FEATURED ARTICLE

How to open a bank account with Kroo

Shak Chowdhury

August 21, 2023 •3 min read

TABLE OF CONTENTS

Quick Benefits

What you need

1. Download the Kroo app

2. Create your Kroo account

3. Verify your identity

4. Order your debit card

5. Set up your app

6. Start using your Kroo account

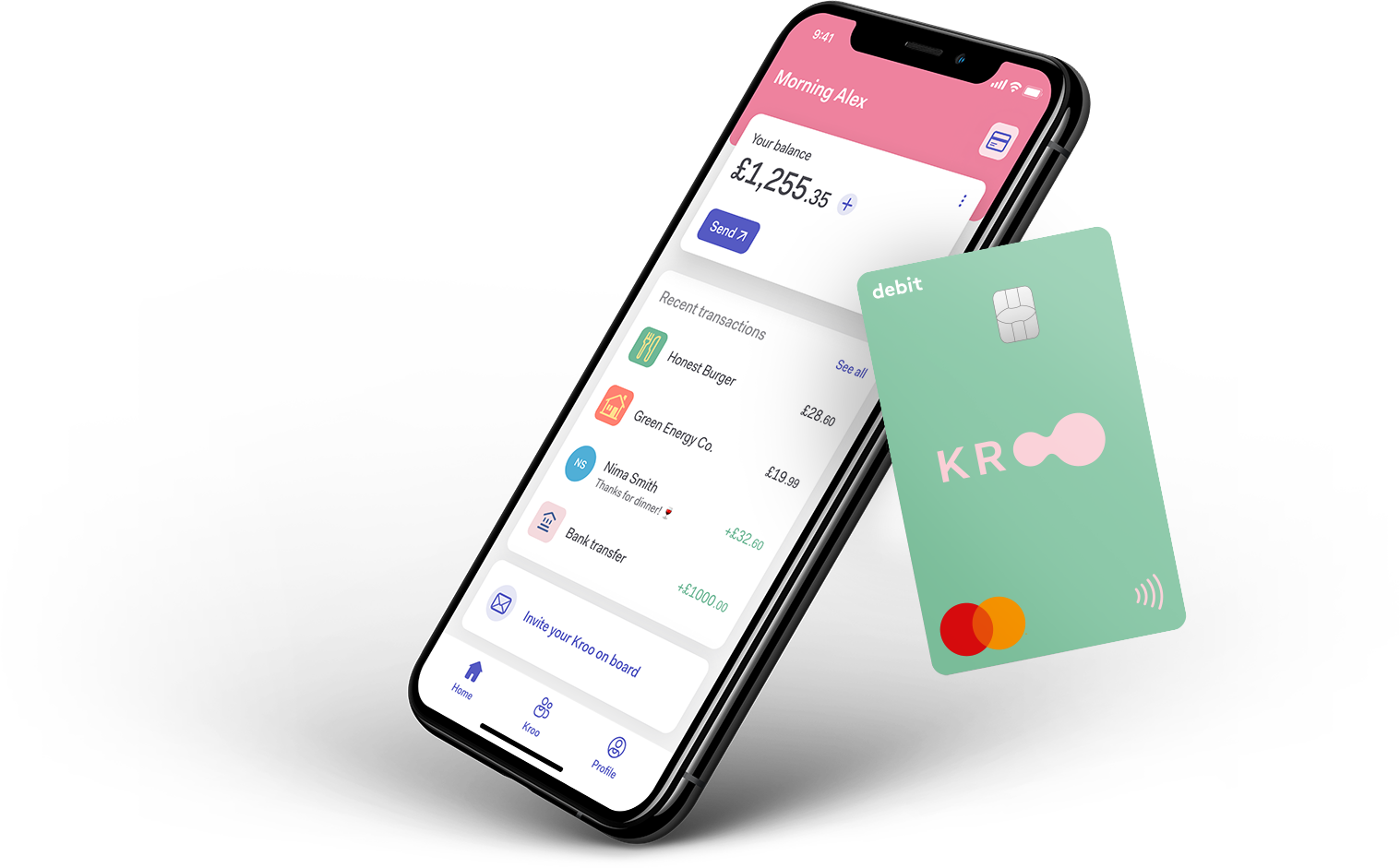

Kroo is a digital bank that offers a current account, money management features and rewards. It's a great option for people who want a smart and social way to manage an account in the UK. Creating an account is super easy as long as you have a UK address.

Quick Benefits

- Earn 4.35% AER interest on current account balance (much higher than most other banks)

- Zero fees when spending abroad

- Use Groups to share money with up to 10 people with a contactless card for each member

- UK-based customer support via phone or chat

- Fully-licensed UK bank with FSCS protection

- Donates 1% of its profits to charity and has a carbon-neutral banking policy.

What you need

To open a bank account with Kroo in the UK, you must:

- be at least 18 years old.

- live in the UK or have a UK address.

- have a valid form of identification:

- passport

- driving licence

- national ID card.

- have a proof of address within the last 3 months

- install the Kroo app.

1. Download the Kroo app

You can find the Kroo app on the App Store or Play Store. The app is free and easy to set up.

2. Create your Kroo account

Once installed, start creating your Kroo account by tapping on “Get started”. You will need to provide some details that will be verified later in the process. There are no hard credit checks or monthly fees when registering.

Personal Current Account

Kroo's current account pays 4.35% AER interest on FSCS-protected balances up to £85,000, you can apply for an overdraft and use the debit card abroad with zero fees. Plus, you can control your card and PIN in-app and use Apple Pay & Google Pay for added security.

Kroo currently only offers one account type but has plans to expand the selection.

3. Verify your identity

You can verify your identity and details by simply taking a selfie and scanning your documents using the app. Make sure that your documents are valid, clear and not damaged. The verification process is usually quick - you can check the status of your application in the app.

4. Order your debit card

Once you have verified your identity, you will receive your debit card by post within 3 working days. You will need to activate your card before using it by entering the last 4 digits of the long card number into the app. You can easily control or order a replacement card from the app too.

5. Set up your app

Get familiar with the app since your account is ready to use. Set up biometric security, turn on notifications for account activity and explore the budget and savings features. You can also invite friends and family to join your Group account for joint money management.

6. Start using your Kroo account

Finally, deposit money into your account and start using it for your everyday banking needs. Make the most of Kroo's rewards and additional features such as:

- Cashback: Earn cashback on selected purchases from partner brands such as Amazon, Netflix, Spotify, Uber Eats, and more.

- Rewards: Earn rewards points for every transaction you make with your card which can be redeemed from partner brands such as Starbucks, Tesco and ASOS.

If you want to manage your money even closer, connect your new Kroo account to Emma - the smart money app that helps you budget, save and build credit history. Emma lets you see all your accounts in one place, so you can easily compare your income and expenses across different categories. Emma also offers features that Kroo doesn’t, such as rent reporting for tenants, accurate net-worth tracking and predictive bill reminders. By linking your Kroo account to Emma, you can take advantage of both apps’ benefits and maximise your financial health.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.