This article is for informational purposes only and does not provide financial, investment, or tax advice.

When it comes to saving money, the right account can make a huge difference. Whether you’re looking to build up an emergency fund, save for a holiday, or put money aside for long-term goals, the right type of account matters. Two common options are a Savings Account and an Individual Savings Account (ISA), including the popular Lifetime ISA. But which one should you choose? Let’s break down the pros and cons of each and see how they compare.

What is a Savings Account?

A Savings Account is a straightforward way to keep your money safe while earning a small amount of interest. There are many types of savings pots, but the basics remain the same:

- You deposit money into the account and it earns interest over time.

- Interest rates can vary, but they are usually lower than other investment options.

- There are no restrictions on how or when you can withdraw your money.

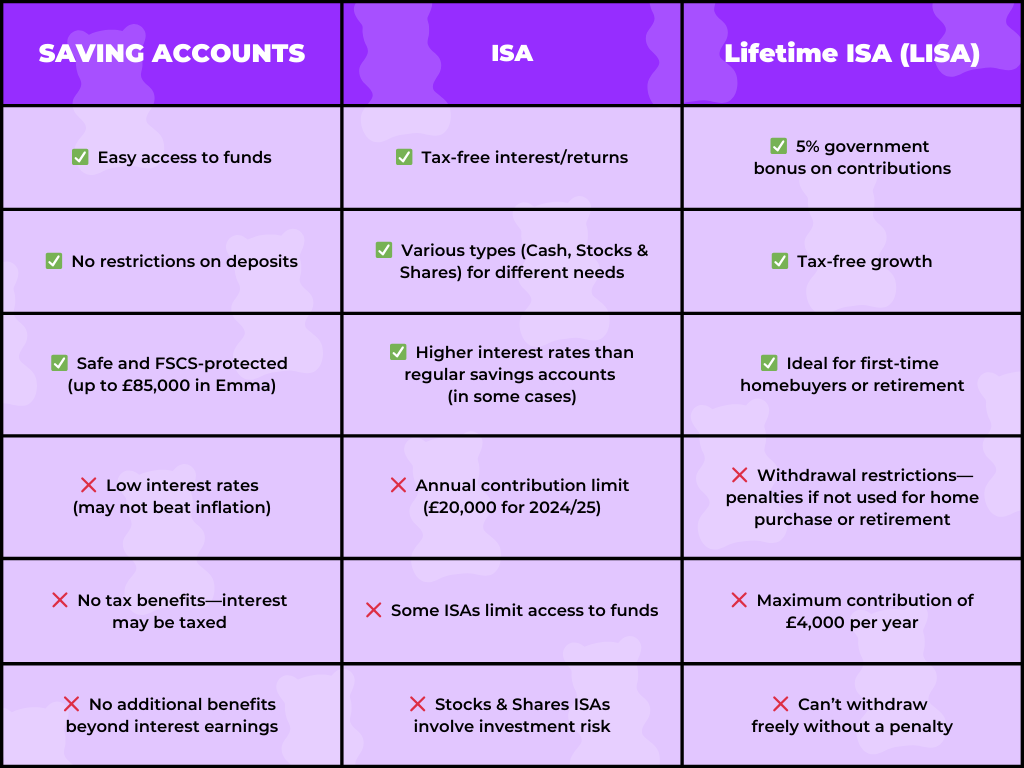

Pros of a Savings Account:

- Easy access – You can withdraw funds whenever you need.

- Flexibility – No minimum deposits or restrictions.

- Safe – Your savings are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000.

Cons of a Savings Account:

- Low interest rates – The interest earned may not keep up with inflation.

- No tax benefits – Interest earned is subject to income tax if it exceeds your personal savings allowance.

What is an ISA?

An Individual Savings Account (ISA) is a tax-efficient way to save money. With an ISA, you can earn interest, dividends, or capital gains without paying tax on them, making it a popular option for savers looking to maximise their returns. There are different types of ISAs, but the two main ones for savers are Cash ISAs and Stocks & Shares ISAs.

Pros of an ISA:

- Tax-free savings – No income tax on the interest or returns you earn.

- Higher interest rates (often) – Some ISAs offer better rates than regular savings accounts.

- Variety of options – Cash ISAs offer guaranteed returns, while Stocks & Shares ISAs allow for more growth potential.

Cons of an ISA:

- Contribution limits – You can only deposit up to £20,000 per year (for the 2024/25 tax year).

- Limited access to funds – With some ISAs, like Fixed-Rate ISAs, you might not be able to access your money before the end of the term.

What is a Lifetime ISA (LISA)?

A Lifetime ISA (LISA) is a specific type of ISA designed to help you save for your first home or retirement. With a LISA, the government gives you a 25% bonus on contributions, up to £1,000 per year, which can add up over time.

Pros of a Lifetime ISA:

- Government bonus – Receive 25% on every contribution (up to £1,000 per year).

- Ideal for first-time homebuyers or retirement – Use the funds for your first home purchase or retirement.

- Tax-free growth – Like other ISAs, your savings grow without tax.

Cons of a Lifetime ISA:

- Withdrawal restrictions – If you don’t use the money for a first home or retirement, you’ll face a penalty when withdrawing.

- Contribution limits – You can only contribute up to £4,000 per year.

Which Should You Choose? ISA or Saving Account?

Choosing between a Savings Account and an ISA depends on your financial goals. Here’s how to decide:

- For short-term goals – If you need easy access to your money or you’re saving for something in the near future, a Savings Account might be best.

- For long-term goals – If you’re planning for retirement, buying your first home, or saving with tax efficiency in mind, an ISA is a better option.

- For both short and long-term – A Lifetime ISA (LISA) could be ideal if you’re saving for a house or retirement, as it offers the added benefit of a government bonus.

How Can You Save With the Rising Cost of Living?

As the cost of living continues to rise, it can feel challenging to set aside money for savings. However, even small contributions can add up over time. Here are some ways to save, even when the cost of living is higher:

- Set realistic savings goals – Start small and gradually increase your savings as you can afford to.

- Take advantage of smart savings tools – Use features that make saving easier without disrupting your day-to-day finances.

In Emma, we have multiple options to help you save, even with the increase in living costs:

- Custom Deposit

Set a recurring savings amount to consistently grow your pots and build your balance effortlessly. By automating your savings, you can ensure you’re contributing without thinking about it every month. - Round-Ups

The smart feature that saves your spare change every time you spend. Emma automatically rounds up your purchases to the nearest pound and adds the difference to your savings pot. It’s a simple yet effective way to save without noticing. - AI Saving

Save without lifting a finger. Our AI calculates the perfect amount to add to your pots, ensuring it won’t disrupt your expenses. It takes the guesswork out of saving, and you won’t have to manually adjust your savings every time you spend.

Final Thoughts

Choosing between a Savings Account, an ISA, or a Lifetime ISA depends on your personal goals. If you want easy access to your money, a traditional savings account might be enough. If you’re focused on long-term growth and tax-free savings, an ISA (or a Lifetime ISA for first-time homebuyers and retirement) is worth considering. Whatever option you choose, don’t forget to make the most of smart tools like Emma’s Round-Ups and AI-powered savings to help you save automatically.