In the realm of personal finance, the 80/20 Rule, also known as the Pareto Principle, is a powerful concept that holds the potential to transform the way we manage our money. The rule, derived from the observation of Italian economist Vilfredo Pareto, suggests that 80% of the outcomes often come from just 20% of the efforts.

Applied to personal finance, the 80/20 Rule encourages us to focus on the most impactful aspects of our financial habits to achieve balance, success, and financial well-being.

Understanding the 80/20 Rule in Personal Finance

The 80/20 Rule in personal finance implies that a significant portion of our financial results can be attributed to a small subset of our actions or decisions. In other words, by identifying and prioritising the most significant financial elements, we can achieve the most impactful outcomes with minimal effort. The rule also highlights the importance of eliminating or minimising inefficiencies that consume time, resources, and money without contributing substantially to our financial goals.

Key Principles of the 80/20 Rule in Personal Finance

Identifying High-Impact Areas: The first step in applying the 80/20 Rule is to identify the financial areas that have the most significant impact on your overall financial health. These areas may include income sources, expenses, investments, debt management, and savings.

Focusing on Core Income Sources: In personal finance, core income sources refer to the main streams of revenue that sustain your financial life. For most individuals, this includes their primary job or business income. By focusing on enhancing and optimising these core income sources, you can significantly boost your financial stability.

Reducing Non-Essential Expenses: The 80/20 Rule also emphasises analysing and reducing non-essential expenses that contribute little to your quality of life or long-term goals. By cutting back on unnecessary spending, you free up resources to allocate toward more meaningful financial objectives.

Prioritising High-Yield Investments: Apply the 80/20 Rule to your investment strategy by prioritising high-yield investments that have the potential to generate substantial returns. Concentrate on investment opportunities that align with your risk tolerance and financial objectives.

Efficient Debt Management: Focus on efficiently managing your debts, directing your efforts toward paying off high-interest debts first. By minimising the impact of interest on your debts, you can accelerate the path to financial freedom.

Strategic Savings Goals: Apply the 80/20 Rule to your savings strategy by setting clear and achievable goals. Allocate a significant portion of your savings efforts toward building an emergency fund, investing for retirement, and funding long-term financial aspirations.

The 80/20 Rule in Daily Financial Habits

Applying the 80/20 Rule to your daily financial habits involves mindful decision-making and a proactive approach to financial management. Here’s how you can integrate the principle into your financial routine:

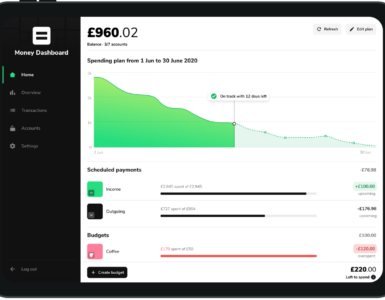

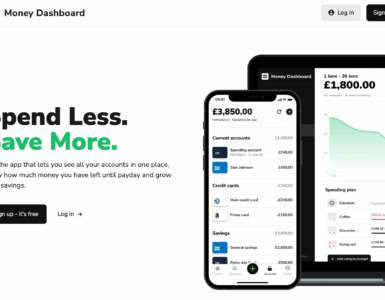

Budgeting: Analyse your spending patterns and identify the 20% of expenses that contribute to 80% of your financial well-being. Allocate your budget accordingly, ensuring that essential needs and meaningful goals receive the bulk of your financial resources.

Automating Savings: Embrace automation to save time and effort in managing your finances. Set up automatic transfers for savings, investments, and bill payments to ensure consistency and discipline in your financial routine.

Debt Repayment: Prioritise paying off high-interest debts first, as these often have the most substantial impact on your overall financial health. Focus on eliminating debt efficiently to reduce financial stress and free up resources for savings and investments.

Investment Diversification: Follow the 80/20 Rule when diversifying your investment portfolio. Allocate a significant portion to well-performing assets that align with your risk tolerance and long-term objectives.

Time Management: The 80/20 Rule also applies to time management in personal finance. Dedicate more time to activities that contribute significantly to your financial well-being, such as researching investment opportunities, enhancing job-related skills, or exploring new income streams.

The 80/20 Rule, derived from the Pareto Principle, offers valuable insights into achieving financial balance and success. By identifying the most impactful areas of your finances and allocating your resources accordingly, you can streamline your financial efforts and maximise results.

Embrace the 80/20 Rule in your daily financial habits, focusing on core income sources, prudent spending, strategic savings, efficient debt management, and high-yield investments. As you integrate this principle into your financial routine, you’ll find yourself making more informed decisions, eliminating inefficiencies, and achieving greater financial well-being.

Remember that the 80/20 Rule is not a rigid formula but a guiding principle to help you prioritise your financial efforts. Embrace the concept, adapt it to your unique circumstances, and embark on a journey toward financial empowerment and success. By applying the 80/20 Rule with intention and discipline, you’ll unlock the true potential of your finances and pave the way for a more secure and prosperous future.

[…] The 80/20 Rule in personal finance states that 80% of results come from 20% of efforts. By identifying the most impactful areas like core income sources, essential expenses, and strategic savings goals, and minimizing inefficiencies, we can streamline our financial efforts and achieve better outcomes with less. Prioritising key elements empowers us to boost savings and work towards our long-term goals, leading to greater financial well-being and success. […]