FEATURED ARTICLE

How To Save Money With The Emma App

Rebekah May

December 1, 2020 •4 min read

TABLE OF CONTENTS

1. Switch Your Broadband

2. Compare Loans

3. Make The Most Of Cashback

4. Save Pots

5. Rent Reporting

Summary

Want to know how to save money with the Emma app? We’ve listed 10 ways our UK users can save big. From cutting the cost of broadband to finding the best deals on home insurance, we’ll show you how easy Emma makes it to save those hard-earned pennies!

1. Switch Your Broadband

There are lots of reasons why you might consider switching to a better broadband service.

Perhaps you’re currently experiencing poor broadband performance? Maybe you’re not happy with the levels of customer service you’re receiving? Or, you might just be looking for a better value deal.

Luckily, switching broadband has never been easier.

If you’re interested in comparing broadband deals, all you need to do is go to the Save tab in Emma. Just tap on the opportunities section, and select View broadband deals. You’ll can then enter your details and you will be directed to a list of broadband deals from a wide range of providers.

How to save money on your broadband:

You can browse through the list of providers, the monthly fees, average speed, and contract length, or you can click on each deal to view more details. You can even use the filter to drill down into your specific requirements, like minimum speed and length of the contract.

Once you’ve found a deal that suits you, click on Visit now to complete the switch. Your new provider will then arrange the transfer for you, as well as letting your old provider know that you have switched deals.

Here’s to speedy, value for money, internet!

2. Compare Loans

A personal loan is an unsecured loan with a fixed interest rate that can be used to purchase big-ticket items, or to consolidate debt. Getting a personal loan is really only a good idea if you purchase something that you plan to repay in less than five years.

Debt, or credit card, consolidation is one of the most popular reasons for taking out a loan, and doing so can actually save you money.

The first reason is that you can pay off existing high-interest loans with a lower interest personal loan. You can also combine different types of existing debt into one single personal loan to make it much easier to manage your debt repayments.

For more information on the different types of loans, read our ultimate guide to loans.

If you’re considering taking out a new loan, visit the Borrow tab in the bottom right of Emma. Getting a quote does not impact your credit score and could help you manage your money much more effectively.

Select the loan type and then enter how much you’d like to borrow. Enter the loan length, and what the loan is for. Fill in a few details about yourself, your home, previous address details, your employment, and your big monthly expenses. Once this information has been provided, the details will be analysed and you’ll receive a quote.

3. Make The Most Of Cashback

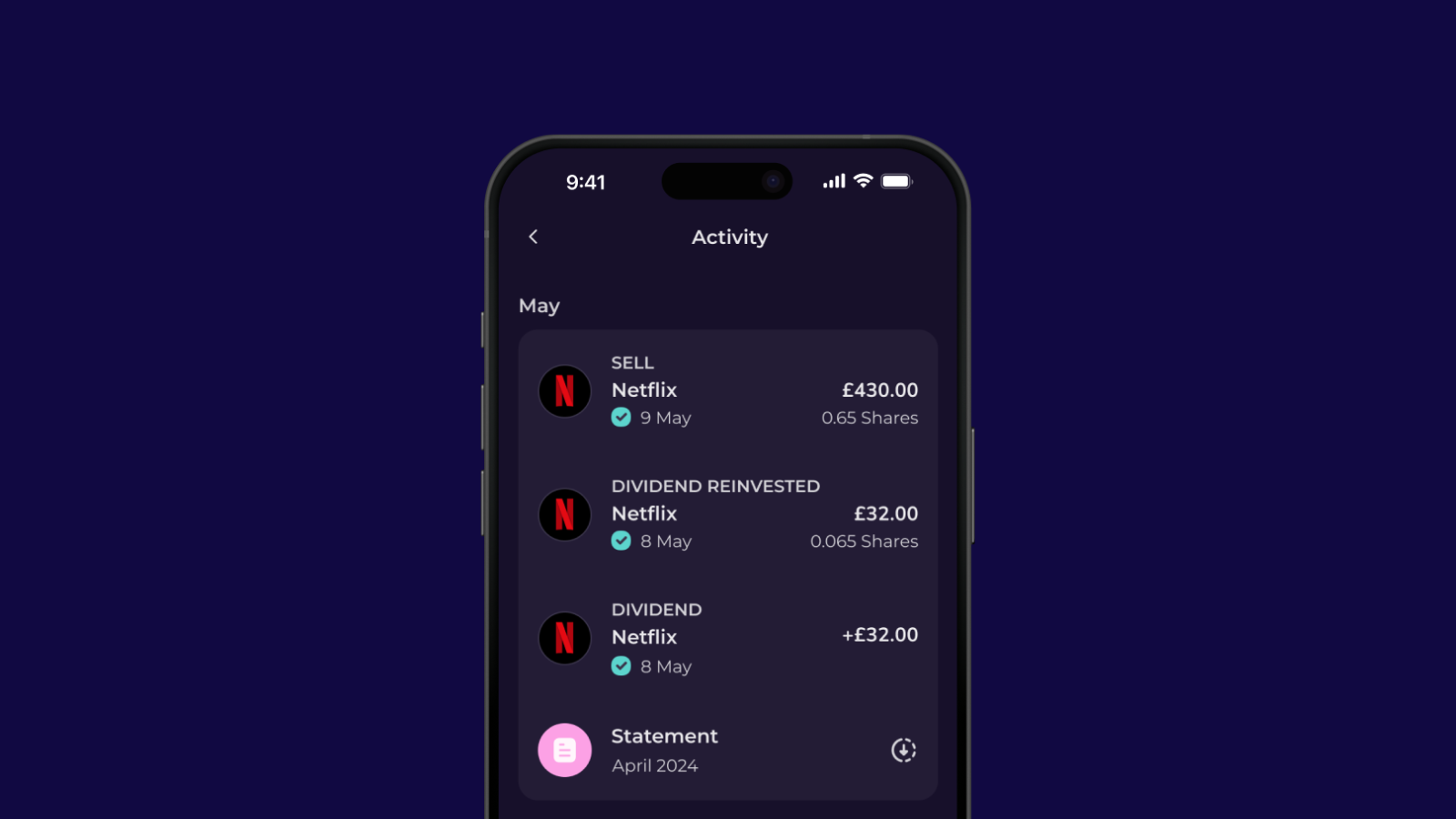

Cashback is a fabulous way to earn money back on items you’re already planning on buying.

You can receive cashback from a whole host of big brands, across fashion, food, tech, beauty and entertainment – with some brands offering huge discounts daily.

To earn cashback with Emma, simply head to the Save tab, tap on Cashback and scroll through the list of brands we’ve partnered with. You’ll see brands like Apple, Samsung, Iceland, Currys PC World, The Body Shop, Boots, Simply Cook, Audible and many, many more.

Once you’ve found a brand you’d like to shop with, we’ll direct you to their website. From there we will be able to track what items you’ve purchased, crediting your Emma account with any cashback gained.

Using cashback is one of the easiest ways to reduce your spending. Make sure you check it out today!

Want to see which cashback brands we’ve been lusting over lately?

4. Save Pots

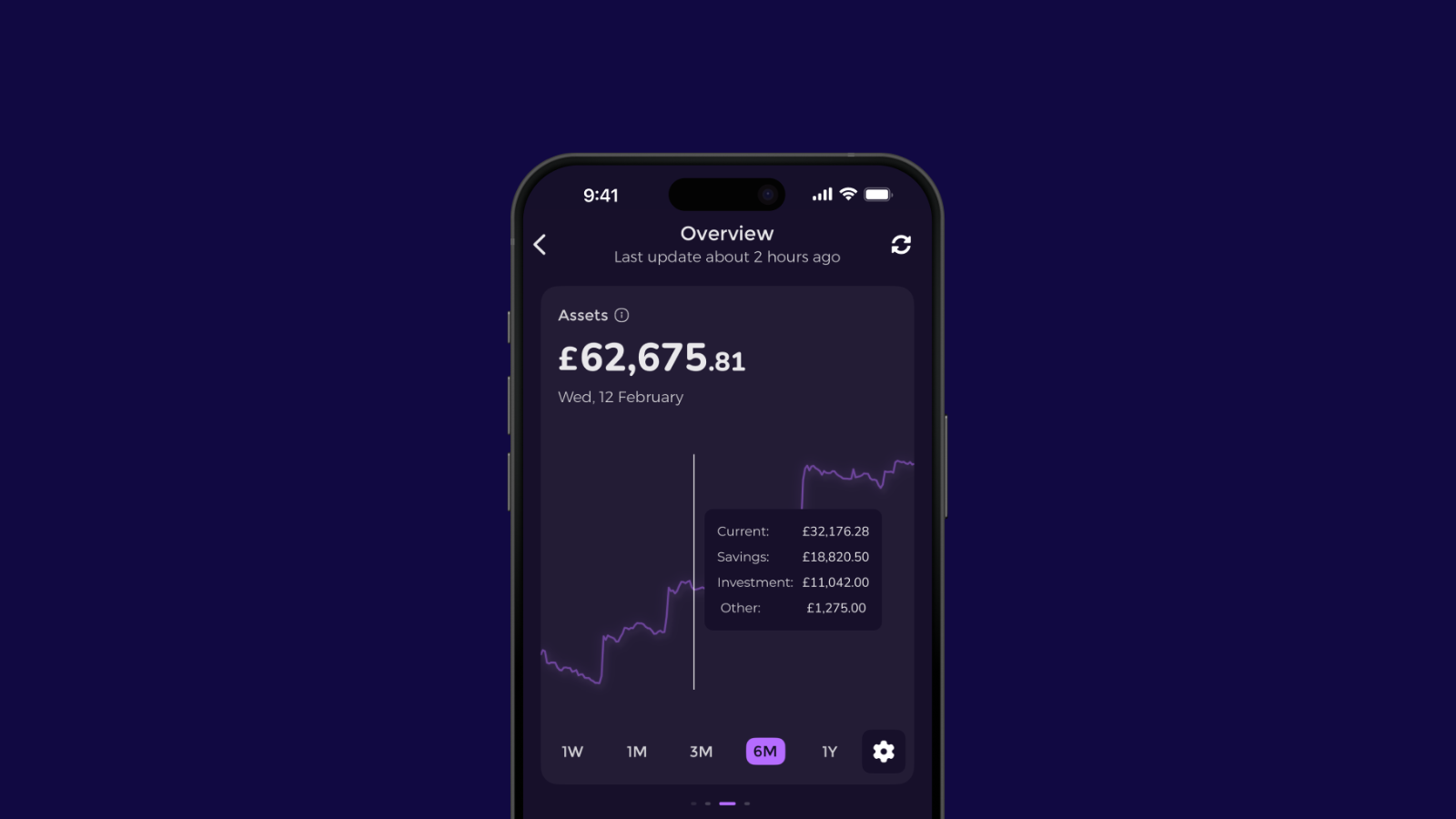

Emma Save Pots will enable you to create Pots - places where you can set money aside to help you reach your financial goals.

You can create multiple savings Pots for anything you need or your heart desires, such as a holiday, something special or an emergency fund for a rainy day!

We have two different types of Pots in Emma:

Easy Access Pots are types of Pots that allow you to easily earn interest on your money. When you put money in an Easy Access Pot, it is sent to a trustee, who deposits it with a bank you choose, on your behalf.

Instant Access Pots are a type of Pots that allow you to manage your money. You can create as many as you want. The money deposited in this type of Pots is safeguarded according to e-money regulations.

5. Rent Reporting

Rent reporting is a tool which helps improve your credit position without taking out a credit card or loan. We’ll report each new rent payment to credit referencing agencies to improve your credit position.

Get your credit position on track by building a higher position with all the credit referencing agencies which has lots of benefits including helping your access finance at better rates which can end up saving you money!

Keep paying your rent as you do today. Emma will securely read the rent payment from your bank and let the credit agencies know.

Summary

There are lots of ways you can save money with the Emma app. If you have any questions about using any of these features, feel free to drop us a message on Instagram or Twitter. You can even reach out to our in-app live chat, where someone will be ready and waiting to answer all your questions!

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.