FEATURED ARTICLE

Joint Account: How to Manage Expenses as a Couple

Giuliano Fabbri

February 24, 2025 •3 min read

TABLE OF CONTENTS

What is a Joint Account?

How to Manage a Joint Account Effectively

Are There Alternatives to a Shared Account?

Final Thoughts

Managing money as a couple isn’t always straightforward. Whether you're splitting rent, planning holidays, or just keeping track of everyday spending, finding a system that works for both of you is key. Some couples swear by a joint account, while others prefer to keep their finances separate. But is a joint account the best option for you? And how do you manage shared expenses without arguments?

Here’s everything you need to know about joint accounts and smarter ways to split costs as a couple.

What is a Joint Account?

A joint bank account is a shared account that both partners can access, allowing you to pool money for common expenses. Typically used by couples, it can be helpful for:

- Household bills – rent, mortgage, utilities

- Groceries & everyday spending

- Savings for shared goals – holidays, a new car, home improvements

- Subscriptions & memberships

While joint accounts can make life easier, they also come with challenges. Let’s break down the pros and cons.

How to Manage a Joint Account Effectively

If you decide a joint account is right for you, here are a few ways to keep things running smoothly:

1. Agree on Contributions

Not all couples earn the same, so it’s important to decide how much each person will contribute. Options include:

- 50/50 split – Each partner contributes the same amount.

- Income-based split – Each person contributes a percentage of their salary.

- Expense-based approach – One person covers rent, the other covers bills and food.

2. Set Clear Rules

Discuss what the joint account should be used for. Is it just for household bills, or will it also cover date nights and personal spending? Defining this upfront avoids misunderstandings later.

3. Keep Personal Accounts Too

Even if you have a joint account, keeping a personal account gives you financial freedom. This way, you can spend on hobbies, gifts, or treats without checking in with your partner.

Are There Alternatives to a Shared Account?

If a joint account doesn’t feel right for you, there are other ways to manage money together:

- Shared expense tracking – Use an app like Emma to keep a running total of who paid what.

- Separate accounts, shared responsibility – Each partner pays for different expenses (e.g. one covers rent, the other groceries).

- A hybrid system – Use a joint account for bills and a budgeting app for everything else.

Emma Groups for Financial Independence and Smart Expense Managements

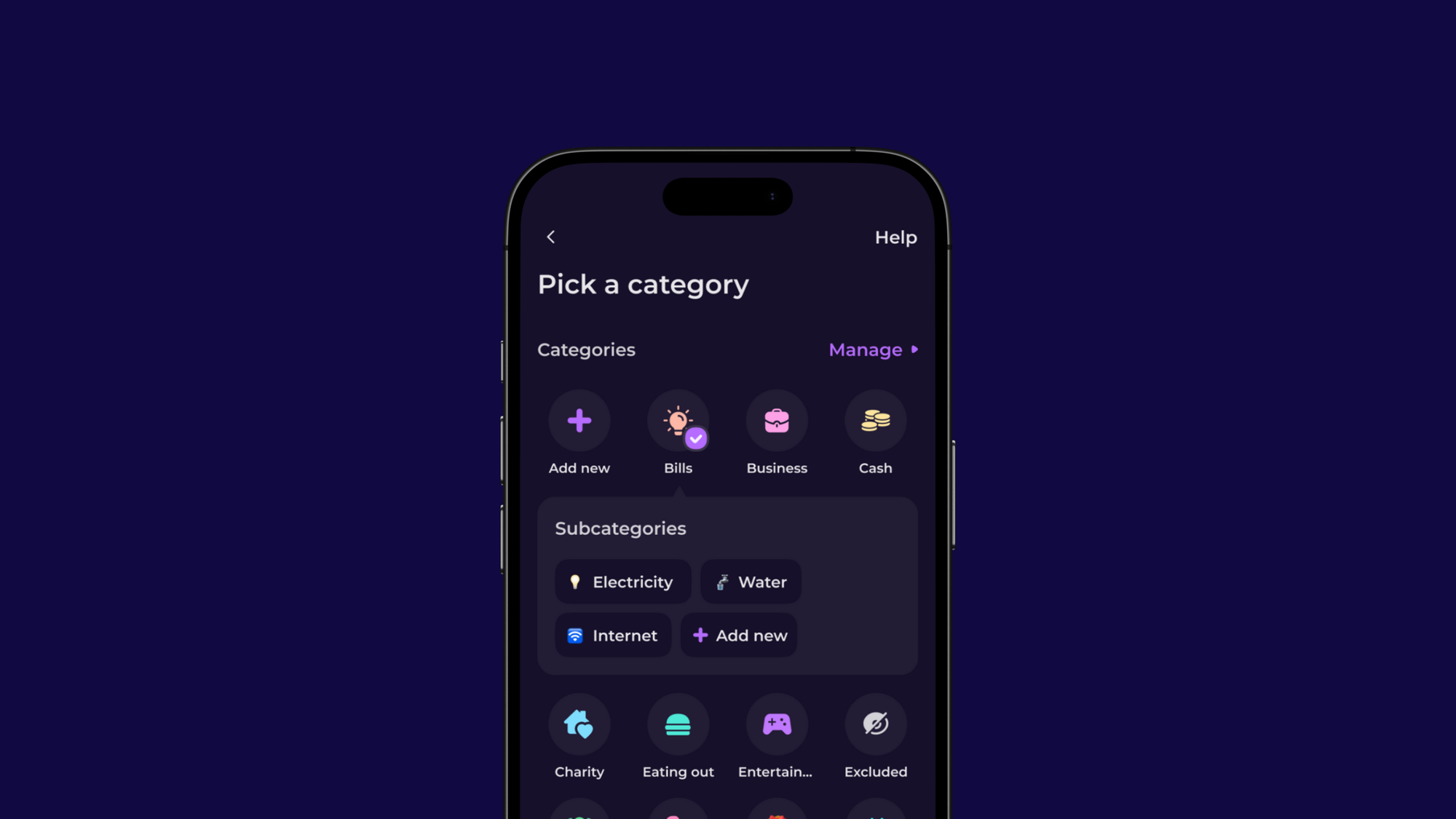

If you’re unsure about opening a joint account but still want an easy way to split expenses, Emma Groups is a perfect alternative. With Emma Groups, you can:

- Split expenses easily – Add shared costs (like rent, bills, or meals out) into a group, and Emma automatically calculates who owes what.

- Maintain financial independence – You don’t need to merge bank accounts; each person keeps full control over their own money.

- Benefit from Emma’s budgeting tools – Emma helps track your spending habits, so you can see where your money is going and avoid unnecessary expenses.

- Stay on top of recurring payments – With Emma’s recurring payment tracker, you’ll never lose track of shared subscriptions like Netflix or Spotify.

Essentially, Emma Groups allows you to manage shared expenses without the hassle of a shared bank account, while still benefiting from Emma’s smart money tools.

Final Thoughts

A joint account can be a great way to simplify finances as a couple, but it’s not for everyone. Whether you choose to open one or use smarter tools like Emma Pay Groups and Emma Spaces, the key is communication. Agree on a system that works for both of you, check in regularly, and keep things flexible as your financial situation evolves.

Managing money together doesn’t have to be stressful – with the right approach, it can actually bring you closer.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.