How Unchecked Subscriptions Can Sneakily Drain Your Finances

With more and more subscription services on the market in the UK the average person is now subscribed to at least 4 different services. These subscription services have seamlessly integrated themselves into our daily lives, presenting convenient access to an array of services and entertainment options.

Initially innocuous, subscribing to a few platforms may lead to unforeseen consequences over time, as the phenomenon of subscription creep sets in, potentially draining finances significantly. We will delve into the dangers of subscription creep, explore its potential consequences, and discuss strategies to combat this stealthy financial threat.

Understanding Subscription Creep:

Subscription creep refers to the slow and continuous accumulation of multiple subscriptions over time. It starts innocently, with one or two subscriptions for entertainment, fitness, or meal services.

These subscriptions may be genuinely useful and add value to our lives. However, as more tempting offers come our way, such as exclusive content, additional features, or free trial periods, we may end up subscribing to more services without fully realising the financial impact.

The Consequences of Subscription Creep:

- Financial Strain: The primary danger of subscription creep is the financial burden it places on consumers. While individual subscriptions may seem affordable, the cumulative cost can quickly surpass what we initially intended to spend on such services. A few dollars here and there can snowball into a substantial monthly expense.

- Underutilisation: As the number of subscriptions increases, it becomes challenging to fully utilise each service. Some subscriptions may end up being underutilised or even forgotten, resulting in wasted money. For example, you may have a gym membership that you rarely use or multiple streaming services with overlapping content.

- Budget Disruption: Subscription creep disrupts budget planning, making it difficult to allocate funds effectively. With multiple recurring charges, it becomes harder to predict and manage monthly expenses. This can lead to financial stress and a lack of control over your financial situation.

- Psychological Impact: The constant presence of subscriptions and recurring charges can create a sense of anxiety and guilt, especially when one realises they are not fully benefiting from all the services they are paying for. This feeling of being tied to multiple commitments can negatively impact overall well-being.

Combatting Subscription Creep:

- Conduct a Subscription Audit: Regularly review all your subscriptions and assess their value and necessity. Create a list of all the subscriptions you are currently paying for and evaluate each one. Consider canceling any services that are no longer essential or underutilised.

- Set a Subscription Budget: Establish a clear monthly subscription budget that aligns with your financial goals and priorities. Determine how much you are willing to spend on subscriptions each month and stick to this budget. Avoid subscribing to additional services beyond your predetermined limit.

- Prioritise Essential Services: Identify essential subscriptions that cater to your core needs and align with your interests. Allocate more of your budget to these services while considering non-essential subscriptions as optional extras. This way, you can focus on services that bring genuine value to your life.

- Track Your Subscriptions: Use budgeting apps or spreadsheets to track your subscriptions. Stay vigilant about upcoming charges and assess their value before renewing. Having a clear overview of your subscriptions will help you make informed decisions about which ones to keep and which ones to let go.

- Rotate Subscriptions: To make the most of your subscriptions, consider rotating services. For example, switch between streaming platforms every few months to fully enjoy their content without being overwhelmed by the number of subscriptions. This approach can also help prevent subscription fatigue.

- Negotiate or Bundle: Contact service providers to negotiate better deals or explore bundled subscription plans that offer multiple services at a reduced cost. Many providers are willing to offer discounts or incentives to retain customers, especially if they see that you are considering canceling a subscription.

Fitting Subscriptions into Your Budget:

When it comes to managing subscriptions effectively, it’s crucial to fit them into your budget strategically. Start by categorising your subscriptions as essential or non-essential. Essential subscriptions are those that fulfill basic needs, such as internet services, utility bills, or necessary software.

Non-essential subscriptions are entertainment, lifestyle, or hobby-related services that add value to your life but can be considered optional. Allocate a specific portion of your monthly budget to cover essential subscriptions, ensuring that these critical services are always accounted for without causing financial strain.

For non-essential subscriptions, consider setting a discretionary spending category within your budget. Determine how much you can comfortably allocate to entertainment and other non-essential services without compromising other financial priorities. By consciously managing this category, you can enjoy the benefits of subscriptions while still maintaining financial stability and saving money.

Using an App Like Emma to Keep Track of Your Subscriptions:

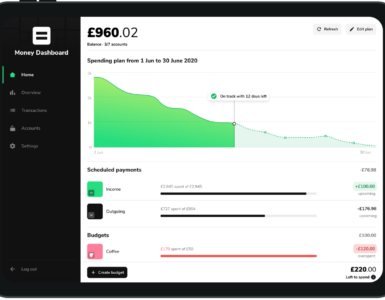

To efficiently manage your subscriptions and maintain control over your finances, consider using budgeting apps like Emma. Emma is a powerful financial tracking app that allows you to link your bank accounts, credit cards and more to provide a comprehensive overview of your financial transactions.

One way it does so is by tracking your recurring payments, including your subscriptions, and alerting you of what these are and the amount/ frequency you are paying them.

Here’s how Emma can help you tackle subscription creep:

- Subscription Tracking: Emma automatically detects and categorises your recurring payments. You can easily view a list of all your subscriptions, along with their costs and billing dates, helping you stay on top of your commitments.

- Budgeting Tools: Emma allows you to set up budget categories, including one specifically for subscriptions. You can establish spending limits for each category and receive real-time alerts if you exceed these limits. This feature helps you ensure that your subscription expenses are in line with your budget.

- Identifying Underutilised Subscriptions: The app’s transaction analysis can reveal subscriptions you may not be fully utilising. By identifying such subscriptions, you can make informed decisions about whether to keep, cancel, or rotate them to optimise their value.

- Financial Insights: Emma provides valuable financial insights, such as your total subscription spending over time. These insights empower you to make data-driven choices about your subscriptions and how they fit into your financial plan. See just how much you have spent on spotify over time or on your netflix subscription.

Incorporating Emma into your financial management routine can significantly help combat subscription creep. Its intuitive interface, personalised insights, and budgeting tools put you in control, making it easier to streamline your subscriptions, save money, and stay on track with your financial goals.

While subscriptions can undoubtedly enhance our lives by providing convenience and access to diverse content, subscription creep is a sneaky financial danger that can compromise our financial well-being. The gradual accumulation of subscriptions can lead to financial strain, underutilisation of services, and budget disruptions.

By proactively conducting subscription audits, setting a budget, and prioritising essential services, we can combat subscription creep and regain control over our finances. Remember, being mindful of our subscriptions and making deliberate choices about the services we truly value will ensure that we enjoy the benefits of subscriptions without falling prey to their hidden dangers.

Ultimately, managing subscriptions responsibly will lead to a more financially secure and stress-free life.