FEATURED ARTICLE

Our Journey So Far!

Edoardo Moreni

May 27, 2021 •5 min read

As you can probably imagine, starting your own company is no easy task. But with every low, comes a huge amount of highs. Here we take a look at our journey so far.

2018: The Start of Emma

Emma was created in January 2018. We set it up with the mission to build the control center of money for the world.

We truly believed in this mission, so we (me and Antonio) decided to invest all our savings to build the first prototype.

We applied for FCA approval and were thrilled to be registered with the FCA.

Our First Customers

It wasn’t long before we had our first few thousand customers!

People loved the fun, quirky style of our app and wanted to get involved.

We also started getting picked up by some huge publications and received a tonne of amazing press features. Including this great piece from City AM.

https://www.cityam.com/emma-banking-app-millennials-gets-fca-approval-and/

Our First Funding

People were definitely noticing us.

In July we then secured pre-seed funding amounting to £420K.

This round was led by Kima Ventures, who were the first investors in Transferwise; and Aglaé Ventures, which is part of the Group Arnault. The rest of the round drew support from Angel investors whose portfolio companies have exited to JustEat, Snapchat and others.

We used this round to help us further develop the product and expand our London team.

Rose Dettloff, deal partner at Kima Ventures, explained why she backed the FinTech startup:

“Emma brings clarity and transparency to people’s financial lives with a product designed and built for an audience that is eager to grow their personal wealth. Kima Ventures is glad to have Emma as part of its family and looks forward to supporting future growth and developments."

Community Feature Requests

Our community was growing too, and we were learning lots from our customers.

Their feedback was invaluable at the start of Emma’s journey and they helped shape some of our now most-loved features. Like one of our most innovative features - the option to budget payday to payday.

In that same year we also launched crypto and added a new asset class next to traditional financial products. This was huge because it meant Emma users could view all their cryptocurrency investments in real time under one platform.

Then we decided to introduce the concept of cashback. We wanted to bring cashback to millennials and help them save like never before.

We launched our rewards page with nine brands, including Gousto recipe kits, Naked Wines and Pact Coffee. Our customers could receive anything from £5 to £20 directly into their savings account when buying products from the selected retailer.

A New Image

We knew from the feedback on our community that our customers loved the fun and colourful design of Emma. But, we knew the branding could be improved.

We spent a couple of weeks crafting the most beautiful finance app the world had ever seen and also revisited our brand logo. That’s when we introduced the gummy bear.

The new logo and app redesign focused on two main themes: playground and progress.

Playground was the first word we thought of. Before Emma, finance apps were boring, complicated, and had never been able to build a true consumer experience. That’s why we worked to make the new Emma even more colorful and interactive, just like a playground. We were the first fun finance app.

Progress was the second key word. Our goal was to build a product that helped people improve their financial life. This meant Emma needed to be able to bring real improvement in our life, but also show it.

The changes were well received, and by the end of the first year, we had gained more than 100,000+ downloads - all without any marketing spend!

2019: When things Really Picked Up

In 2019 we made the decision to allow anyone in North America to download Emma.

This launch came after we partnered with Plaid, the American leader in account aggregation. This meant 350 million people could now access Emma and all our amazing features. This was the natural progression for Emma. We launched in the US and Canada to achieve our mission faster, and we had some great results.

Another highlight from 2019 was being featured as “App Of The Day”.

This meant Emma was the most downloaded finance app that week, beating all the traditional and challenger banks!

2020: Funding From Connect Ventures

By now we were really on a roll. We had been releasing new features every week for the last year, and had a huge number of people using the app on a daily basis.

We knew it was time to start a fundraising process with the top VCs in the UK, France, Germany, and North America. We started having meetings with some funds we were connected to, as well as new ones we hadn’t met before.

During this time we met Rory from Connect ventures. We were only focused on product and organic growth and this made us a perfect match.

Rory said this about Emma:

“There is no equivalent today for the role that Emma can play in future. This is not about building a better PFM versus 10 years ago. This is about building a new category of tool that uses software to scale the very best financial analysis, advice, and support to the mass market.”

We raised a huge $2.5M from Connect Ventures, with participation from Ithaca Investments, Tiny.vc, and existing investor - Aglaé Ventures, alongside incredible angels who have built companies like Zenly, Voodoo, and Kapten!

2021: A Tonne Of New Features

After our funding we continued building new features that we felt fitted with the idea of becoming the best tool for financial analysis, advice and support to the mass market.

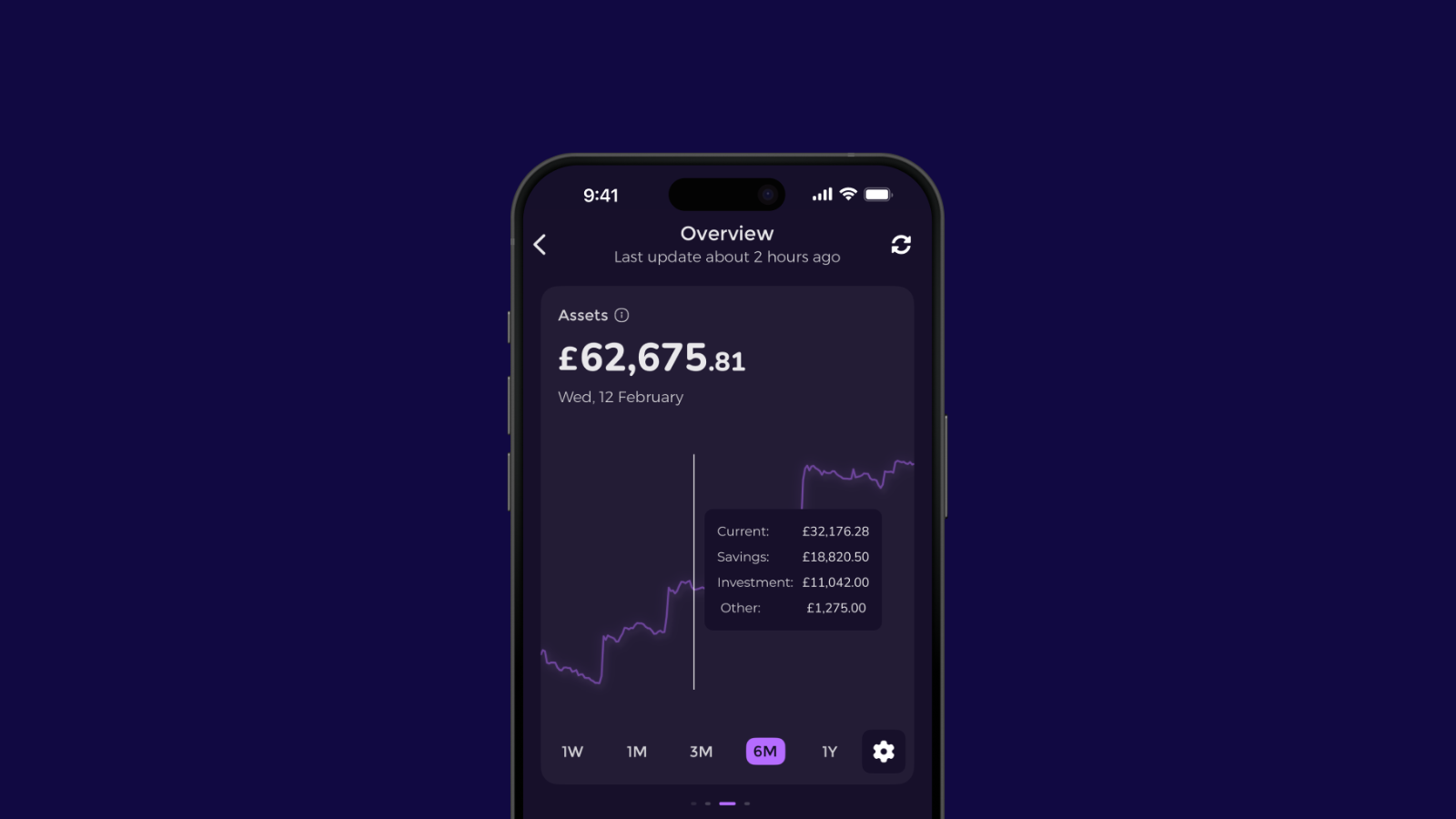

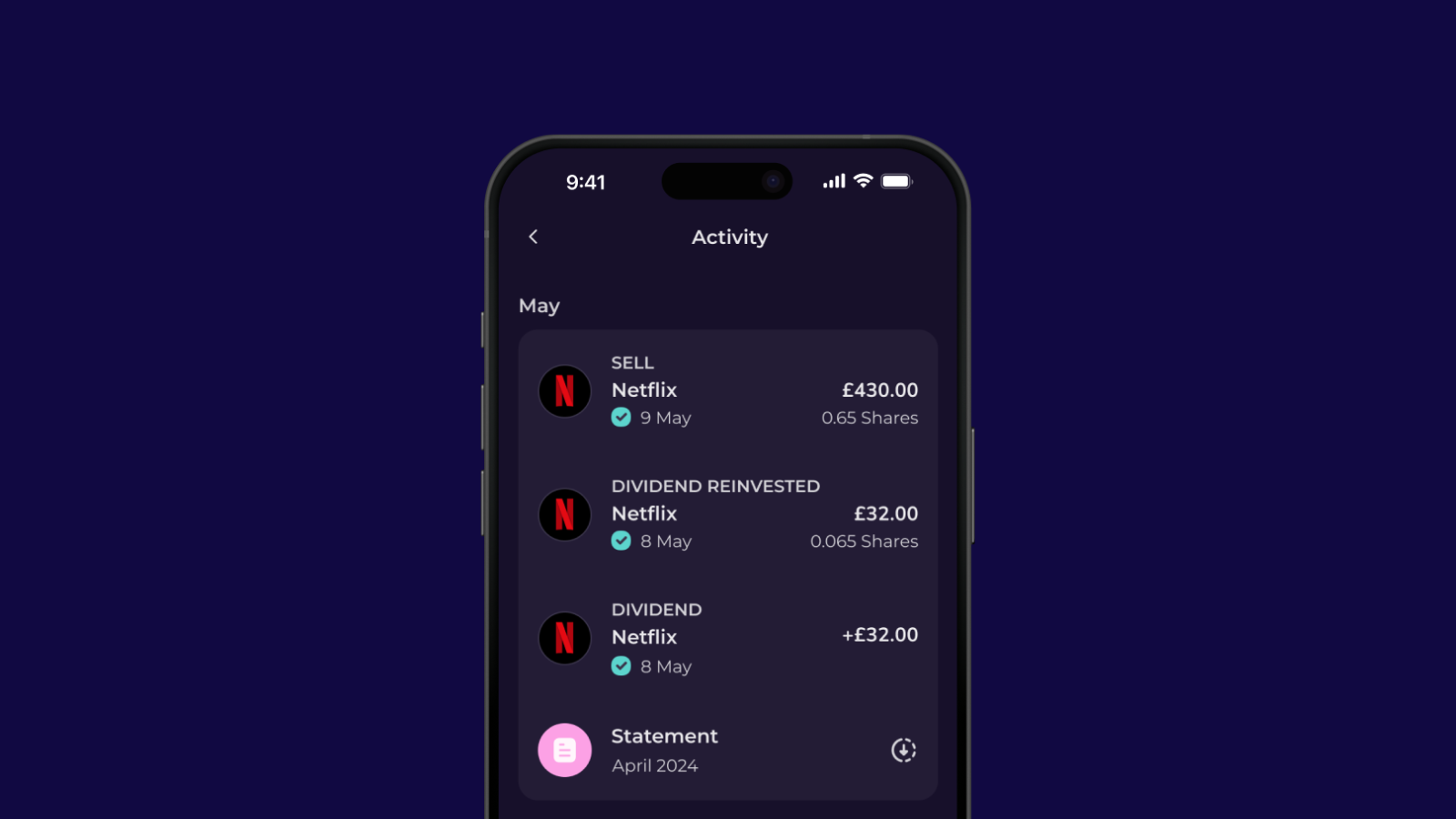

We added Net Worth into the app. We included lots of different ways to save money. And, we added clever features like Smart Rules (amongst others).

By now we were also regularly being featured in articles about the best budgeting apps to download, both in the UK and North America.

Emma was becoming the number one choice for anyone looking to improve their finances.

And while all of this is incredible, there’s still a whole lot more we’d like to achieve...

That’s why, we’re crowdfunding for the first time ever.

Crowdfunding will help us build the ultimate finance app and will supercharge our growth across Europe and North America.

Head to our crowdfunding registration page here, or visit the Emma Community for more information.

Capital at risk.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.