FEATURED ARTICLE

Is £50,000 a Good Salary in the UK?

Giuliano Fabbri

July 22, 2025 •6 min read

TABLE OF CONTENTS

Is £50,000 Above the UK Average Salary?

The Cost of Living in the UK: A £50k Salary Breakdown

Location, Location, Location: London vs. Newcastle

What Can You Buy (and Save) with a £50k Salary?

The Emma App Advantage: Budgeting for Your £50k Salary

£50,000 a year – it sounds like a healthy income, especially when you're considering a move or a new job in the United Kingdom. But is £50,000 a good salary in the UK? The honest answer, like with all financial questions, is: it depends! While it's significantly higher than the national average, your comfort level and ability to save will hinge on several key factors, particularly your cost of living and location.

At Emma, we're all about empowering you to budget smarter and achieve your financial goals. Understanding what your salary truly means in the context of UK living costs is the first step. Let's break down if £50,000 a year provides a comfortable lifestyle, allows for saving, and what you can realistically afford.

Is £50,000 Above the UK Average Salary?

Yes, absolutely! According to the Office for National Statistics (ONS), the median gross annual earnings for full-time employees in the UK were approximately £37,430 in April 2024. This means a £50,000 salary places you well above the national average, indicating a strong financial position for many.

This level of income generally allows for a comfortable standard of living and the potential to build significant savings, invest for the future, or work towards big financial milestones like buying property.

The Cost of Living in the UK: A £50k Salary Breakdown

While £50,000 is a good gross salary, it's crucial to understand your net take-home pay after taxes and National Insurance. For the 2024/2025 tax year, with a £50,000 gross salary (assuming tax code 1257L and not in Scotland, where rates differ slightly):

- Gross Salary: £50,000

- Tax-Free Personal Allowance: £12,570

- Taxable Income: £37,430

- Income Tax (20% on £37,430): £7,486

- National Insurance (8% on income between £12,570 and £50,270): £2,994.40

- Estimated Net Take-Home Pay: £39,519.60 per year, or roughly £3,293.30 per month.

This is your disposable income – the money you have to budget for all your expenses and savings.

The average UK household budget in mid-2024 is estimated to be around £2,700 a month (or £32,500 a year) for a 2/3 - person household. This suggests that a single person on £50,000 could have a substantial amount left over, while a household might find it more comfortable depending on their specific circumstances and shared expenses.

See how to check your payroll with this guide.

Location, Location, Location: London vs. Newcastle

The biggest factor influencing how far your £50,000 salary stretches is your geographic location within the UK. The cost of living varies dramatically between major cities and other regions.

Let's compare London with a city like Newcastle Upon-Tyne, a major hub in the North East known for its relative affordability:

| Expense Category | London (Approx. Monthly Cost) | Newcastle (Approx. Monthly Cost) | Notes |

| 1-Bed Rent (City Centre) | £1,600 - £2,200+ (can be higher for prime locations) [1, 2, 3] | £700 - £1,000 [4, 5] | Rent is the biggest differentiator. Newcastle rent prices can be over 100% lower than in London. |

| Basic Utilities | £200 - £300 (electricity, heating, water, garbage for 85m² apartment) [6, 7] | £100 - £160 (electricity, heating, water, garbage for 85m² apartment) [6, 7] | Utilities are notably cheaper in Newcastle. |

| Groceries | £250 - £350 (for a single person) [8, 9] | £200 - £300 (for a single person) [9] | While some individual items might vary, overall grocery bills tend to be lower outside of London. Recent UK grocery inflation is impacting all regions. |

| Meal at Inexpensive Restaurant | £15 - £25 [10] | £10 - £15 [10] | Dining out is considerably more affordable in Newcastle. |

| Monthly Transport Pass | £150 - £200+ (depending on zones for Tubes/Buses) [11] | £60 - £100 (bus/metro pass) [12] | Public transport is significantly more expensive in London. |

| Overall Consumer Prices | Generally much higher | Generally lower (Consumer prices in Newcastle are estimated to be around 16.54% lower than London) [10] | This includes general goods and services beyond the specifics listed. |

What does this mean for your £50k salary?

- In London: A £50,000 salary will certainly cover your living expenses, but you'll need to be mindful of your budgeting strategies, especially when it comes to housing. You might find yourself sharing accommodation or living further out to save on rent. Saving a substantial amount could be challenging unless you're very disciplined and actively use a budgeting app like Emma to track every penny.

- In Newcastle (or other Northern/Midlands cities): A £50,000 salary goes a lot further. You could comfortably afford a good apartment, enjoy a vibrant social life, and still have significant funds left over for savings, investments, and discretionary spending. This provides much more financial flexibility and less financial stress.

What Can You Buy (and Save) with a £50k Salary?

With a net monthly income of around £3,293, a £50,000 salary provides substantial purchasing power, especially outside of expensive major cities. Here's a general idea of what you can afford and how Emma can help you manage it:

Housing:

- Renting: As discussed, you can comfortably afford a good quality 1-2 bedroom apartment in most UK cities outside of London. In London, you'll likely be looking at a smaller studio or 1-bedroom, or needing flatmates to keep costs down. Emma's budgeting tools can help you track your rent and utility expenses, ensuring you stay within your housing budget.

- Buying: While purchasing a house in London on a £50k salary is challenging (often requiring a much higher income for a mortgage), it's entirely feasible in many other parts of the UK. For example, a terraced house in some northern towns might require a salary of around £18,000-£25,000, making £50k more than sufficient for a mortgage. Emma's net worth tracker can help you monitor your property value and mortgage, providing a holistic view of your financial health.

Transportation

Whether it's public transport passes, fuel for a car, or ride-sharing, £50k allows for comfortable transport. Emma can categorize your spending to show you exactly how much you spend on commuting, helping you identify areas to save.

Groceries & Dining Out

You can afford a healthy and varied diet, with room for regular dining out, takeaways, and coffees. Use Emma's spending categories to see where your food budget goes and set limits.

Leisure & Entertainment

A £50k salary allows for a good social life – going to concerts, theatres, sporting events, holidays, and pursuing hobbies. Emma's custom budget categories can help you allocate funds for fun without overspending.

Savings & Investments

This is where a £50k salary truly shines outside of expensive cities. After essential expenses, you should have a healthy surplus. This surplus can be directed towards:

- Emergency Fund: Building 3-6 months of essential living expenses.

- Retirement Planning: Contributing generously to a pension.

- Investments: Exploring options like Stocks & Shares ISAs or General Investment Accounts.

- Big Purchases: Saving for a car, a house deposit, or a dream holiday.

Emma's automated savings goals and investment tracking can be invaluable here, helping you consistently put money aside and visualize your progress towards financial independence.

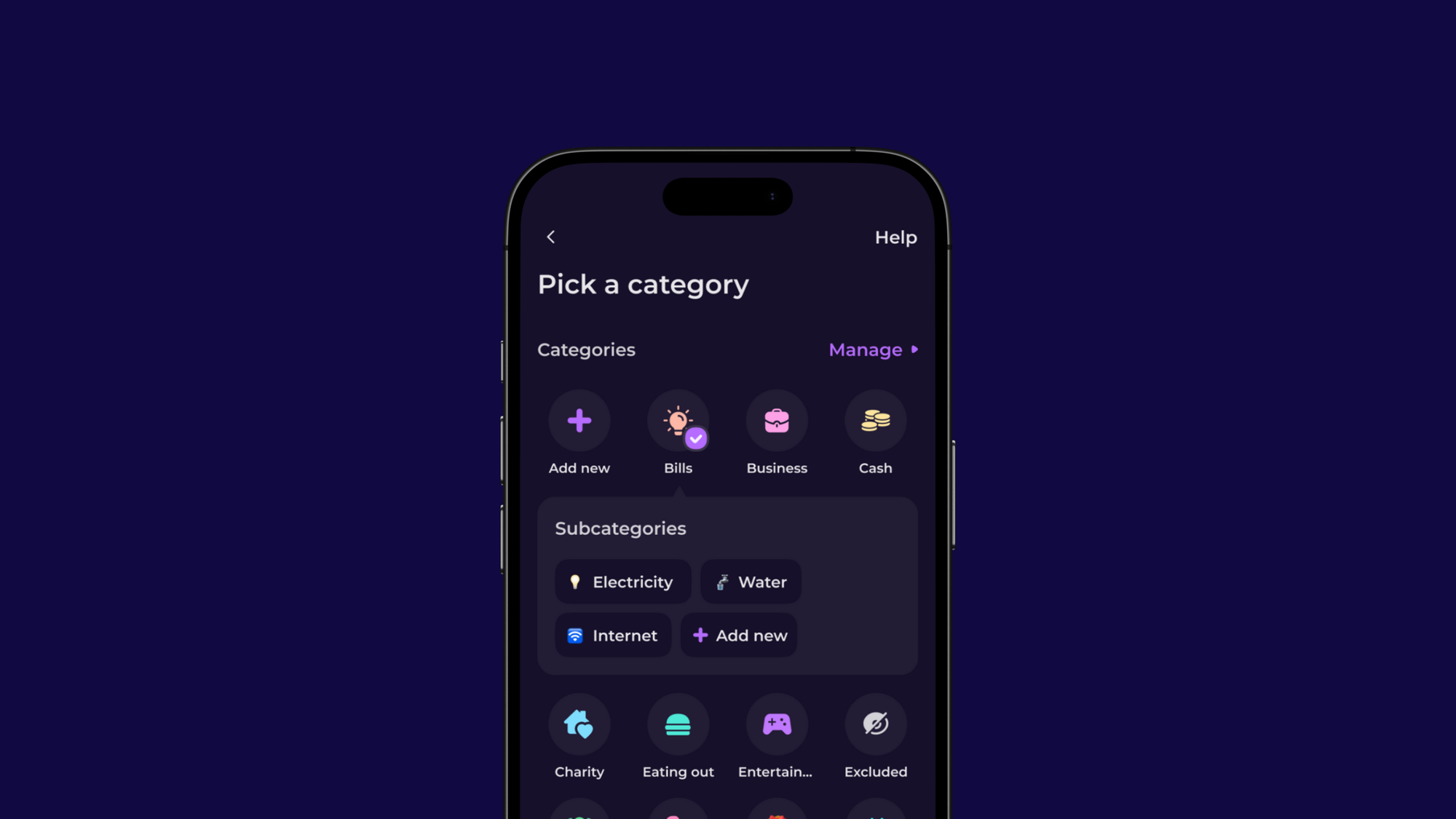

The Emma App Advantage: Budgeting for Your £50k Salary

A £50,000 salary in the UK offers a fantastic foundation for financial well-being. However, truly making the most of it requires smart budgeting and financial planning. Emma is designed precisely for this:

- Connect All Accounts: Get a complete overview of your finances in one place.

- Smart Categorisation: Automatically track where your money goes.

- Custom Budgets: Set spending limits for different categories (e.g., "Dining Out," "Transport") and receive alerts if you're approaching them.

- Rolling Budgets: Our enhanced rolling budgets ensure your budget adapts to real life, carrying over both underspending and overspending for continuous accountability.

- Savings Goals: Create specific goals and track your progress towards them.

Take Control with Smart Budgeting

While £50,000 is a highly desirable salary in the UK, its true value is unlocked when managed effectively. By understanding the cost of living in your chosen location and leveraging powerful budgeting tools like Emma, you can ensure your £50k salary provides a comfortable lifestyle, ample opportunities for saving, and a clear path to your financial aspirations.

Ready to make your £50,000 salary work harder for you? Download Emma today and start budgeting smarter!

External Resources for Further Reading:

- Simply Business: Average Rental Prices in London 2024

- London Relocation: Average Rent in London 2024

- Simply Business: Landlord insight – what's the average rent in London?

- ONS: Housing prices in Newcastle upon Tyne

- UniAcco: Cost of Living in Newcastle for Students [Updated Prices 2025]

- Essential Living: A Guide to the Cost of Living in London in 2025

- Uninist: Average Utility Bills UK: How to Budget Effectively for 2025 (Student Edition)

- WORKgateways: Cost of Living UK [Updated 2024]

- Newcastle University: Student Living Costs

- Budget Direct: Compare the cost of living in London vs Newcastle

- TFL: Travelcard Prices (Link to official TFL site for current prices)

- Nexus: Metro Tickets & Passes (Newcastle) (Link to official Nexus site for current prices)

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.