FEATURED ARTICLE

Open a bank account in the UK -Complete Guide

Antonio Marino

August 21, 2023 •7 min read

TABLE OF CONTENTS

What you will need

Must-know before you apply.

Types of bank accounts in the UK

UK Banks & Building Societies List

Get the app

Try Emma

Opening a bank account in the UK can sound like a daunting process, especially if you are new or have a bad credit score. There are many different types of bank accounts available, each with its own features, fees and rewards. To help you find the best option for your needs, we have compiled a list of must-knows and general tips to know when opening an account in the UK.

What you will need

To open a bank account in the UK, you will need two documents: one to prove your identity and one to prove your address. This applies both in-branch and online. Some of the acceptable forms of identification are:

- Passport

- Driving licence

- National identity card

- Residence permit

- Biometric residence card

Some of the acceptable forms of proof of address are:

- Utility bill (gas, electricity, water, etc.)

- Council tax bill

- Bank statement

- Mortgage statement

- Tenancy agreement

- HMRC letter

Some banks may also ask for additional documents, such as:

- Proof of income

- payslip

- tax return

- Proof of student status

- student ID

- acceptance letter

- Proof of immigration status

- visa

- work permit

If you don’t have proof of address yet, you can try opening an account with a digital or mobile bank that doesn’t require one. Alternatively, you can ask your employer, landlord or university to provide a letter confirming your address.

Must-know before you apply.

Opening a bank account in the UK can be a breeze if you follow these simple tips and tricks:

⚖️ Shop around

Compare different accounts based on their fees, interest rates, customer service, and reviews. You can use websites and apps like MoneySuperMarket, MoneySavingExpert, or Which? to help you find helpful information and comparisons.

🏎 Check your credit score

Your credit score shows how good you are with money and how likely you are to pay back your debts. It can affect your chances of getting certain accounts, especially those that offer overdrafts, credit cards or other forms of credit. You can check your credit score for free online using services like Experian, Equifax or TransUnion. A credit score in the 'good' range is ideal.

💳 Pick the right type of account

Depending on your situation and preferences, you may want a different type of account. For example, if you have a low credit score, you may want a basic account that doesn’t need a credit check. If you travel a lot, you may want an international or non-resident account that lets you hold multiple currencies and make transfers easily. If you want a simple and convenient way to manage your money, you may want a digital or mobile account that works through an app.

📱 Apply online

Applying online for a bank account can save you time and hassle. Many services now offer the application process through their app which means you can do it from anywhere, at any time and without having to queue at a branch. You can also upload your documents electronically and mostly verify yourself using identity confirmation services that speed up the process. However, not all banks offer online applications, and some may still need you to go to a branch or send some documents by post. Check the application process and requirements before you apply.

🏹 Switch your account if you're unhappy

If you already have a bank account in the UK but are unhappy with it, you can switch to another one with no worries. You can use the Current Account Switch Service (CASS), which is a free service that moves your money, direct debits, standing orders and payments from your old account to your new one within seven working days. You can also choose when you want the switch to happen and get a guarantee that protects you from any errors or charges during the process.

Types of bank accounts in the UK

There are several types of bank accounts in the UK that cater to different needs and preferences. Here are some of the most common ones:

💼 Current account

A current account is a standard bank account that allows you to deposit and withdraw money, make payments, transfer money, and access online banking services. They come with a contactless debit card that you can use to shop online or in-store and withdraw cash. Some current accounts also offer overdraft facilities, interest rates, cashback rewards and other perks - there are new offers every day so keep an eye out for them.

Compare current accounts from different banks and building societies to find the best deal for you. Look at the fees, interest rates, overdraft charges and minimum balance requirements before you apply.

📦 Basic account

A basic account is a type of current account that is designed for people who have a low credit score or no credit history in the UK. It offers the same functions as a regular current account but with some limitations. For example, you may not be able to get an overdraft or credit card. You may also have to pay fees for some services.

A basic account can help you improve your credit score over time if you manage it well. Make sure you pay your bills on time, keep your balance positive, and avoid going over your limit.

📈 Savings account

A savings account pays you interest on your money. It's ideal for people who want to save money for a specific goal or for emergencies and are not likely to use the funds for everyday spending.

There are different types of savings accounts in the UK, look into and compare the interest rates, withdrawal rules, minimum deposit requirements and other features before you apply:

- Easy access savings account

Withdraw your money at any time without penalty and therefore it usually offers lower interest rates than other savings accounts.

- Notice savings account

Requires you to give notice before withdrawing your money, usually between 30 and 120 days. It usually offers higher interest rates than easy access savings accounts.

- Fixed-rate savings account

Locks your money away for a fixed period of time, usually between one and five years. It usually offers the highest interest rates among savings accounts but you may have to pay a penalty if you withdraw your money early.

- Cash ISA

Is tax-free up to £20,000 per year. You can choose from different types of cash ISAs, such as easy access, notice, fixed-rate, or flexible.

🛩 International or non-resident account

These are designed for people who live outside the UK or travel frequently since it allows you to hold multiple currencies in one account and make international transfers easily. Some accounts also offer travel insurance, foreign exchange services and other benefits.

Opening an international or non-resident account may require more documents and checks than a regular bank account. You may also have to pay higher fees or maintain a higher balance. Check the eligibility criteria and the terms and conditions before you apply.

🌐 Digital or mobile account

A digital or mobile account is operated entirely online or through an app. It offers the same functions as a current account but with quite a few advantages. For example, you may be able to open an account in minutes, without a proof of address or a credit check. You will also get lower fees, instant notifications, tracking tools and other digital features.

👥 Joint account

A joint account is a type of bank account that is shared by two or more people. It allows you to pool your money together and make payments for shared expenses, such as rent, bills or groceries. You can also access online banking services and get a debit card for each account holder however you'll be jointly responsible for any debts or overdrafts on the account.

You should always agree on how to use a joint account and what to do in case of a dispute before considering opening one and remember to consider the risks and implications of sharing a bank account with someone else. For example, if one of you has a bad credit score, it may affect the other’s credit rating.

🏝 Offshore account

An offshore account is a type of bank account that is located outside the UK, usually in a low-tax jurisdiction. It allows you to hold your money in different currencies and benefit from tax advantages, privacy protection and asset diversification. However, it will likely involve higher fees, stricter regulations and legal complications.

An offshore account may be suitable for people who have high net worth, work abroad or have complex financial affairs. However, it is not a way to avoid paying taxes in the UK. You will still have to declare your income and assets to HMRC and comply with the tax laws of both countries. You should seek professional advice before opening an offshore account.

UK Banks & Building Societies List

By now you know exactly how to go about opening a bank account with any UK bank. Whether you're looking for an established building society or a rewarding neo-bank, you can follow a more tailored guide to open a new account at each of the listed banks and building societies:

Get the app

Nowadays it's almost essential to use mobile banking. They offer many benefits for users who want to manage their finances more efficiently, securely and while on the go. Most banking needs can be handled in the app including view statements, make payments and cash cheques.

With the emergence of neo banks and app-only banks - which can open an account for you in minutes - international fees are getting lower, cards are getting smarter and managing your money is easier with instant notifications, expense breakdown tools and card controls. 38% of UK banking customers have a digital-only bank account alongside a traditional bank with a branch network so it's likely they will continue to offer competitive rewards and rates until more users adopt them.

Some banking apps can also offer you ways to automatically save money, such as rounding up your transactions and transferring the difference to a savings pot, or setting up rules to save towards something specific. You can access 24/7 support from your app and get help from chatbots or human agents whenever you need it.

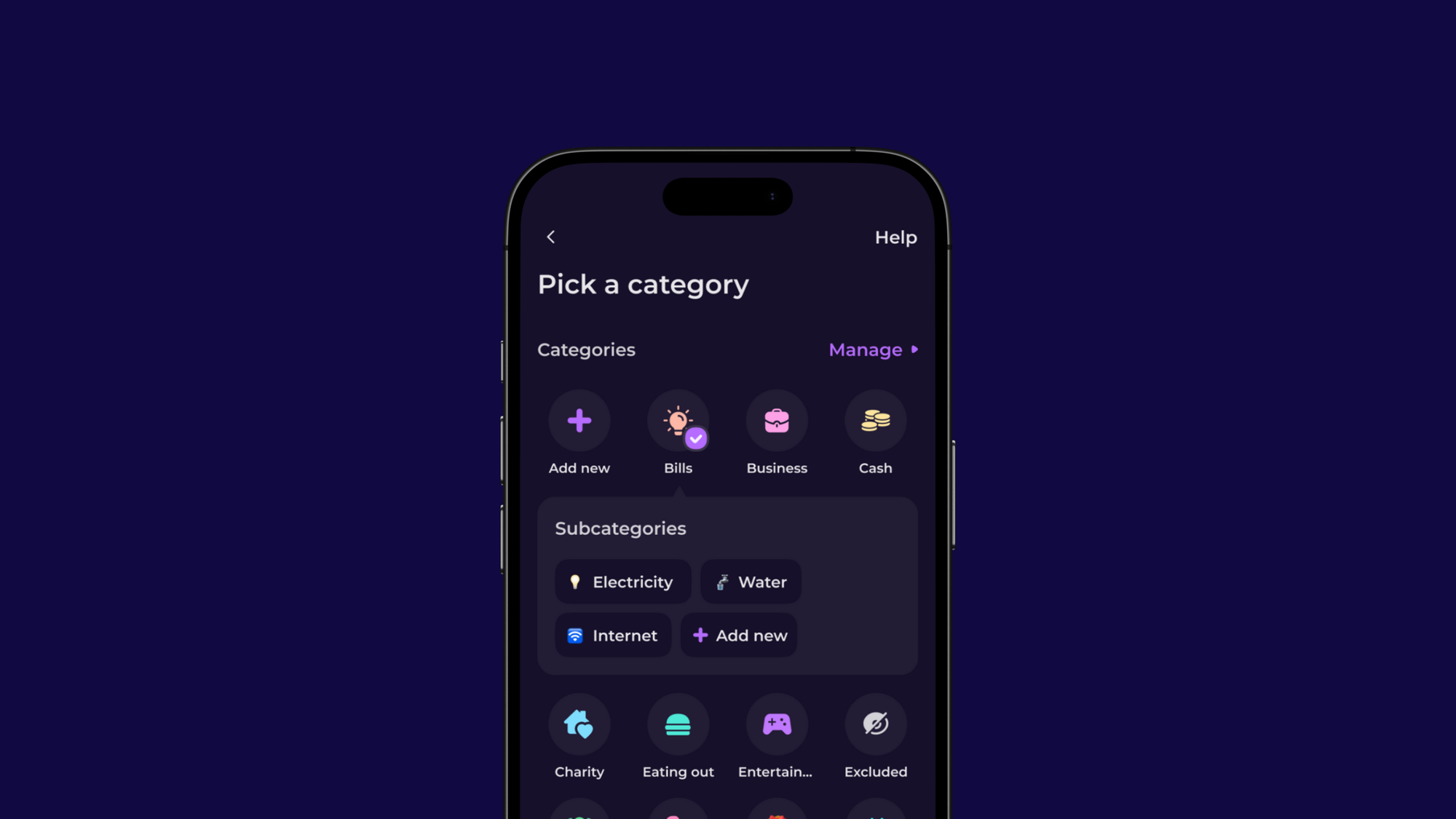

Try Emma

You are very likely to have more than 2 bank cards at which point it gets hard to keep on top of all your outgoings, savings and net worth. Everyone has a net worth and it reflects your financial health, and it’s important to track it and improve it over time. Emma can help you do that by connecting all your accounts in one place! By linking your bank accounts, credit cards, investments and crypto assets to Emma, you can see your net worth in real-time, and how it changes over time. Emma also does an amazing job at setting budgets, categorising expenses, noticing price hikes and avoiding overdrafts. Connecting all your accounts to Emma can give you a complete picture of your financial situation while growing your savings, building your credit history and suggesting better deals.

Start your free trial now.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.