FEATURED ARTICLE

PSD2, Open Banking and 2018: on the verge of a banking revolution

Edoardo Moreni

December 31, 2017 •3 min read

In 2017, we have seen the rise of new fintech products, such us Emma, but also the consolidation of others. TransferWise reached profitability, while other challenger banks started rolling out their current accounts. At the same time, different services, which are direct competitors of Emma, have been testing their own interfaces to be ready for the big game.

I am referring to what will happen on the 13th of January. PSD2 will be fully operative in the UK. This means, businesses like Emma will be authorised and registered to operate, and thanks to the Open Banking initiative, the access to banking data as well as the initiation of payments will be much easier.

Although this is a great thing, since it will democratise a market that has been owned by banks for the past decades, it's also getting harder for startups to get in. In order to read banking data, a company needs to be registered and approved by the Financial Conduct Authority (FCA) as an Account Information Service Provider (AISP). This includes several different documents, a three months approval period and a Personal Indemnity Insurance, which is required by law.

The next Bill Gates won't have any of these, but only a great passion and an ability to ship products fast. This is why the real innovation is not really happening on the 13th of January as many believe. The ability of building and releasing Fintech products has always been costly and difficult for young entrepreneurs, and with PSD2 this will just get worse.

In the upcoming year, we'll see those who managed to get in the game, competing to become the leading banking interface in a market that has never really been taken by anyone. While in the US, we have seen the impressive growth of Mint.com, which has more then 16 million users, no one has ever reached these numbers in Europe. Bankin, a french product, is the only one who advertises two million users.

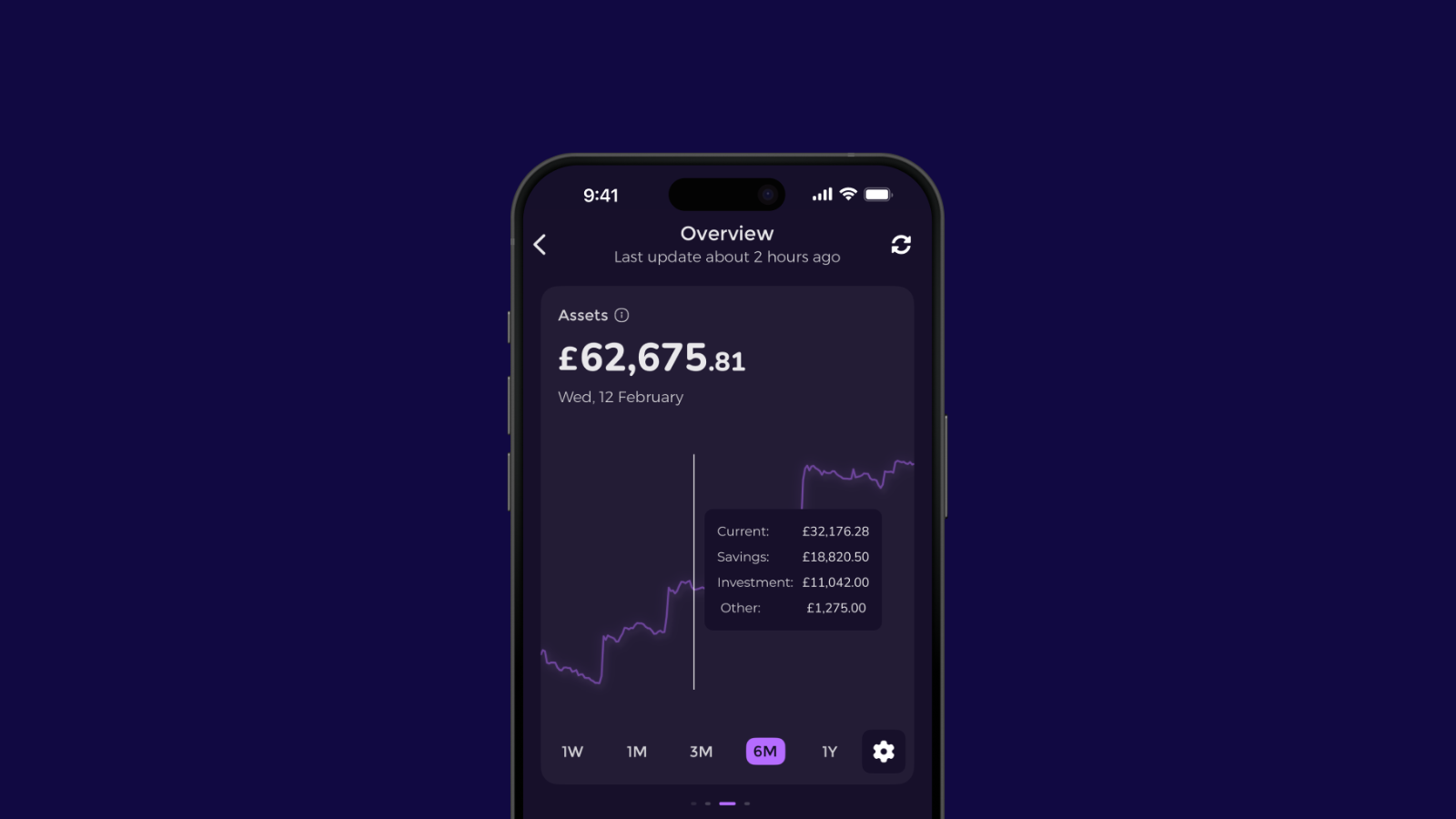

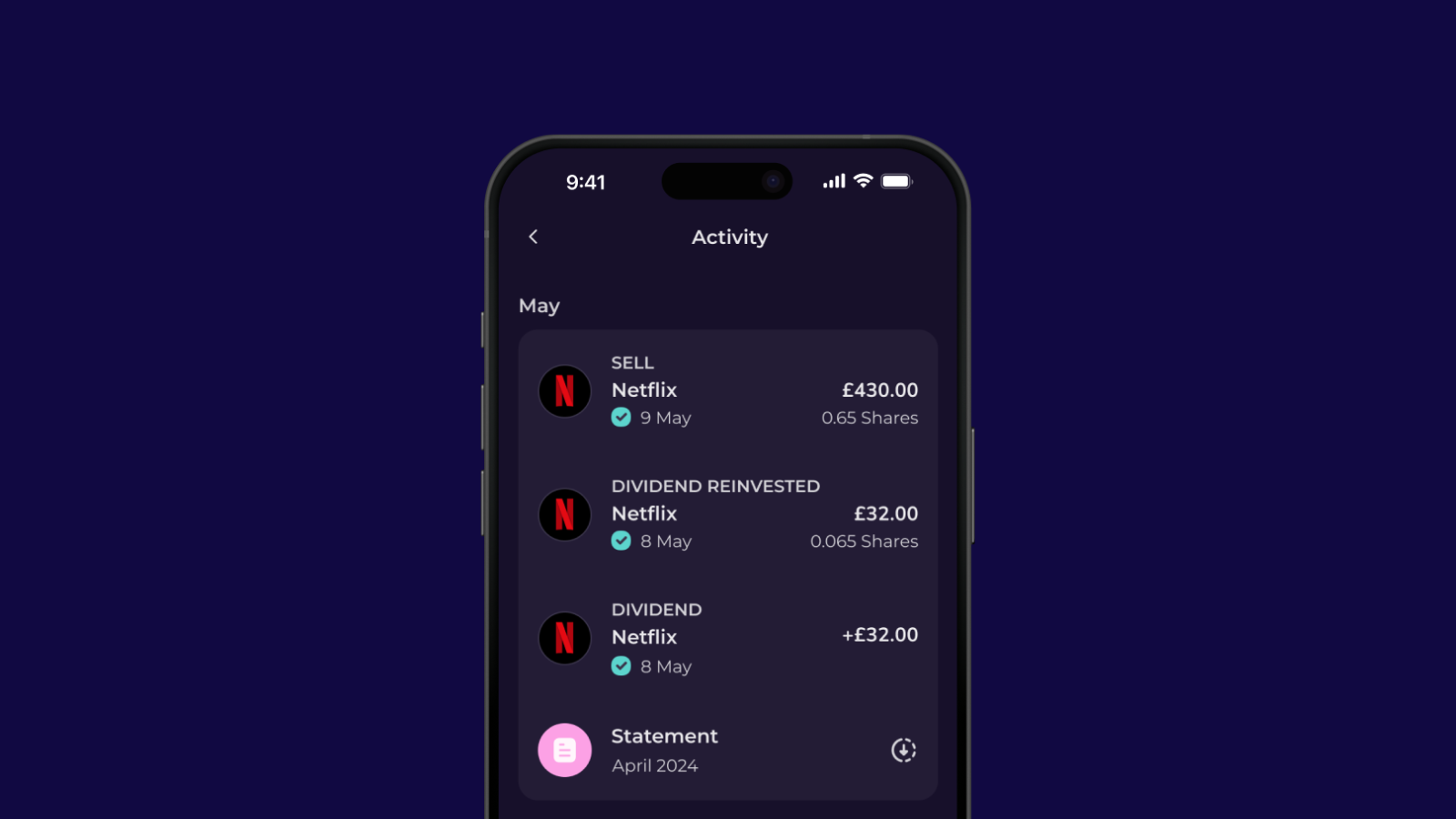

PSD2 and Open Banking will give us the opportunity to read banking data in a much cleaner way. However, from a competitive point of view, this won't change anything. The game we are playing is not even about how many users a service has, but focuses on how data is understood and used. Hence why, the next European "Google" will be the company who manages to have a symbiotic relationship with banking data, led by AI and Machine Learning.

2017 has shown us a different side of finance, which can be more human-friendly, but also pushes the boundary of trust. While banks have built web and mobile interfaces based on cold and strong colors to look more trustworthy, startups are now challenging the status quo with gifs, chatbots and any type of colors. This is a remarkable trend, which should also ring some bells in Canary Wharf.

My predictions for 2018 expect to see banks shipping aggregator-like services. We have already seen the work that ING and HSBC have been doing in this context. The impact will be minimal and the good news is startups are still faster.

In terms of trust, we'll see a market that will be more open to accept solutions like Emma. The FCA and all the bureaucracy that comes with PSD2 will definitely help. At the same time, the startups who started with savings-only solutions, we'll try to get into the aggregator space by offering features to track and manage finances.

Chatbots will still be present and we expect to see more. Why? It takes a weekend to build one. There is no proprietary technology behind a chatbot. The majority of solutions that are present in the UK market use Wit.AI, a framework owned by Facebook, and either an app or Facebook Messenger to build their product.

In terms of Emma, we have an intense roadmap ahead, which we intend to execute as fast as possible. We have been averaging a release per week and we'll try to raise the bar to two by the end of the year. Our product is still in closed beta and it will stay as it is for a few more months. We are excited about the future and we won't stop until we see our mission realised, because anyone deserves a financial advocate, and that's not your bank.

Happy new year!

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.