FEATURED ARTICLE

New in Emma App: Reinvest Your Dividends and Grow Your Wealth Automatically

Giuliano Fabbri

May 22, 2025 •2 min read

TABLE OF CONTENTS

What Is Dividend Reinvestment?

Why Reinvesting Dividends Works

How to Reinvest Dividends in Emma App

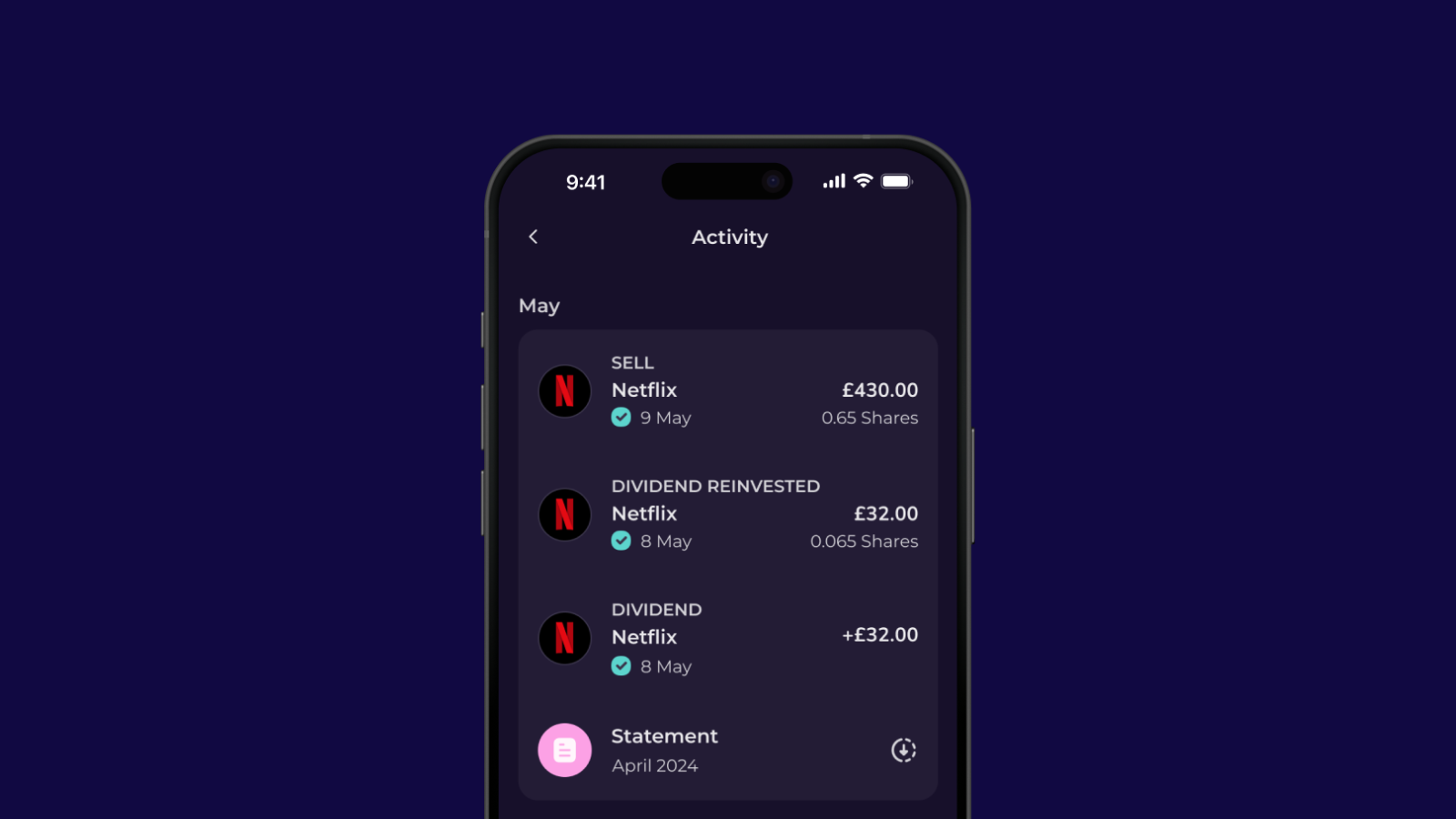

We’ve just launched a brand new feature in Emma Invest - Dividend Reinvestment.

If you’re investing through the Emma app, you can now automatically reinvest any dividends you receive - giving your money the best chance to grow without any extra effort.

But what is dividend reinvestment and how can it make a difference to your financial future?

What Is Dividend Reinvestment?

When you invest in shares that pay dividends, you receive cash payouts - usually quarterly - as a reward for holding the stock. Instead of withdrawing that cash or letting it sit unused, dividend reinvestment allows you to automatically use it to buy more of the same investment.

This simple strategy taps into the power of compound growth - where your returns start generating their own returns. Over time, that can mean a significantly larger portfolio, especially if the stock’s value also increases.

Why Reinvesting Dividends Works

Here’s how reinvesting dividends can benefit you:

- Build wealth faster through the power of compounding;

- Automatically buy more shares with zero commission fees;

- Make every pound of dividend income work harder;

- Fractional shares mean even small dividends get reinvested fully.

It’s a strategy used by long-term investors worldwide, and now it’s available to all Emma Invest users in just a few taps.

A Quick Example

Let’s say you hold £2,000 worth of shares in a company that pays an annual dividend of £1 per share. With 100 shares, you’d receive £100 in dividends over the year.

With dividend reinvestment enabled, that £100 buys more shares of the same company - let’s say 5 additional shares if the price is £20. Next year, your dividend payout is based on 105 shares, not 100 — and the cycle continues.

Over time, this snowball effect can significantly boost your long-term returns, turning passive income into active portfolio growth.

How to Reinvest Dividends in Emma App

Getting started is quick and easy:

- Open the Emma app and go to the Invest tab;

- Select the share or fund you want to reinvest in;

- Toggle on the Dividend Reinvestment option;

- That’s it! Your future dividends will be reinvested automatically.

Make every payout count by automatically reinvesting your dividends back into the stocks you own.

Get started in Emma Invest. Capital at risk.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.