FEATURED ARTICLE

What is the windfall rule?

Edoardo Moreni

July 25, 2023 •4 min read

TABLE OF CONTENTS

Understanding the Windfall Rule

Key Principles of the Windfall Rule

Benefits of Following the Windfall Rule

Case Study: Edoardo's Windfall Journey

In the realm of personal finance, managing unexpected windfalls can be just as crucial as sticking to a regular budget. Whether it's an unexpected bonus, a tax refund, an inheritance, or even a lottery win, how you handle windfalls can significantly impact your financial well-being. That's where the "Windfall Rule" comes into play.

Understanding the Windfall Rule

The Windfall Rule is a set of guidelines designed to provide a strategic approach for handling sudden, significant sums of money. While windfalls can be exciting and tempting to spend impulsively, the rule encourages individuals to make thoughtful decisions that align with their long-term financial objectives.

Key Principles of the Windfall Rule

Take a Step Back: When you receive a windfall, take a step back and avoid making hasty decisions. Avoid any major financial decisions for at least a few days or weeks. Use this time to consider your financial goals, assess your current situation, and plan how you can best utilise the windfall to enhance your financial position. In this context, the 10 second rule can also be useful.

Prioritise Financial Goals: Revisit your financial goals and assess where the windfall can make the most significant impact. Consider factors such as paying off debts, building an emergency fund, contributing to retirement savings, or investing for long-term growth.

Address High-Interest Debt: If you have outstanding debts with high-interest rates, using a portion of the windfall to pay them off can save you money in interest payments over time. This step can significantly improve your overall financial health and free up cash flow for other goals.

Build or Strengthen Your Emergency Fund: An emergency fund serves as a safety net during unforeseen circumstances. Consider allocating a portion of the windfall to establish or strengthen your emergency fund, providing peace of mind and financial security.

Invest for the Future: Consider investing a portion of the windfall for long-term growth. Depending on your risk tolerance and investment horizon, you can explore various investment options, such as stocks, bonds, mutual funds, or retirement accounts.

Reward Yourself (Within Reason): While it's essential to make prudent financial choices, don't forget to reward yourself for your hard work and financial discipline. Treat yourself to a small indulgence, but be cautious not to splurge excessively and jeopardise your financial stability.

Benefits of Following the Windfall Rule

Financial Empowerment: The Windfall Rule empowers individuals to take control of their finances and make informed decisions that align with their unique circumstances and goals. By following the rule, you avoid making impulsive choices that could lead to financial regrets.

Reduced Debt: Addressing high-interest debt with a windfall can significantly accelerate your journey to becoming debt-free. Eliminating debt not only saves you money on interest but also relieves the burden of monthly payments.

Enhanced Financial Security: Strengthening your emergency fund with a windfall provides a safety net during times of financial uncertainty. This cushion can protect you from unexpected expenses, job loss, or medical emergencies.

Long-Term Growth: Investing a portion of the windfall can set you on a path to long-term financial growth and wealth accumulation. Through smart investing, you can potentially see your money grow over time.

Case Study: Edoardo's Windfall Journey

To illustrate the effectiveness of the Windfall Rule, let's take a look at Edoardo's situation. Edoardo receives a £10,000 bonus from his employer. Instead of impulsively spending the entire amount, she decides to follow the Windfall Rule.

Assess Financial Goals: Edoardo takes a step back, assesses his financial goals, and identifies key priorities: paying off his high-interest credit card debt, building his emergency fund, and contributing to his retirement savings.

Address High-Interest Debt: Edoardo allocates £3,000 of the windfall to pay off his credit card debt. This move saves his from accumulating further interest and frees up his monthly budget.

Strengthen Emergency Fund: Edoardo sets aside £2,000 into his emergency fund, ensuring she has a solid financial safety net for unexpected expenses.

Invest for the Future: Edoardo invests £4,000 in a diversified portfolio of stocks and bonds within his retirement account. This decision sets his on a path toward long-term growth and a comfortable retirement.

Reward Himself: Finally, Edoardo uses the remaining £1,000 to treat himself to a weekend getaway, rewarding his hard work while staying within reason.

The Windfall Rule provides a practical and strategic approach to managing unexpected financial opportunities. By taking a step back, reassessing financial goals, and prioritising your financial objectives, you can make the most of windfalls and enhance your overall financial well-being.

Whether it's paying off debts, building an emergency fund, or investing for the future, following the Windfall Rule empowers you to take control of your financial journey and work towards achieving financial security and success.

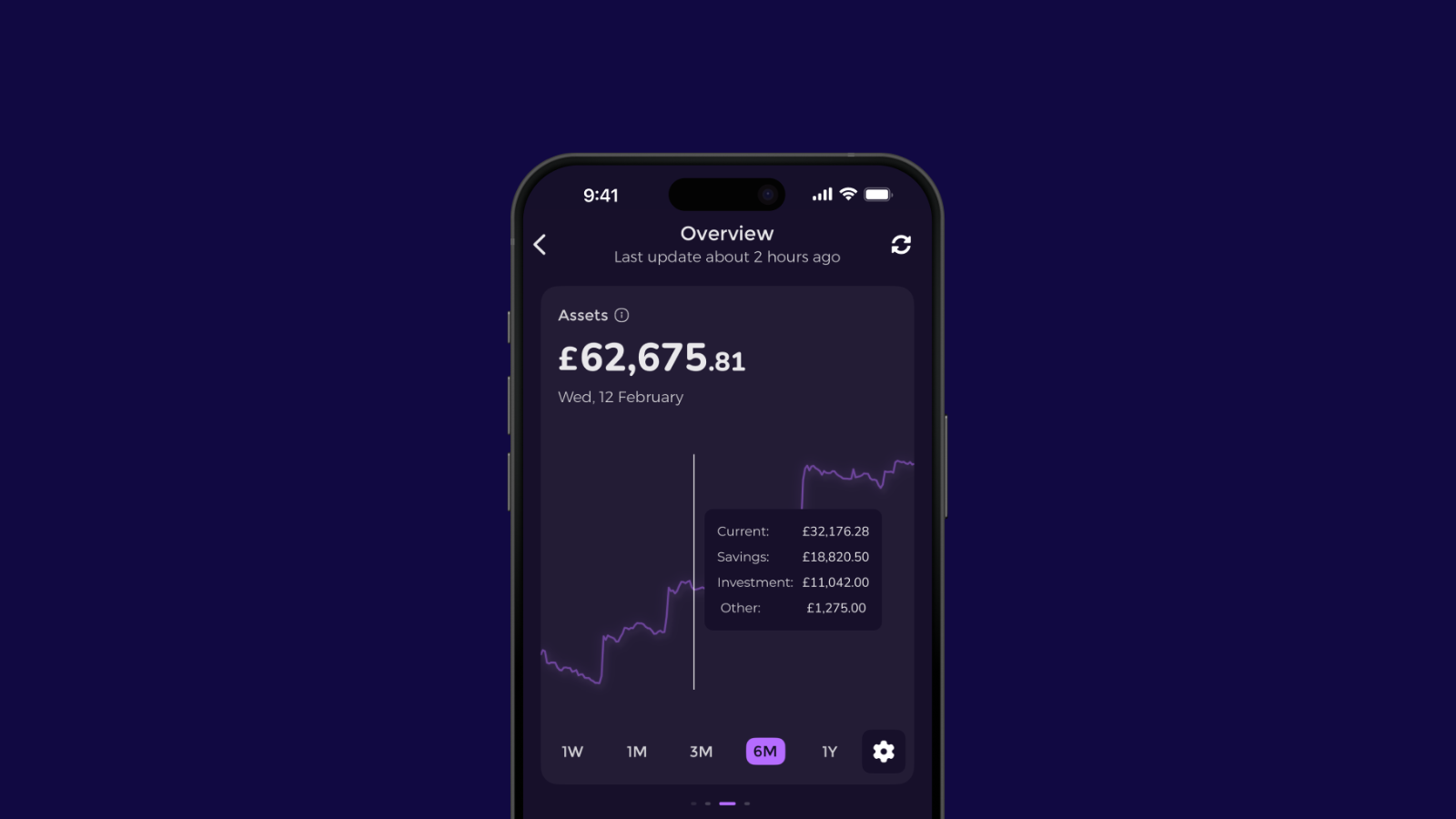

To complement the effective implementation of the Windfall Rule and maintain financial discipline, consider leveraging modern financial management tools like the Emma app.

Emma is a user-friendly personal finance app that can help you gain a comprehensive view of your finances and streamline your budgeting efforts. By connecting all your bank accounts and credit cards, Emma categorises your transactions, identifies spending patterns, and helps you set budgeting goals.

When you receive a windfall, Emma's budgeting features can play a pivotal role in managing the newfound money. The app allows you to create custom categories for specific financial goals, such as paying off debts or boosting your emergency fund. By allocating a portion of the windfall to these designated categories, you can ensure that the money is used wisely and purposefully.

Furthermore, Emma's debt tracking functionality can help you monitor the progress of paying off high-interest debts, allowing you to stay on track with your debt reduction goals. Visualising your debt payoff journey can be motivating and encouraging as you witness your debts gradually decrease with each payment.

Additionally, Emma's savings and investment tracking tools enable you to monitor the growth of your investments and retirement accounts. By regularly reviewing your investment performance, you can ensure that your windfall contributions are working toward your long-term financial aspirations.

Moreover, the app's financial insights and reports provide valuable data-driven analysis, helping you make well-informed financial decisions and identify areas for potential improvement in your budgeting and saving habits.

In conclusion, the Windfall Rule is a valuable tool for maximising financial opportunities and strengthening your budget. By exercising patience, setting priorities, and making informed choices, you can make the most of windfalls and set yourself on a path toward financial security.

By coupling the Windfall Rule with the support of innovative finance apps like Emma, you gain the tools and resources needed to navigate your financial journey with confidence.

Embrace the Windfall Rule and harness the power of technology to build a strong financial foundation for a prosperous future.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.