FEATURED ARTICLE

More Top Money Tips From The Emma Team

Rebekah May

May 11, 2021 •2 min read

TABLE OF CONTENTS

Edoardo - CEO

Antonio - CTO

Simona - Design

Varadh - Software Engineer

Summary:

Last week we shared some of the Emma team's top money tips. You heard from four team members across marketing and customer support, but it’s now time to hear from a few more of the gang.

Read on to find out what top money tips the rest of the team have to share.

Edoardo - CEO

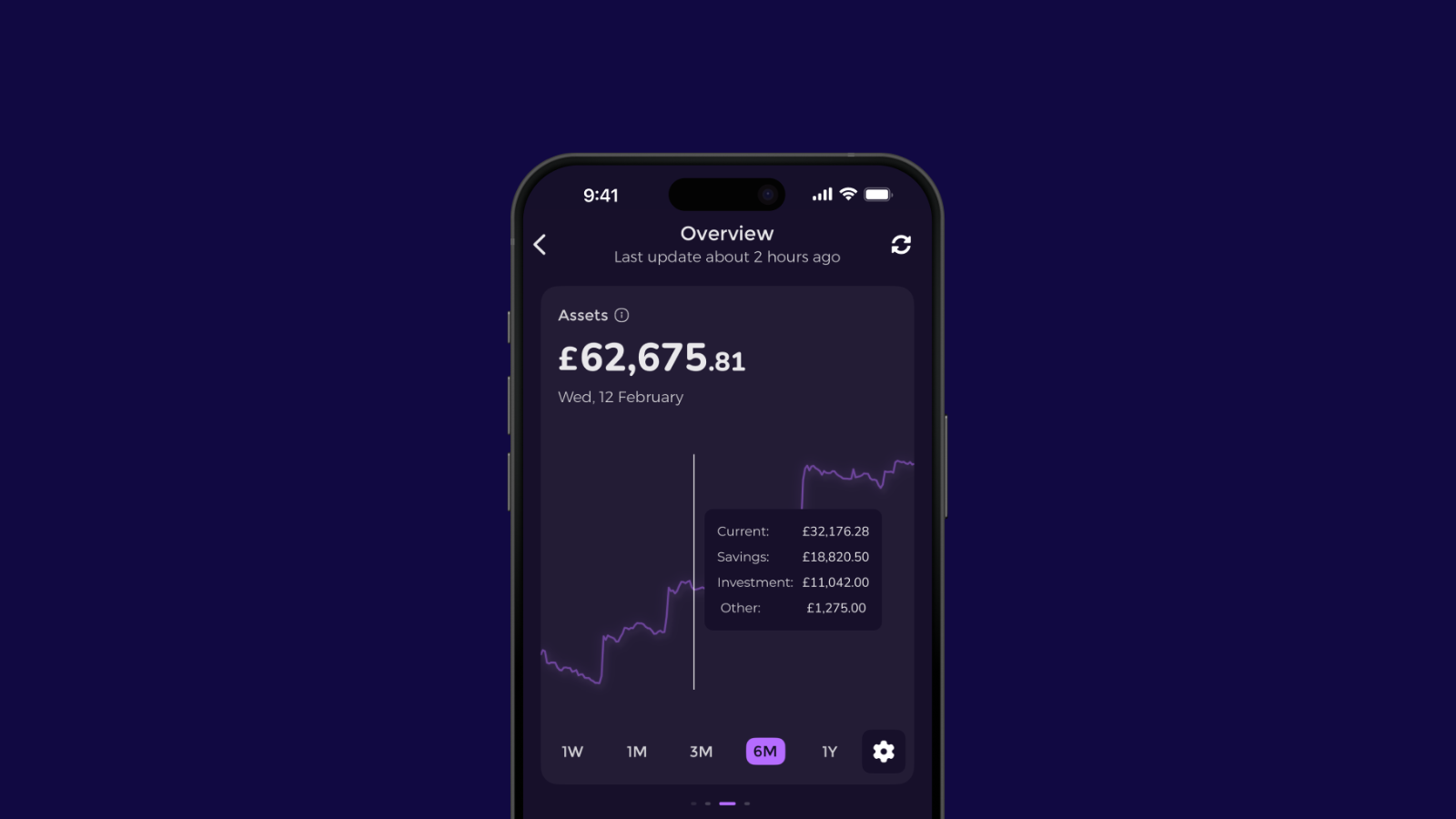

I would have to say that my top money tip is to use Emma ;)

Other than that, I think it’s a good idea for everyone to work on improving their financial knowledge. By this I mean keeping up to date with financial news, being aware of new saving and investment opportunities and generally understanding how to make your money work for you.

Being aware of what’s going on in the financial world means you can pick the best saving accounts, can choose the best investment platforms, and can make the best decisions surrounding your money.

Antonio - CTO

There are a couple of things I do every month to make sure that I’m managing my money in the best way possible, but the one thing I always do is to track my spending and see how it compares to my budget.

I’m very good at coming up with elaborate reasons as to why I need to buy something, so having a budget keeps me on track and makes me think twice about buying so many unnecessary things.

If you’re new to budgeting and tracking your spending it can seem like a lot of effort, but after a few weeks, you’ll get into a good routine and will find that managing your money is quite simple and really rewarding.

Simona - Design

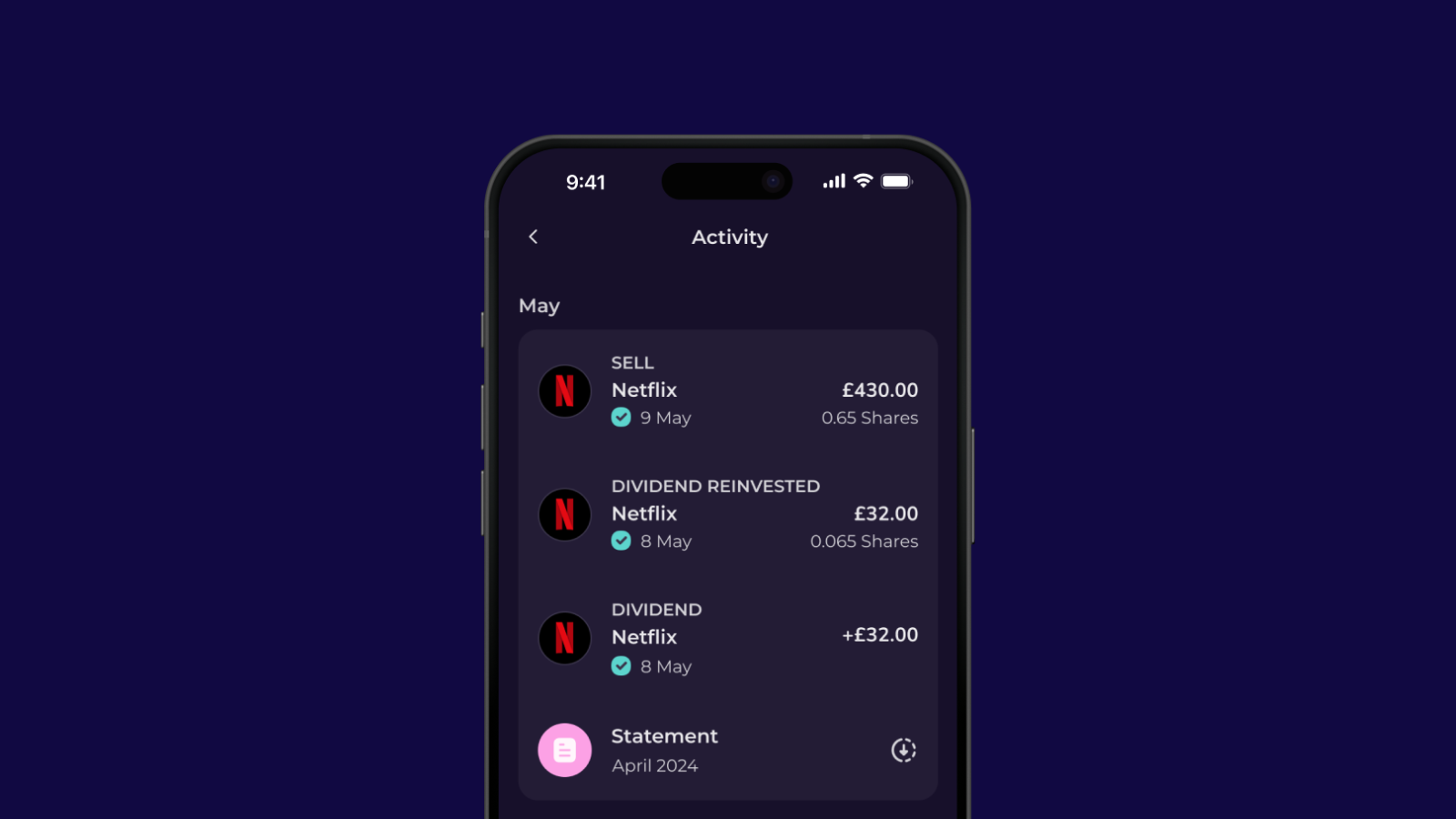

If I had to pick one money tip I’d say to always track your subscriptions.

Companies have made it so easy to sign up for their subscription services and free trials, that you could easily be paying for a subscription that you no longer need or want anymore.

Keeping an eye on all my subscriptions just means that I can regularly assess if I’m still happy to be spending that money, or if there are other, better things I could be spending the money on instead.

Varadh - Software Engineer

I think a good tip is to organise your finances in terms of percentages. For example, as soon as you’re paid, move 10% of your salary into a savings account, 10% into an investment account, and so on.

Managing your money like this can also help you spot any areas that you might be spending too much. Or even, not enough?

If you worked out that you were spending 50% of your salary on rent, and 45% of your salary on living expenses then that easily highlights that you’re not prioritizing saving/ investing in your future.

There’s a popular budgeting method called the 50/30/20 rule that suggests you should spend 50% of your after-tax income on “needs”, 30% on “wants” and 20% on “savings”. I don’t think you need to match these percentages exactly, but I do think it can be a useful guide.

Summary:

What did you think about these top money tips from the Emma Team? Have you learned anything that you could see yourself taking up?

Let us know by dropping us a quick message on the Emma Community, or by reaching out to us on Instagram and Twitter.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.