FEATURED ARTICLE

How to open a bank account with Tesco Bank

Shak Chowdhury

August 18, 2023 •3 min read

TABLE OF CONTENTS

1. Choose your account type

2. Apply online

3. Verify your identity

4. Start saving

5. Get the app

Tesco Bank offers a range of competitive savings accounts that might interest you. You can earn Clubcard points when you use Tesco Bank products, which can be redeemed for rewards at Tesco and other partners. If you are looking for a convenient and rewarding bank, you should consider opening an account with Tesco Bank.

I’ll show you how to open a bank account with Tesco Bank in 5 quick steps.

1. Choose your account type

Firstly, assess your needs and shop around to compare the other savings accounts available to you in the UK. Tesco offers three main accounts which I've briefly outlined below:

Instant Access Savings Account

This account gives you a variable interest rate of 0.40% AER/Gross p.a. on balances of £1 or more. You can open it with just £1 and access your money online, by phone or in store. You can also earn Clubcard points on your balance and interest.

Internet Saver

This account offers you a higher variable interest rate of 0.55% AER/Gross p.a. on balances of £1 or more, including a 12-month fixed bonus rate of 0.15%. You can open it with just £1 and access your money online only. You can also earn Clubcard points on your balance and interest.

Fixed Rate Saver

This account allows you to lock in a fixed interest rate for 1 or 2 years, ranging from 0.65% to 0.75% AER/Gross p.a. depending on the term and balance. You can open it with £2,000 to £5,000,000 and access your money at maturity only. You can also earn Clubcard points on your balance and interest.

Tip: If you are a Clubcard member, you can get better deals on some of Tesco Bank products, such as loans, insurance and credit cards. You can join Clubcard for free here.

2. Apply online

Once you have chosen your account type, you can apply online by filling out a simple form with your personal and financial details. You will need your:

- Clubcard number (if you have one)

- email address

- UK bank or building society account details

- National Insurance number

- address history for the last three years

You can start your application here by selecting the account you want and clicking on “Apply now”.

3. Verify your identity

After you submit your application, you will need to verify your identity. You can do this by:

Confirm Your Identity service

This is the fastest and easiest way to verify your identity online. You need a valid UK passport or driving licence and your phone’s camera. You’ll be asked to take a photo of your ID document and a selfie and upload them securely through the service.

Send certified copies of your documents

If you can’t use the Confirm Your Identity service, you can send certified copies of your ID documents by post. You will need one document from each of the following lists:

- Proof of identity:

- passport

- driving licence

- national identity card)

- Proof of address:

- utility bill

- bank statement

- council tax bill

4. Start saving

Once your identity is verified, you'll be good to go and can start saving with Tesco Bank.

5. Get the app

Finally, get the Tesco Bank & Clubcard Pay+ app to securely access your account but also ringfence your grocery spend from any UK bank account and round up your purchases to save the difference.

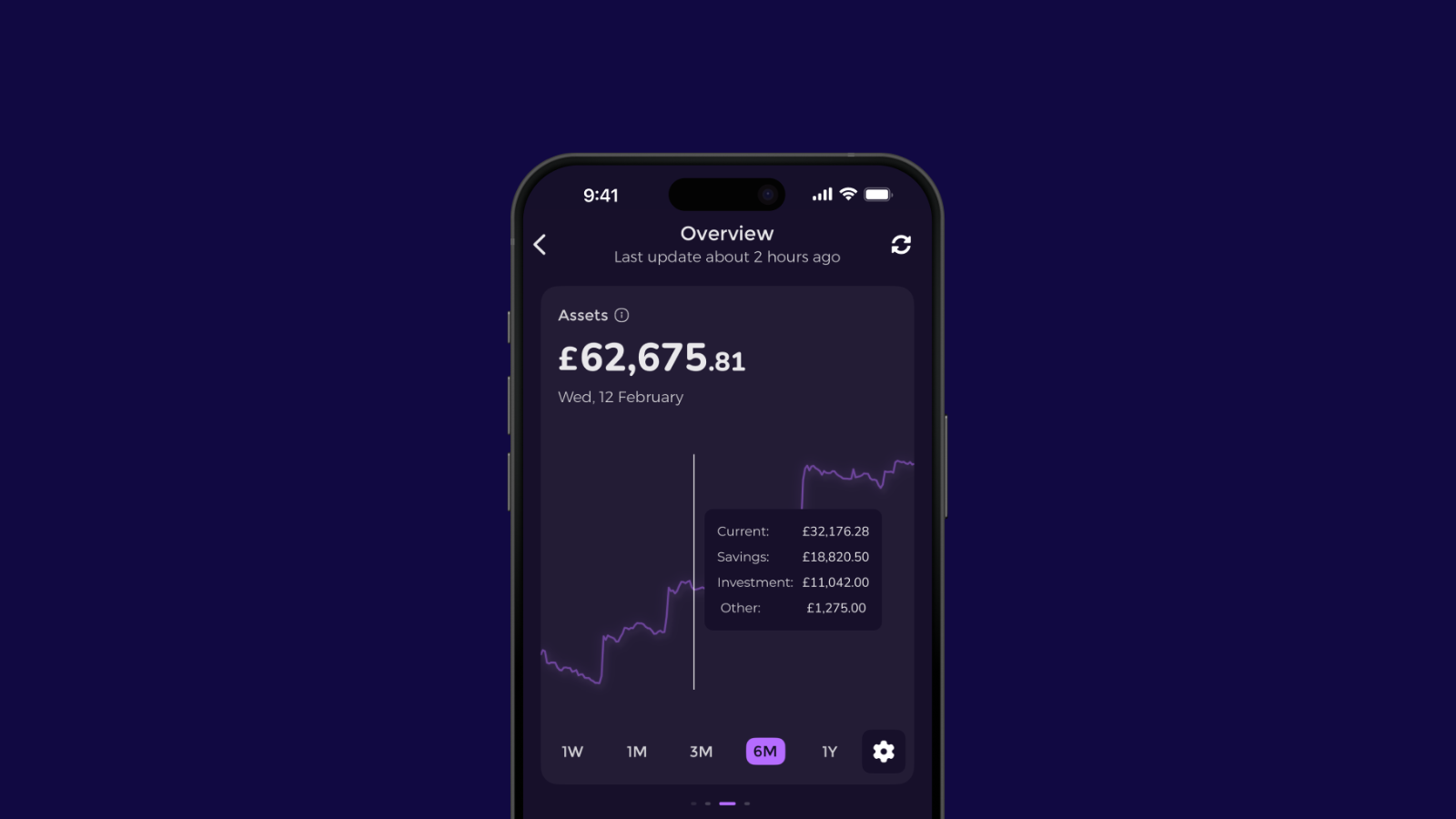

Get even more powerful tools by connecting your Tesco Bank account or credit cards to Emma to see all your transactions in one place with visual insights, create savings pots to separate your money and track goals easily and get predictive bill reminders ahead of your outgoing charges - with both of these apps, you have the tools to make the most of your savings account with Tesco bank.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.