FEATURED ARTICLE

Coronavirus: you can now apply for a 3-month mortgage payment holiday

Edouard Daunizeau

March 30, 2020 •2 min read

The UK government recently introduced policy to help borrowers with reduced income throughout the coronavirus outbreak: the mortgage payment holiday.

Homeowners con now contact their lenders to apply for a 3-month mortgage payment holiday. But there has been confusion regarding how the new process works and who is eligible to apply.

In this article, we run you through how the policy works, eligibility criterias and all the information you need to know to apply for a mortgage payment holiday.

What exactly is a mortgage payment holiday?

A mortgage payment holiday is effectively a temporary pause in your mortgage repayments.

You can apply for up to 3 months of payment holiday by contacting your lender with a valid reason.

How do I know if I qualify?

Homeowners that are up to date on their mortgage repayments are eligible for up to three months of portage payment holidays.

Buy-to-let landlords whose tenants are affected by the coronavirus can also apply for a payment holiday, and are expected to pass on the financial relief to their tenants.

The FCA also provided new guidance for lenders, urging them not to repossess properties unless the can prove that the borrower has agreed it is in their best interest.

Will I need to pay more interest?

Even under the payment holiday, you will still owe the bank the same amount.

This means your repayment period will be extended and you will accrue a bit more interest as a results.

Homeowners with the ability to meet repayments should continue as normal and avoid applying for for the temporary exemption.

Do I need to pass an affordability test?

Under the new policy, lenders do not require you to provide any documents or pass any tests.

You will simply self-certify that your income has been affected by the Covid-19 outbreak.

Landlords will also need to self-certify that their tenants' income has been affected on their behalf.

What happens after the 'holiday'?

You lender will contact you at the end of the period to assess your situation and agree on a feasible way for you to make up the deferred payments.

Banks will typically provide a variety of options, including altering your monthly payments or extending your mortgage term.

Will this affect my credit score?

According to trade body UK Finance, mortgage providers will work to ensure the payment holiday does not impact your credit score.

However this is not a guarantee.

Experian, a credit reporting agency, reported that banks should not record payment holidays as missed payments on credit reports. But this responsibility lies with the individual lender.

Hence if you have the ability to meet your mortgage payments, we strongly advice you do so.

How do I apply for a mortgage payment holiday?

Simply contact your lender's customer service to discuss your options. They will be able to provide you with more information and submit an application on your behalf.

However, while some banks such as Natwest have set up online forms to apply for a payment holiday, most banks still require you to contact them by telephone.

You can refer to the UK government website here for more information.

Need more advice to save during coronavirus?

We have recently published some articles to help consumers reduce their monthly expenses during the Covid-19 outbreak.

These include:

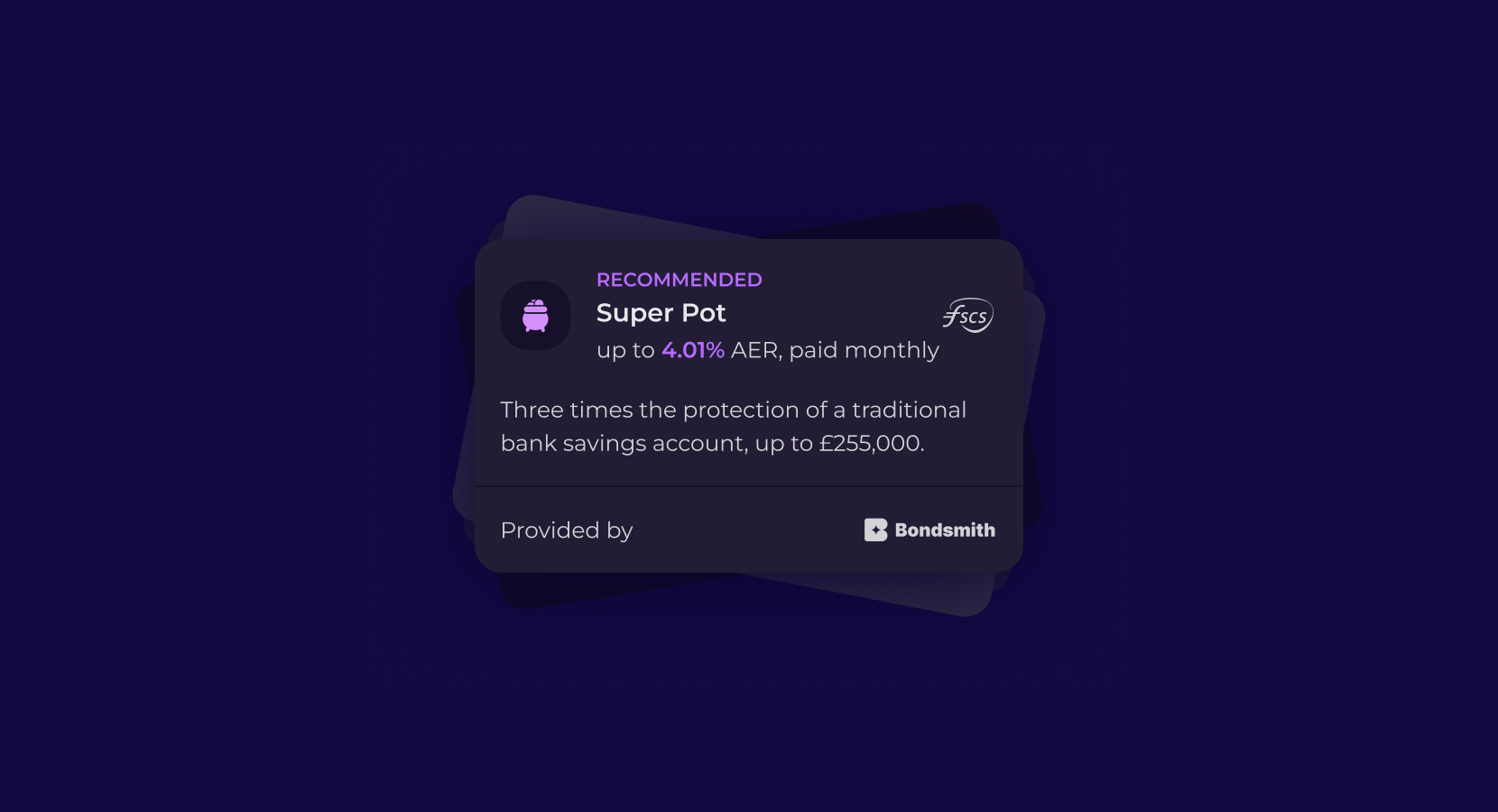

You can also download the Emma app to track your spending by category and identify areas for improvement in your finances.

We hope this advice has been helpful and wish you all the best during this quarantine period.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies Ltd is an Introducer Appointed Representative of Quint Group Limited, which is authorised and regulated by the Financial Conduct Authority (FRN 669450). Emma Technologies Ltd is not a lender. Emma Technologies Ltd introduces customers to Monevo Limited who is a licensed credit broker.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.