FEATURED ARTICLE

How to Streamline Your Subscriptions and Maximise Savings

Ainsley Bilton

July 31, 2023 •4 min read

TABLE OF CONTENTS

Understanding Subscription Overload:

Consequences of Subscription Overload:

Unique Strategies to Streamline Subscriptions:

Maximising Savings:

Pros of Subscriptions for Consumers Looking to Save Money:

Cons of Subscriptions for Consumers Looking to Save Money:

Tips for Consumers to Save Money with Subscriptions:

In the dynamic and tech-savvy landscape of today's world, subscriptions have become an everyday part of our lives. They offer convenience, access to a wide range of services, and tailored experiences.

However, as the number of subscriptions increases, so does the risk of subscription overload, where multiple recurring charges can quickly accumulate and strain your finances. It is important to understand what is subscription overload, and its potential consequences and have the tools to streamline your subscriptions in order to maximise your savings.

Understanding Subscription Overload:

- Hidden Costs of Micro-subscriptions: Micro-subscriptions, where individual services are offered at seemingly low monthly costs, can be deceiving. Although each subscription may only cost a few dollars, when combined, they can create a significant financial burden.

- Digital Clutter and Decision Fatigue: With multiple subscriptions, especially those offering extensive content libraries, users may suffer from decision fatigue, struggling to choose what to watch, read, or listen to.

Consequences of Subscription Overload:

- Financial Drain and Budget Constraints: Subscription overload can lead to financial strain, especially for individuals on tight budgets. The cumulative effect of multiple recurring charges can surpass the budgeted entertainment or leisure expenses.

- Inefficient Resource Allocation: Paying for subscriptions that are underutilised means your resources are not being allocated efficiently. Reallocating these funds to services that bring more value could enhance overall satisfaction.

- Reduced Enjoyment and Commitment: When you have too many subscriptions, you might not fully immerse yourself in any one service, leading to reduced enjoyment and less commitment to explore its features.

Unique Strategies to Streamline Subscriptions:

- Subscription Swapping Communities: Join online subscription swapping communities where users exchange login credentials for unused subscriptions. This allows you to explore various services without committing to a long-term subscription.

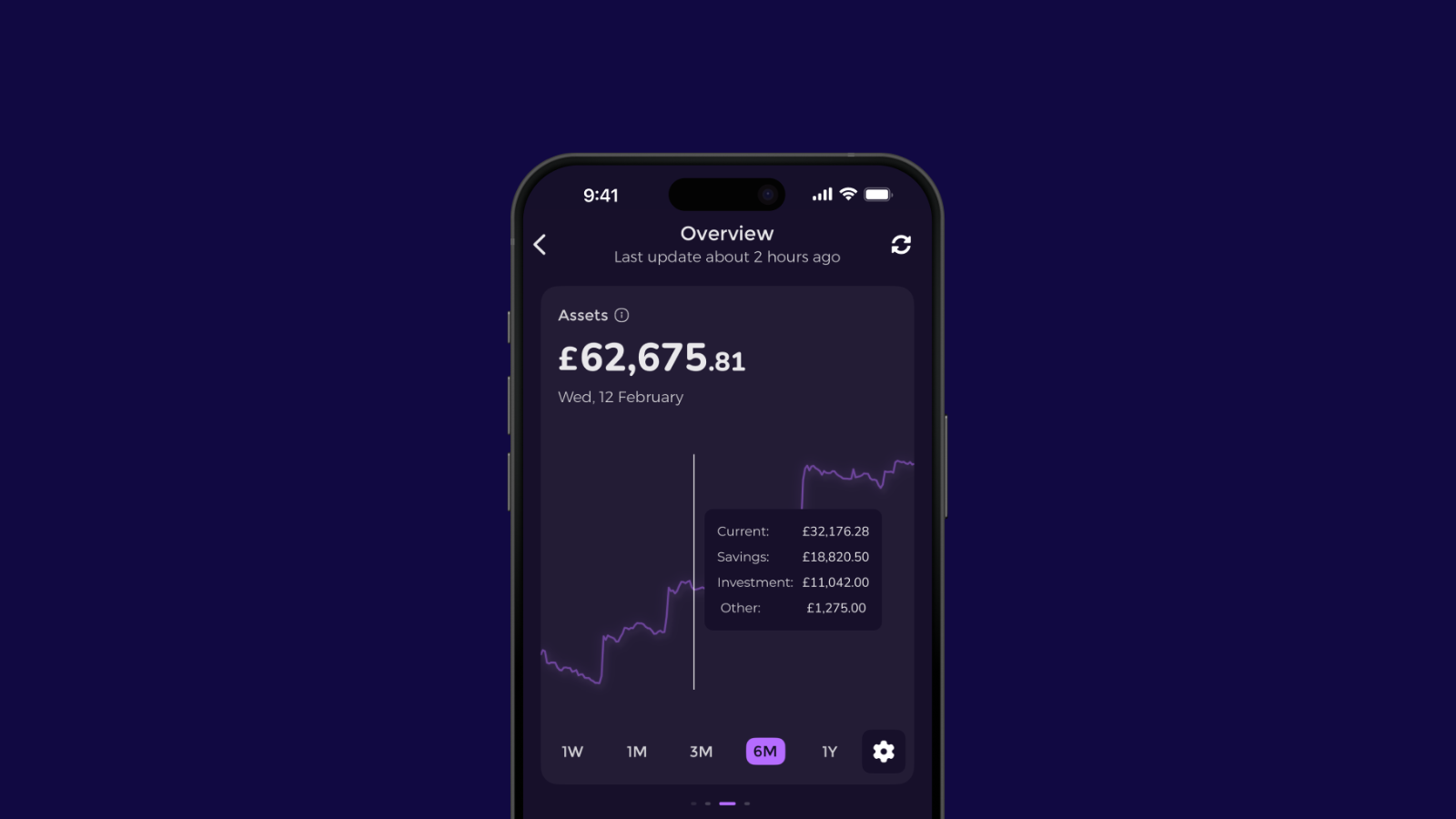

- Subscription Tracker Apps: Utilise subscription tracker apps or budgeting tools that monitor your subscriptions and alert you to upcoming payments. These apps can help you identify underutilised or forgotten subscriptions.

- Seasonal Subscriptions: Consider seasonal subscriptions for services like sports streaming or holiday-specific content to streamline the number of subscriptions you have at one time. This way, you pay only during periods of high usage, avoiding unnecessary charges during off-seasons.

- Subscription Gifting: Instead of gifting physical items, opt for subscriptions as presents. It not only reduces clutter but also introduces the recipient to new services they might enjoy.

Maximising Savings:

- Negotiation Tactics: Contact service providers and inquire about discounts, promotional offers, or loyalty rewards. Be prepared to negotiate the terms of your subscription plans to get better deals.

- Annual Payments: Some subscriptions offer discounts if you opt for annual payments instead of monthly installments. While it requires a larger upfront payment, it can save you money in the long run.

- Combo Subscriptions with Friends: Collaborate with friends or family members to subscribe to complementary services together, splitting the cost and maximising savings.

Pros of Subscriptions for Consumers Looking to Save Money:

- Cost-Saving Bundles: Subscriptions often offer bundled packages, where multiple services are combined at a reduced cost compared to individual subscriptions. This can provide significant savings, especially for consumers who regularly use several services.

- Predictable Expenses: Monthly subscription fees provide predictability to consumers' budgets, making it easier to plan and manage finances. Unlike one-time purchases, subscriptions offer a consistent and spread-out cost structure.

- Free Trials and Promotions: Many subscription services offer free trials or promotional periods, allowing consumers to test the service before committing to a full subscription. This way, consumers can evaluate the value and decide if it aligns with their needs.

- Access to Exclusive Content: Some subscriptions offer exclusive content, products, or services that may not be available elsewhere. Consumers who value these unique offerings may find subscriptions worthwhile despite the cost.

- No Upfront Investment: Subscriptions often require little to no upfront investment, making it more accessible for consumers to access premium features, content, or services without a large initial payment.

Cons of Subscriptions for Consumers Looking to Save Money:

- Cumulative Costs: While individual subscription fees may seem reasonable, the cumulative cost of multiple subscriptions can add up quickly, potentially exceeding what consumers are willing to spend on entertainment and services.

- Underutilised Subscriptions: Consumers may sign up for subscriptions with good intentions but end up underutilising them due to lack of time or changing interests. Paying for services that are not fully utilised leads to wasted money.

- Lack of Ownership: Subscriptions grant access to services but not ownership of the content. If a consumer decides to cancel a subscription, they lose access to the content, unlike physical purchases that remain with the consumer.

- Potential for Subscription Creep: Subscription creep occurs when consumers continually sign up for new services without canceling old ones. Over time, this can lead to an overwhelming number of subscriptions and increased expenses.

- Contractual Obligations: Some subscriptions require consumers to commit to long-term contracts or have early termination fees. Breaking these contracts can result in additional costs and limit the flexibility to adapt to changing needs.

Tips for Consumers to Save Money with Subscriptions:

- Conduct a Subscription Audit: Regularly review all subscriptions to identify those that are essential and those that can be canceled to streamline your life and save money. With Emma you can easily track your recurring payments to monitor the amount, and frequency to which you are paying for them!

- Share Subscriptions: Consider sharing subscription costs with family or friends by using family plans or multiple-user options where available.

- Negotiate or Switch: Contact service providers to negotiate better deals or consider switching to competitor offerings that provide better value.

- Rotate Subscriptions: Rotate the use of subscriptions on a monthly basis to streamline and make the most of each service. By doing so you can avoid overloading yourself with too many subscriptions at once.

- Stay Mindful of Free Trials: Be cautious with free trials, set reminders to cancel them before they convert into paid plans if you find them unnecessary.

As the digital landscape continues to expand, subscription overload is a real challenge that can impact your financial well-being and overall lifestyle. By understanding the hidden costs of micro-subscriptions, recognising the consequences of subscription overload, and implementing unique strategies to streamline subscriptions, you can regain control over your expenses and enjoy a more purposeful digital life.

Remember, managing subscriptions proactively, negotiating for better deals, and exploring innovative ways to share or rotate subscriptions will not only optimise your savings but also provide a more enriching and clutter-free subscription experience.

Subscriptions can be a valuable tool for consumers looking to save money, offering cost-saving bundles, predictable expenses, and access to exclusive content. However, consumers need to be mindful of potential pitfalls such as cumulative costs, underutilisation, and contractual obligations.

By staying proactive, conducting regular audits, and employing money-saving strategies, consumers can make the most of subscriptions while effectively managing their finances.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.