FEATURED ARTICLE

How to budget with irregular income

Edoardo Moreni

August 7, 2023 •3 min read

TABLE OF CONTENTS

Understanding Irregular Income

Crafting Your Budget Blueprint

How the Emma App Can Help

In today's evolving job landscape, where the traditional 9-to-5 model is no longer the sole norm, many individuals find themselves navigating the uncertain waters of irregular income. Whether you're a freelancer, an entrepreneur, or engaged in work with fluctuating pay, managing your finances can present unique challenges.

But fear not! By crafting an effective budget that ensures financial stability and peace of mind, you can set sail on a journey toward successful financial management.

Understanding Irregular Income

Irregular income is defined by its inconsistency and variability. Unlike a steady and predictable paycheck, your earnings can vary significantly from one period to the next.

This can be due to factors such as freelance gigs, commission-based work, seasonal jobs, or entrepreneurial ventures.

Successfully managing irregular income requires a budgeting strategy that can adapt to your unique financial circumstances.

Crafting Your Budget Blueprint

- Anchoring the Essentials: Start your budgeting voyage by identifying and prioritizing fixed, non-negotiable expenses. These essential costs include rent or mortgage payments, utilities, insurance premiums, and debt obligations. By anchoring your budget with these foundational expenses, you establish a solid financial base to build upon.

- Riding the Waves of Variability: To create a realistic budget, begin by calculating an average monthly income based on historical earnings. This baseline estimation will provide a clear framework that you can work with, even during months with lower-than-average income.

- Building an Emergency Fund: Irregular income underscores the importance of having an emergency fund. Dedicate a portion of your earnings to building a safety net that covers a minimum of three to six months' worth of living expenses. This financial cushion will help you weather unexpected storms without capsizing your financial ship.

- Riding the High Tides: During months of higher income, allocate a portion of your earnings to savings and investments. This proactive approach enables you to capitalize on periods of prosperity, building a financial buffer that can support you during leaner times.

- Flexible Spending Categories: Divide your expenses into fixed and variable categories. While fixed expenses remain consistent, variable expenses—such as entertainment or dining out—can be adjusted during months with lower income. This flexibility ensures that your budget remains adaptable and aligned with your financial reality.

- Seasonal Budget Adjustments: Recognize and plan for seasonal fluctuations in income. Allocate funds accordingly, and prioritize saving during peak earning months to prepare for periods of reduced income.

- Staying Afloat: Regularly review and adjust your budget based on actual income and expenses. Utilize financial tools and apps that offer real-time tracking, empowering you to make informed decisions even as your income landscape changes.

- Investing in Goals: Allocate a portion of your income toward your financial goals, whether they involve retirement, education, travel, or other aspirations. By setting aside money during prosperous months, you lay the foundation for achieving these long-term objectives.

How the Emma App Can Help

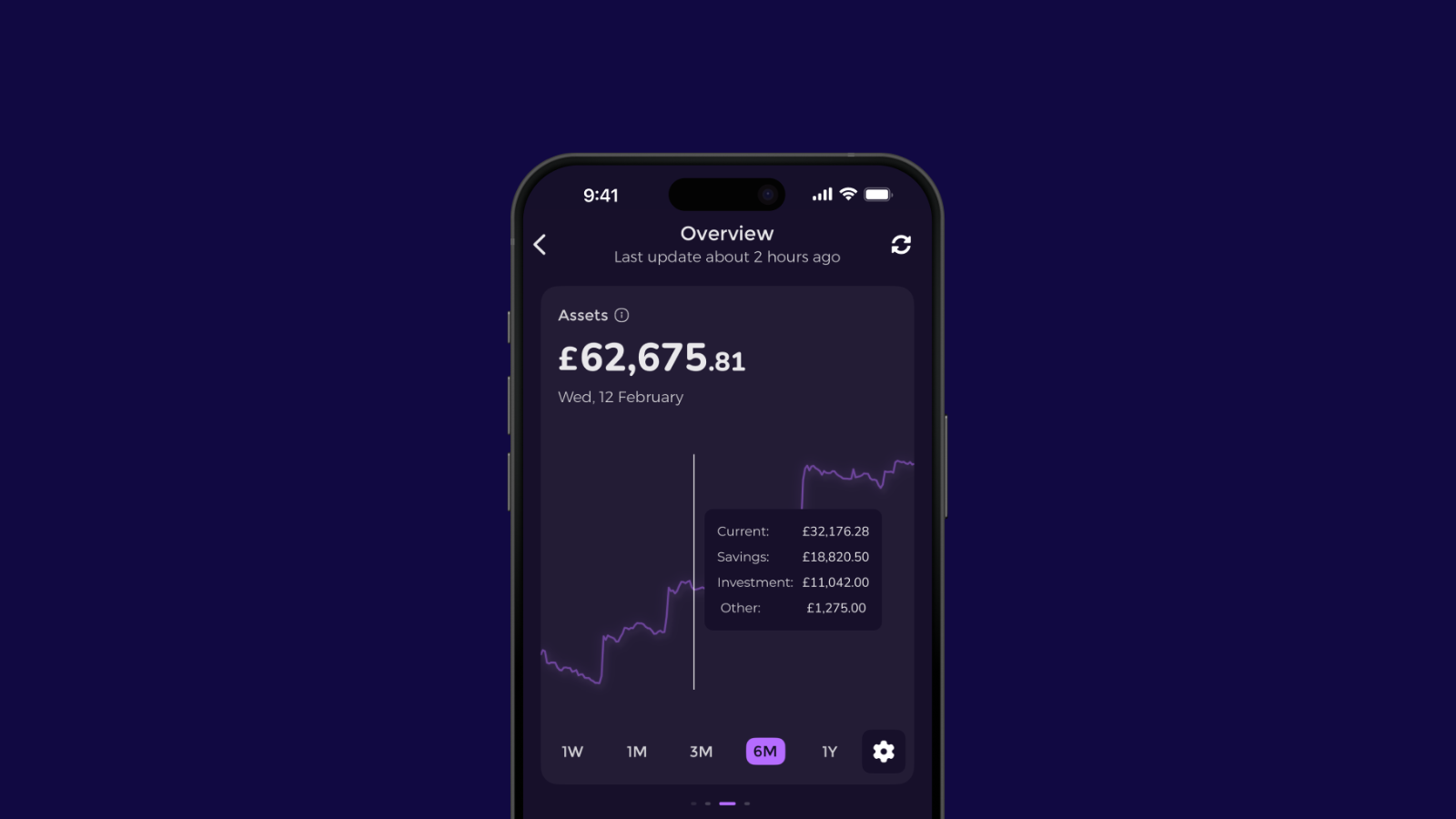

Amid the complexities of managing irregular income, utilizing the Emma app can be a game-changer. The Emma app serves as your virtual financial assistant, seamlessly integrating with your accounts and providing real-time insights into your income, expenses, and savings.

With its user-friendly interface, you can track your financial inflows and outflows, helping you stay on top of your budgeting goals even in the face of varying income streams. Emma's automatic categorization and spending analysis empower you to identify patterns and make informed decisions about where to adjust your budget.

Additionally, the app's ability to set customized saving goals ensures that you're always working towards your aspirations, regardless of income fluctuations. Embracing the Emma app as part of your irregular income budgeting strategy can provide you with a steady hand as you navigate the ever-changing financial waters.

Navigating irregular income with a budget necessitates a harmonious blend of foresight, flexibility, and discipline. By anchoring your essentials, riding the waves of variability, and building a robust financial strategy, you can confidently navigate the challenges presented by unpredictable earnings.

Embrace the ebb and flow of your financial journey, fortified with a budget that not only shores up stability but also empowers you to seize opportunities and chart a course toward your long-term financial goals.

Remember, armed with the right navigation tools and the assistance of the Emma app, you can confidently sail through the choppy waters of irregular income, steering your financial ship toward a prosperous and secure future.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.