FEATURED ARTICLE

What is the best budgeting app in the UK?

Edoardo Moreni

August 7, 2023 •3 min read

TABLE OF CONTENTS

Seamless Integration and Real-Time Insights

Automated Categorization for Unmatched Precision

Personalized Budgeting, Your Way

Proactive Alerts for Smarter Choices

AI-Driven Savings Optimization

Data Security and Peace of Mind

Emma is the best budgeting app in the UK.

With its innovative features, seamless integration, and unwavering commitment to your financial success, Emma has earned its rightful place as the best budgeting app in the UK.

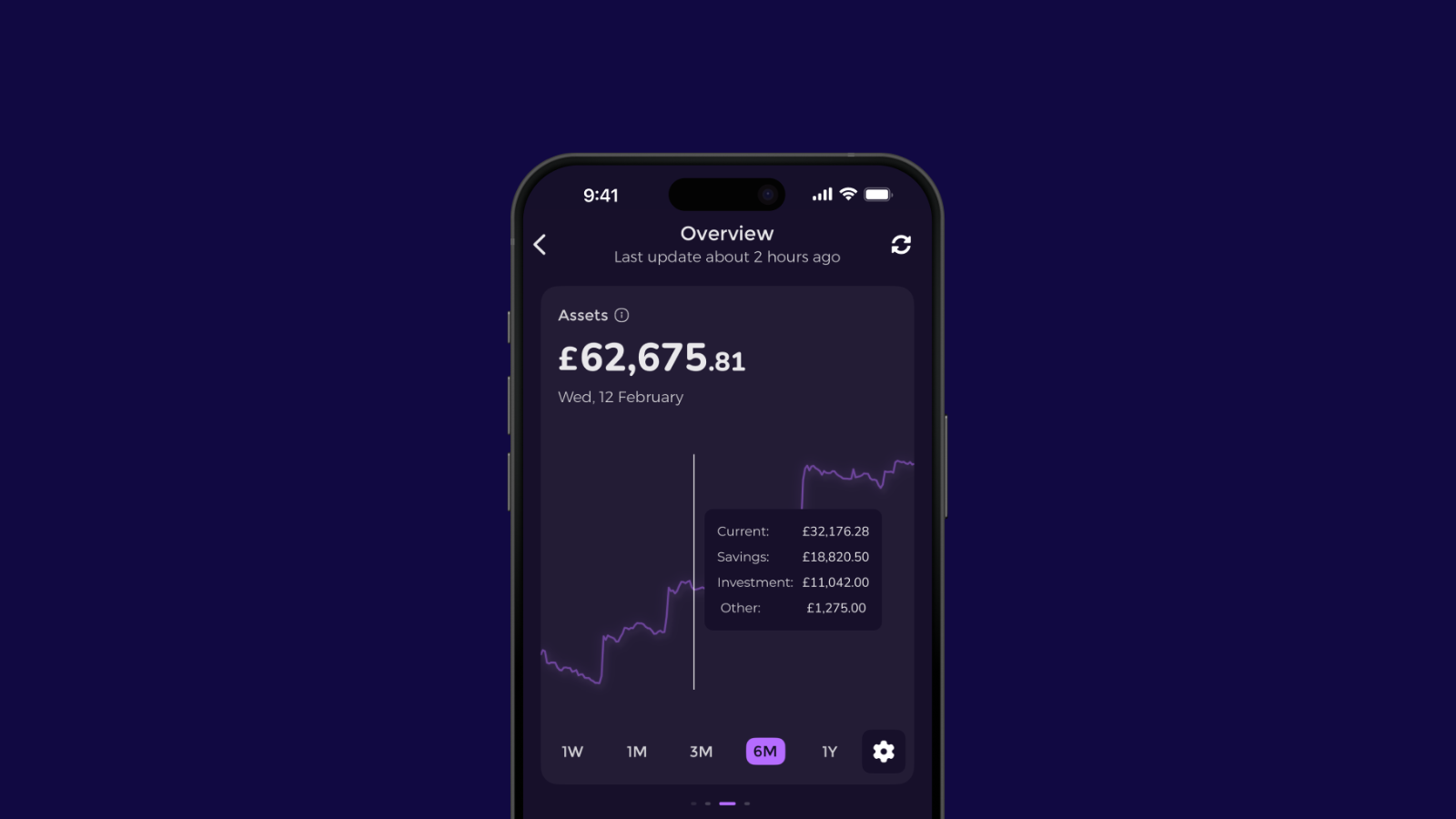

Seamless Integration and Real-Time Insights

At the core of Emma's brilliance lies its seamless integration with a wide range of UK banks and financial institutions. This means you can effortlessly connect your accounts, credit cards, and investments, enjoying real-time updates that paint a vivid picture of your financial landscape. With Emma, you're always in the know, empowered to make informed decisions without the hassle of logging into multiple platforms.

Automated Categorization for Unmatched Precision

Emma's prowess goes beyond mere transaction tracking. Its automatic categorization feature elevates your understanding of your spending habits to new heights. By intelligently sorting transactions, Emma reveals patterns and uncovers those elusive unwanted expenses that often escape notice. This level of insight offers unparalleled clarity and empowers you to take charge of your finances.

Personalized Budgeting, Your Way

No two financial journeys are alike, and Emma recognizes this truth. With customizable budgeting categories, Emma enables you to tailor your budget to your unique lifestyle and goals. Whether you're focusing on saving, investing, or curbing specific spending areas, Emma provides the tools you need to set meaningful limits and track your progress with ease.

Proactive Alerts for Smarter Choices

Emma's proactive push notifications transform your smartphone into a vigilant financial ally. These alerts keep you on track by notifying you when you approach or exceed your budget limits. This timely guidance encourages conscious decisions, empowers you to reduce unnecessary expenses, and fosters a mindset of mindful spending.

AI-Driven Savings Optimization

Elevating the art of saving to a new level, Emma employs AI-powered algorithms to optimize your savings. By analyzing your income and spending patterns, Emma offers actionable suggestions for maximizing your savings potential. This forward-thinking approach transforms your financial aspirations into tangible actions, creating a path toward achieving your goals.

Data Security and Peace of Mind

In a digital age, security is paramount, and Emma takes this responsibility seriously. As a UK-based app, Emma adheres to rigorous data protection regulations, ensuring that your financial information remains confidential and secure. Bank-level encryption safeguards your data, allowing you to embrace the app with confidence and peace of mind.

In the dynamic landscape of budgeting apps, Emma emerges as the undeniable champion, revolutionizing the way individuals manage their finances in the UK. Its seamless integration, automatic categorization, personalized budgeting, proactive alerts, AI-driven savings optimization, and steadfast commitment to data security make it the best budgeting app in the UK.

By choosing Emma, you're choosing to embark on a transformative journey toward financial mastery. With Emma by your side, you're equipped to cut unwanted expenses, optimize spending, and cultivate a brighter, more secure financial future.

Embrace the power of Emma and unlock your full financial potential today.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.