Financial success is often the result of sound money management practices and disciplined habits. One such guiding principle that has stood the test of time is the 10% Rule.

This simple yet powerful rule advocates setting aside 10% of your income for savings and investments.

Understanding the 10% Rule

The 10% Rule encourages individuals to allocate 10% of their pre-tax income towards savings and investments each time they receive a paycheck.

This concept of “paying yourself first” is based on the idea that setting aside a portion of your income before any expenses ensures that you prioritise saving for the future.

How the 10% Rule Works

Implementing the 10% Rule is relatively straightforward:

Calculate 10% of Your Income: Begin by determining 10% of your gross income (pre-tax income). For instance, if you earn £3,000 per month, 10% of that would be £300.

Create a Dedicated Savings Account: Open a separate savings account where you will deposit the 10% portion of your income consistently. This account should be easily accessible but separate from your regular spending account.

Automate the Process: Set up an automatic transfer on payday to move the designated 10% into your dedicated savings account. Automating the process ensures that you consistently save without the temptation to spend the money elsewhere.

The Benefits of the 10% Rule

Building an Emergency Fund: Regularly saving 10% of your income allows you to build an emergency fund over time. This fund acts as a safety net, providing financial security during unforeseen circumstances such as medical emergencies, car repairs, or unexpected job loss.

Long-Term Wealth Accumulation: Consistently investing 10% of your income enables you to accumulate wealth over the years. By harnessing the power of compounding, your savings and investments can grow significantly, helping you achieve your financial goals faster.

Reduced Financial Stress: Having a dedicated savings habit means you are better prepared to handle financial challenges without relying on credit cards or loans. This reduces financial stress and promotes peace of mind.

Achieving Financial Goals: The 10% Rule sets the foundation for achieving various financial goals, such as buying a home, funding higher education, or planning for retirement. Regular savings create a strong financial base, allowing you to work towards your dreams with confidence.

Developing Discipline: Following the 10% Rule fosters financial discipline. It encourages responsible spending and enables you to live within your means while prioritising your long-term financial well-being.

The 10% Rule is a time-tested principle that can transform your financial life. By consistently saving and investing 10% of your income, you take proactive steps towards building financial security and achieving your dreams. To help you effortlessly adhere to this rule and manage your finances effectively, the Emma budgeting app comes to the rescue.

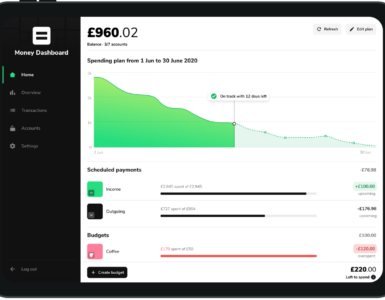

The Emma app is a powerful financial tool that allows you to track your income, expenses, and savings in one place. With its user-friendly interface, you can set custom categories, including one specifically for your 10% savings goal. Emma automatically categorises your transactions, making it easy to see how much you’ve saved each month towards your 10% target.

Moreover, Emma provides insightful reports and analyses, helping you identify areas where you can cut unnecessary expenses and maximise your savings potential. By linking all your accounts to the app, you gain a holistic view of your financial health, making it easier to adhere to the 10% Rule and stay on track.

With Emma, you can also set up recurring transfers to move the designated 10% directly into your dedicated savings account, ensuring you never miss a contribution. The app’s notification feature gently reminds you to save, keeping you accountable and disciplined in your financial journey.

By combining the power of the 10% Rule with the Emma budgeting app, you gain an unbeatable duo that streamlines your savings process, fosters financial discipline, and propels you towards your long-term financial goals.

Embrace this simple yet impactful strategy, and with the help of Emma, watch as your savings grow, providing you with the means to lead a more fulfilling and financially secure life.

Add comment