Did you know the average person has 11 jobs over their working life? Which means they’re also likely to have money in 11 different pension pots…?

If you have multiple pots from the different jobs you’ve worked in over the years, then consolidating your pensions into one scheme could be a good idea.

No one wants to be tracking down money in a pension pot from a job over 50 years ago! So combining them into the same plan now, can save you lots of time and hassle in the long run.

Combining them now might even mean you end up with a higher pension income and a more cushty retirement. Who wouldn’t want that?

In this article, we’re going to delve into some more reasons why you might want to consolidate your pensions. If you decide that consolidating your pensions is the right thing for you to do, we’ll then show you one way you can quickly and efficiently get this task done.

The Benefits To Consolidating Your Pensions

1. All your money will be in one place

The most obvious benefit to consolidating your pensions is that all your money will be in one place. That means only one pension pot to keep track of, and more importantly, only one set of paperwork you need to do!

Having to keep track of just one pension pot also makes understanding your current pension savings a whole lot easier. You’ll easily be able to calculate if you’re on track to reaching your ideal retirement savings goal, or not.

2. Your pension will be much easier to manage

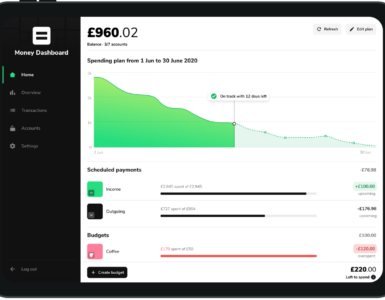

You’ll be shocked at how many pension providers still use letters or old online systems as their main communication method. Get back into the 21st century and consolidate your pensions through an easy to manage online provider like PensionBee. You’ll be able to check your current balance, make a contribution or a withdrawal, without having to wait for the postman to arrive.

3. You can choose better performing funds

Another benefit of consolidating your pensions is that you can move your pension into a plan that offers a better return on your investment. For some people this is a no brainer because it ultimately means they can boost their retirement savings.

You can even pick and choose a plan that better suits your appetite for risk, letting you decide how you want your money invested instead of leaving it to someone else.

Make sure you’re clued up on any plan you take out by reading the pension factsheet – this will help you understand how your money will be invested. It won’t however, be able to predict how well your investment will do.

4. Gives you access to lower fees

Consolidating your pensions also means you could pay less in administrative fees. Some providers make their fees look lower than they really are by adding hidden fees into the plan. Things like investment charges, contribution fees and inactivity fees could be costing you money without you really even realising.

Only having one plan means you can easily keep track of exactly what is coming in and out of your account.

Companies like PensionBee only charge a single annual management fee – with no sneaky hidden costs! And, if your pension pot is over £100,000 the good folks will even halve the fee on the portion of your savings over this amount.

(The only time you might have to pay anything extra is if you transfer to Pensionbee and then take your whole investment out within a 12 month period)

Questions To Ask Before You Consolidate Your Pensions

Are there any exit fees?

Some pension schemes may charge you an exit fee if you want to transfer your money out of your account. The fee is usually a percentage of your pension savings, so before you consolidate your pensions, check if there are any exit fees.

Am I entitled to any safe-guarded benefits?

Some pension schemes offer safe-guarded benefits, so it’s important to check if you are entitled to these. If you are, take into account that if you transfer out of the scheme at any point you might lose these benefits.

Safe-guarded benefits could include a guaranteed growth rate on your pension, access to your pension early, and might offer you more tax-free cash than other accounts, so it’s worth checking before you transfer to a new consolidated pension scheme.

How To Consolidate Your Pensions

To get started with pension consolidation, you will need to provide information about your old pensions to your new provider.

You’ll need to know details like the provider name, or your old policy numbers. Speak to your old provider directly, and ask them for this information – the more information you can get from them the better.

Pension consolidation services like PensionBee are then a good low-cost, easy way to combine all your old pensions into one pot.

You can even sign up for their service in just a few minutes through the Emma app. Head to the Save tab, the opportunities and click on the “Combine Pensions” button. From there you’ll be directed to PensionBee where you can sign up straight away.

You’ll be assigned your very own BeeKeeper who’ll be on hand to support you with any questions you have. And, they’ll also keep you up to date throughout your whole PensionBee journey!

If you’re thinking about combining your pensions with PensionBee, but have a few questions, don’t hesitate to get in contact with us through our in-app live chat, or ask fellow Emma users about their experiences of using PensionBee through our Community forum.

Emma is a money management app that connects all your bank accounts to track your monthly spending and subscriptions. Emma will help you visualise and take control of your finances. Make sure you aren’t overspending and show you practical steps to start budgeting effectively. Download Emma today.

[…] See More: Four Reasons Why You Might Want To Consolidate Your Pensions […]

[…] out more about the benefits of consolidating your old pensions into one plan […]