FEATURED ARTICLE

5 facts about your credit score

Edoardo Moreni

July 11, 2017 •2 min read

TABLE OF CONTENTS

#1 - You don't have a credit score

#2 - Past missed payments do count

#3 - Your credit history covers the past 6 years

#4 - Debt is not bad for your credit score

#5 - If you’ve never borrowed before, you'll be in trouble

Credit score is not a nightmare, but a reality. This is something we all share and have to go through at least once in our lifetime. If you still haven't stumbled across the definition of credit score and why you should care about it, you have to keep reading this. These are 5 facts about your credit score.

#1 - You don't have a credit score

This is the first fact. You really don't have a credit score, what you have is a credit report, also called credit file. When you are trying to borrow money, each lender or bank looks at your credit report. They make an assessment before deciding whether to lend you money. This report includes details of all your current accounts, loans, bill payments and also your personal information, such as your name and date of birth. In the UK, there are three market leaders that compile credit reports: Experian, Equifax and Callcredit - you can ask any of them for your credit report.

These companies can also provide you with a credit score, which is an indication of how you are doing. At the same time, each lender uses a unique method to calculate their own credit scores and some use a different formula for different products, such as loans and credit cards.

#2 - Past missed payments do count

Your credit report keeps track of your financial life. This means that County Court Judgments for non-payment of debts, Individual Voluntary Arrangements (IVAs) and bankruptcies stay on your credit report. Furthermore, missed repayments for your credit card are recorded as well. These could count against you. They prove you have a "track" record of not being able to pay back someone. For this reason, lenders might not be willing to loan you money.

#3 - Your credit history covers the past 6 years

Yes, your credit report doesn't cover your entire lifetime, but only the last six years. This is the case because the report is designed to give lenders a picture of your recent and current financial position. They are unlikely to be concerned about a missed payment that occurred over a decade ago because it has no relevance on your likely behaviour today.

#4 - Debt is not bad for your credit score

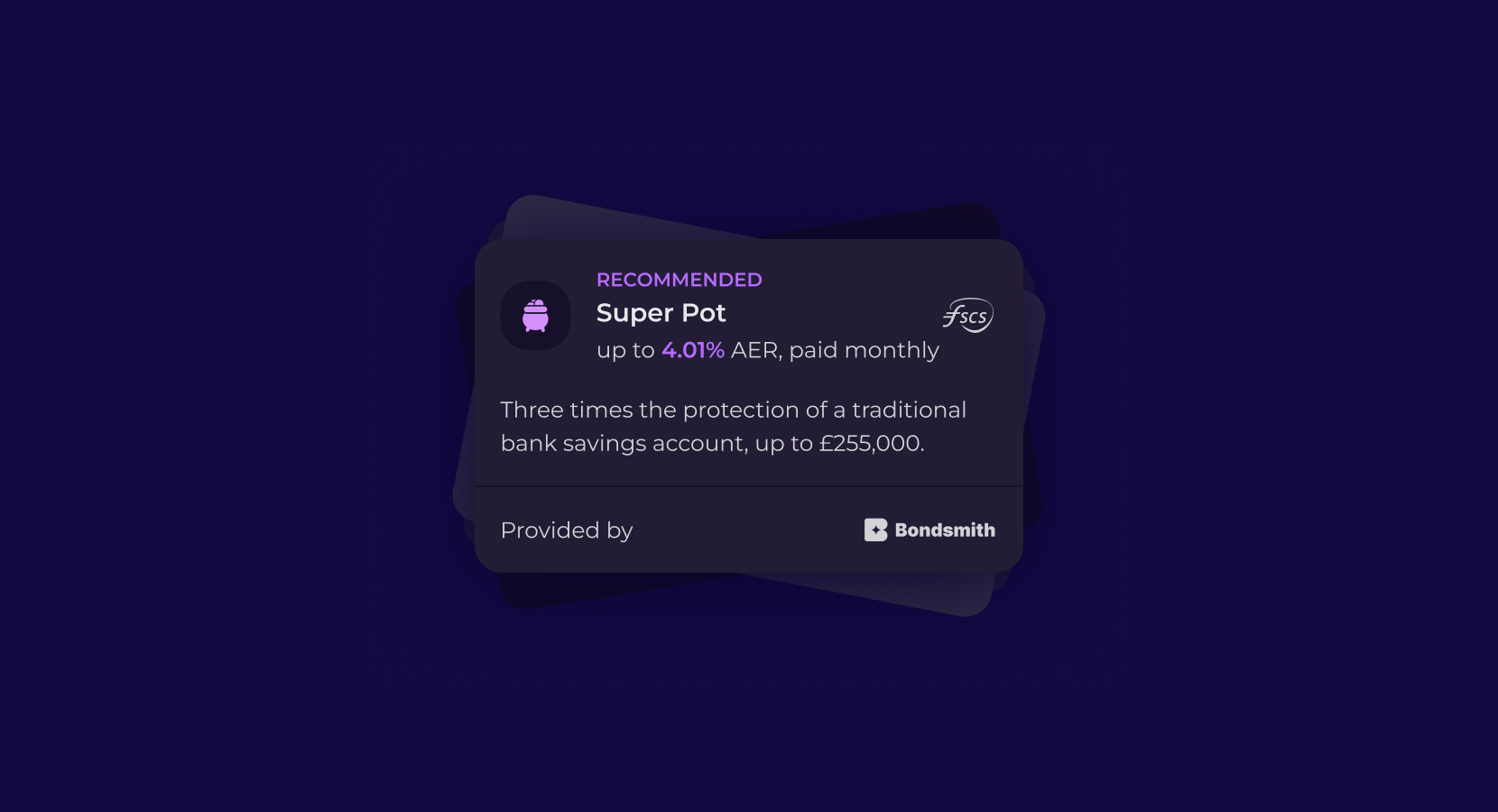

Debt is scary, but it's not the end of the world. The whole idea behind having a credit score is to see how likely you are to pay back when you lend money. That's why if you take a loan and then pay back every instalment on time, this will improve your credit score. One of the best tips to improve the score is to have a credit card and use it regularly. In this way, you can build a credit history pretty quickly and showcase how good you are.

#5 - If you’ve never borrowed before, you'll be in trouble

This means you don't have a credit history. Lenders have no way of predicting how reliable you'll be in the future and may even turn down your application. Building a credit history is key to have a great score.

We think this is a really important topic, which we'll keep covering in the future. If you want to reach financial freedom, you also need to be aware of how things work. You can read more about how to improve your score here.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies Ltd is an Introducer Appointed Representative of Quint Group Limited, which is authorised and regulated by the Financial Conduct Authority (FRN 669450). Emma Technologies Ltd is not a lender. Emma Technologies Ltd introduces customers to Monevo Limited who is a licensed credit broker.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.