 10% of their income for savings and investments. By adopting this simple yet powerful practice, individuals "pay themselves first" before allocating funds to other expenses.

This approach helps create a consistent savings habit and empowers individuals to build emergency funds, pay off debts, and work towards long-term financial goals. Whether you are just starting on your financial journey or seeking to strengthen your financial foundation, the 10% Rule serves as a guiding principle towards achieving financial security and a more prosperous future.

The No-Spend Challenge

The No-Spend Challenge is a compelling financial experiment that encourages individuals to refrain from non-essential spending for a designated period.

During this challenge, participants consciously cut back on unnecessary expenses, such as impulse purchases, dining out, or entertainment subscriptions, while still covering essential needs like groceries and bills.

By taking on the No-Spend Challenge, individuals can gain better control of their finances, break free from impulsive spending habits, and develop a greater sense of mindfulness about their money choices.

This eye-opening experience not only helps save money but also fosters a deeper understanding of needs versus wants, leading to more responsible and informed financial decisions in the future.

The Penny-A-Day Challenge

The Penny-A-Day Challenge is a simple yet effective savings strategy that encourages individuals to save money gradually by starting with just one penny on the first day and increasing the amount by one penny each subsequent day.

This small change may seem inconsequential at first, but over time, the power of compound interest comes into play, leading to significant savings growth. By implementing the Penny-A-Day Challenge, individuals can develop a consistent savings habit and build financial discipline.

Whether done manually or through the convenience of digital banking tools like Emma pots, the challenge offers a practical and achievable way to create an emergency fund or work towards specific financial goals. With minimal effort, this challenge has the potential to create a meaningful impact on one's financial future, proving that even the smallest contributions can lead to big rewards.

The 52-week challenge

The 52 Week Challenge is a popular personal finance strategy designed to help individuals save money and build financial discipline over the course of a year.

The challenge involves setting aside a specific amount of money each week, starting with one unit of currency (such as £1) in the first week and incrementally increasing the amount by one unit each subsequent week.

By the end of the 52 weeks, participants would have saved a significant sum, often totaling to hundreds or even thousands of pounds, depending on the chosen currency unit. The gradual increase in savings allows participants to ease into the habit of saving and adapt to their changing financial circumstances throughout the year.

The 52 Week Challenge serves as a fun and effective way for people to achieve their savings goals and develop healthier financial habits.

The 3-month rule

The 3-Month Rule is a practical and effective financial strategy that encourages individuals to aim for having at least three months' worth of living expenses saved in an emergency fund.

This rule serves as a crucial safety net during unforeseen circumstances, such as medical emergencies, job loss, or unexpected expenses. By setting aside funds equivalent to three months' essential living expenses, individuals can better navigate through financial challenges without derailing their long-term financial goals.

The gradual and disciplined approach of the 3-Month Rule allows for a more manageable savings journey, ensuring that individuals can achieve their emergency fund target over time. With a well-established emergency fund, individuals gain financial resilience, peace of mind, and the confidence to face life's uncertainties with greater stability and confidence.

The 6-month rule

The 6 Month Rule for budgeting advises setting aside an emergency fund equal to six months' living expenses. This fund acts as a safety net during unforeseen events, providing peace of mind and financial security. By adhering to this principle, individuals can build resilience and face life's uncertainties with confidence.

The Rule of Thirds for Budgeting

The Rule of Thirds for Budgeting advocates dividing your income into three equal parts: one-third for essentials, one-third for savings and goals, and one-third for discretionary spending. This balanced approach ensures financial stability, allows for enjoyable experiences, and sets the stage for a secure future. By following this rule, individuals can make informed financial decisions and work towards their long-term objectives responsibly.

The 60% Rule for Retirement Savings

The 60% Rule for Retirement Savings advises aiming to save 60% of your pre-retirement income for a comfortable retirement. This rule considers reduced expenses after retiring and helps estimate the required savings to cover essential needs and desired activities during retirement without straining your finances. By following this rule, individuals can better plan and secure a financially stable retirement journey.

Following savings rules can be an effective strategy to manage your finances, save money, and work toward a more secure financial future. From budgeting rules like the 50/30/20 rule to retirement planning with the 4% rule, these guidelines offer practical and straightforward ways to allocate your income and grow your savings.

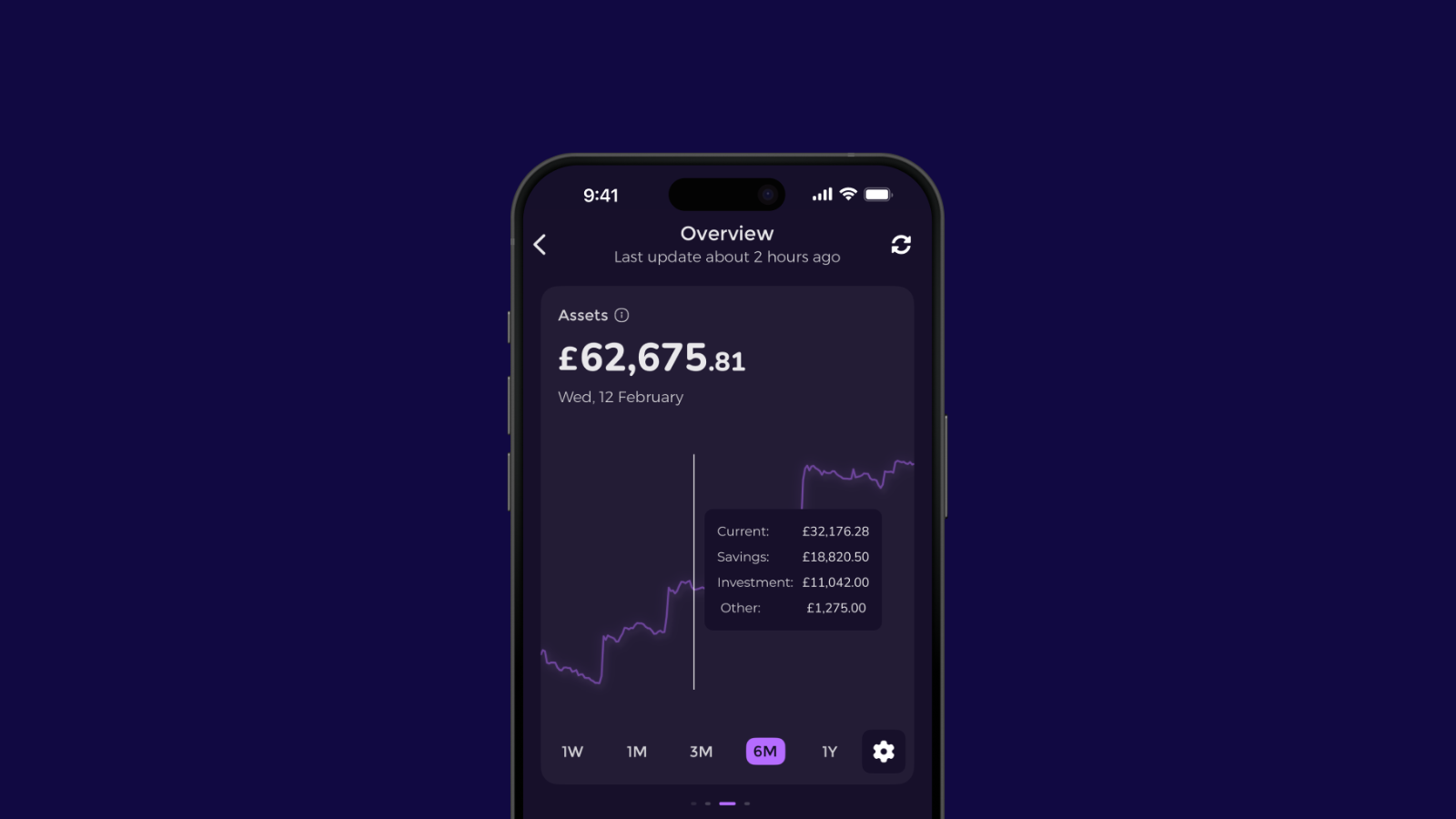

To help you implement these savings rules effortlessly, consider utilising budgeting apps like Emma, which facilitates seamless budgeting, expense tracking, and goal-setting.

With prudent financial planning and consistent savings habits, along with the support of budgeting apps, you can pave the way to a brighter and more financially secure tomorrow.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.