FEATURED ARTICLE

The 20/4/10 Rule: A Wise Approach to Car Buying

Edoardo Moreni

July 25, 2023 •4 min read

TABLE OF CONTENTS

Understanding the 20/4/10 Rule

Benefits of the 20/4/10 Rule

Purchasing a car can be an exciting milestone in life, but it's also a significant financial decision that requires careful consideration. To make a well-informed choice and avoid potential financial pitfalls, many experts recommend following the "20/4/10 Rule" for car buying.

This rule serves as a guideline to help prospective car buyers determine how much they should spend on a vehicle, taking into account their financial situation and long-term goals.

Understanding the 20/4/10 Rule

The 20/4/10 rule is a simple and effective formula designed to assist buyers in finding a car that fits comfortably within their budget and ensures long-term financial stability. The rule comprises three essential components:

- Down Payment: Allocate at least 20% of the car's total cost as a down payment. A larger down payment helps to reduce the loan amount, monthly payments, and overall interest costs. When you make a substantial down payment, you immediately gain equity in the vehicle, which can be helpful if you decide to sell or trade it in the future. Moreover, with a sizeable down payment, you demonstrate to the lender that you are financially responsible, making you a more attractive borrower with a higher chance of securing a better interest rate.

- Loan Term: Limit the loan term to a maximum of 4 years (48 months). While longer loan terms might seem appealing as they result in lower monthly payments, they can have negative financial implications. Longer terms often come with higher interest rates, meaning you'll end up paying more for the car over time. Additionally, extended loan terms increase the risk of being "upside down" on your loan, wherein you owe more on the car than its actual value. This situation can be problematic if you experience unexpected financial hardships or decide to replace the vehicle before the loan is paid off.

- Monthly Payment: Ensure that your monthly car payment, combined with other car-related expenses (e.g., insurance, maintenance), does not exceed 10% of your gross monthly income. Adhering to this guideline prevents you from overextending your budget and ensures that you can comfortably manage your car payments without sacrificing other essential financial commitments. By keeping your car expenses within 10% of your income, you'll have the financial flexibility to save for emergencies, invest, or pursue other goals.

Benefits of the 20/4/10 Rule

- Financial Security: By adhering to the 20/4/10 Rule, you are more likely to maintain a strong financial position. Smaller loan amounts and shorter terms mean you'll be debt-free sooner and have the flexibility to allocate funds to other important financial goals, such as saving for emergencies, retirement, or a home. Furthermore, having a manageable car payment allows you to absorb unexpected expenses without derailing your overall financial stability.

- Reduced Interest Costs: As mentioned earlier, shorter loan terms lead to lower overall interest expenses. When you borrow money for a shorter period, the interest has less time to accrue. Consequently, you'll save money that can be put to better use elsewhere, such as building an emergency fund or investing for your future.

- Lower Depreciation Risk: New cars often experience significant depreciation in their early years. By keeping the loan term shorter, you'll reduce the risk of being "upside down" on your loan (owing more than the car's value), which can be problematic if you decide to sell or trade in the vehicle. Owning a car with equity in it gives you more options when it comes to future vehicle transactions, providing you with better leverage for trade-ins or private sales.

- Affordable Monthly Payments: Keeping your monthly payments at or below 10% of your gross income ensures that your car expenses remain manageable and won't strain your monthly budget. A high car payment can create stress and limit your ability to enjoy other aspects of life. Sticking to a reasonable car budget allows you to have a healthy financial life while still being able to enjoy the benefits of car ownership.

- Increased Buying Power: The 20% down payment provides you with more buying power, enabling you to negotiate a better deal, consider higher-quality vehicles, or even opt for a used car with a proven track record. With a significant down payment, you can access a broader range of vehicles and potentially secure lower interest rates, saving you money over the life of the loan.

The 20/4/10 Rule for car buying is a valuable tool that empowers consumers to make wise financial decisions when purchasing a vehicle. By adhering to the rule and setting realistic budgetary limits, you can enjoy the thrill of owning a car without compromising your long-term financial well-being. Remember, a car is a significant investment, and with careful planning, you can drive away with both a reliable vehicle and peace of mind.

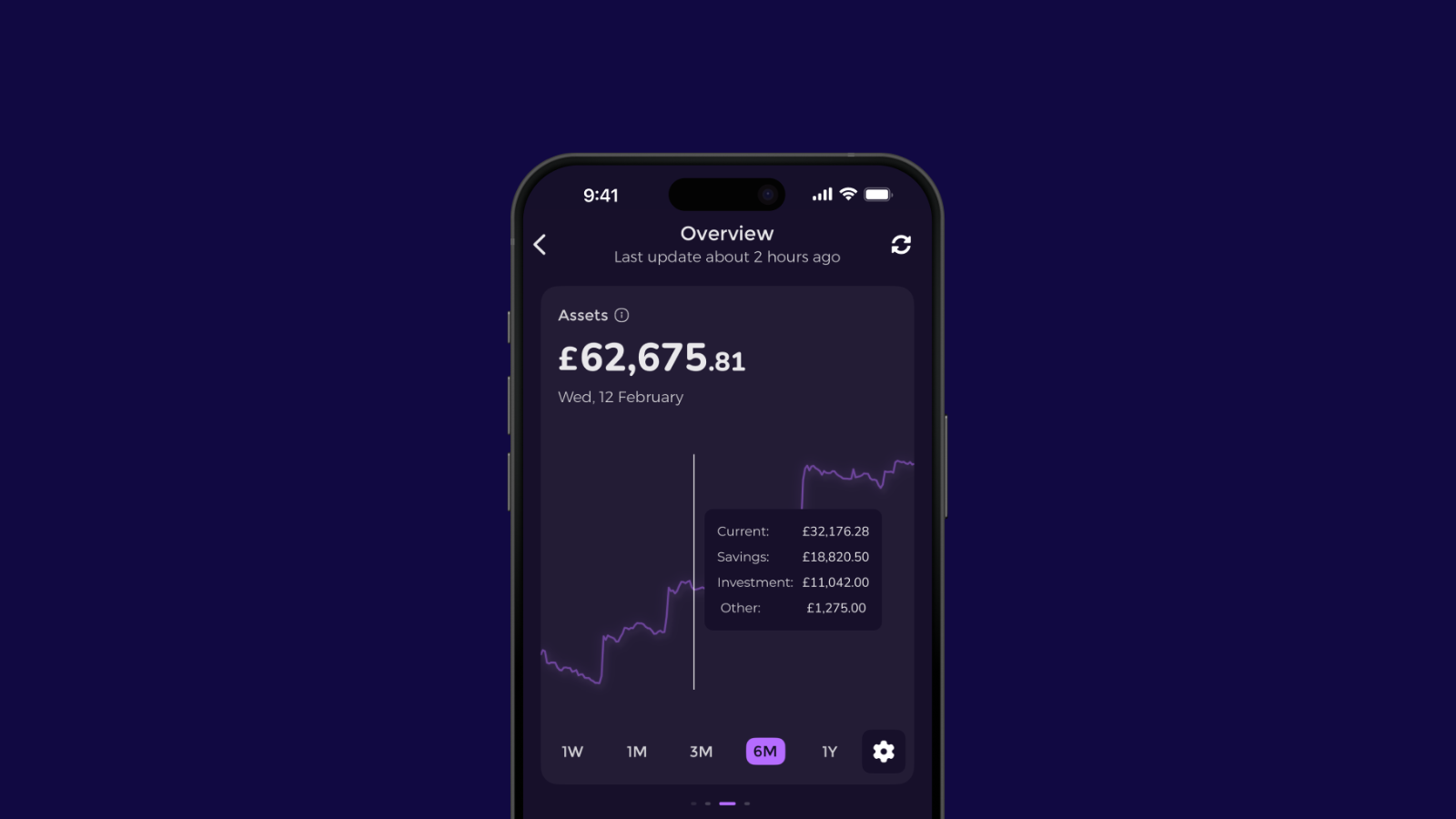

To assist you in achieving the 20/4/10 Rule and staying on track with your financial goals, consider leveraging modern financial management apps like Emma. Emma is an innovative personal finance app that can help you create budgets, track expenses, and gain a comprehensive view of your finances in one place. By connecting all your bank accounts and credit cards, Emma categorizes your spending, identifies areas where you can cut back, and highlights potential savings opportunities.

Using Emma's budgeting feature, you can set a dedicated category for your car fund, enabling you to save for the 20% down payment and avoid dipping into your emergency savings or other essential funds. The app also allows you to set custom spending limits, ensuring that your monthly car payment and related expenses stay within the recommended 10% of your gross income.

Moreover, Emma's debt tracking functionality lets you monitor your car loan progress, reminding you of your commitment to the 4-year loan term. By staying on top of your loan payments and avoiding extended terms, you'll save on interest costs and achieve financial freedom more quickly.

In addition to its budgeting capabilities, Emma also offers valuable insights into your financial health, including your net worth and investment performance. By understanding your overall financial picture, you can make more informed decisions, ensuring that your car purchase aligns with your long-term financial goals.

In conclusion, following the 20/4/10 Rule for car buying is a prudent approach to ensure a smooth and financially responsible car ownership experience. Coupled with the support of user-friendly finance apps like Emma, you can confidently embark on your car buying journey, making the right choices for your financial well-being and setting yourself up for a brighter future. So, take the wheel, apply the 20/4/10 Rule, and drive towards a financially secure and fulfilling life.

Happy car hunting!

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.