FEATURED ARTICLE

Emma Set To Release New Subscription Plan Called Emma Plus

Rebekah May

July 22, 2021 •2 min read

You may have seen on our product roadmap that we’re going to expand our subscription service. One way we’re doing this is by releasing an entry-level plan called Emma Plus.

Emma Plus will be an introduction to the Emma world and will include the following features:

1) Cashback:

You’ll be able to save money at hundreds of retailers across fashion, beauty, food, and tech by using Emma’s cashback feature. Just shop directly through the app, and we’ll debit your account with any cashback savings made.

2) Turbo Updates:

Emma Plus users will see their accounts updated 4 times a day with Turbo Updates. This is an increase from twice a day and is the maximum we can do by law. This means your account balances will be more up to date and will need fewer manual refreshes.

3) Priority Support:

Need help using an Emma feature, or have a problem with your account? Drop a message to our live chat support in the app, and you’ll be given priority support.

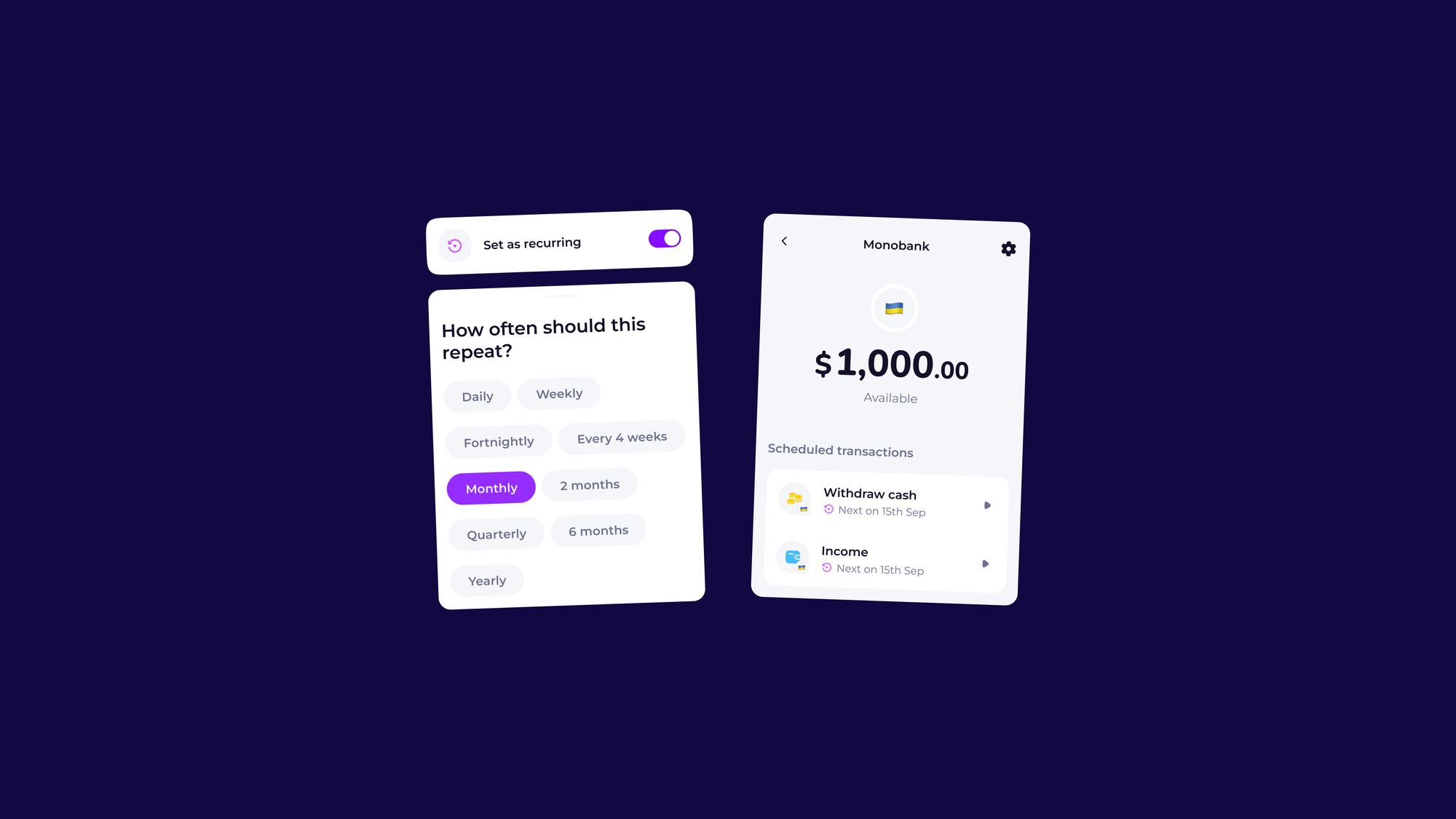

4) True Balance:

The true balance feature will forecast what your current account balance is after all your bills go out, making it easier to identify how much money you have left to spend each month.

5) Bill Reminders:

Let us keep track of when each of your bills are due. We’ll be able to identify any upcoming payments and will send a gentle nudge so you can rest assured you’ll never miss a payment again.

6) Fraud Detection:

This new feature will help you identify if your phone and email address has been breached or stolen, and what data was involved. Fraud detection will let you know if you need to manage any passwords or change any email addresses. This is just one more way we can help you become more financially secure.

7) Emma Plus Custom Icon:

All Emma Plus users will get access to a special custom icon. You know, to make you feel special.

8) Bank Transfers:

We recently added Payments to Emma. This meant that for the first time you can send and request money directly from the Emma app.

We’ll soon be extending this feature to include bank transfers. You’ll be able to transfer money between your own accounts in Emma at the click of a button.

Pricing:

Emma Plus will be cheaper than Emma Pro; our current subscription service. It’ll be priced at £41.99 per year or £4.99 per month.

How Is This Different To Emma Pro?

Emma Pro is our existing subscription service.

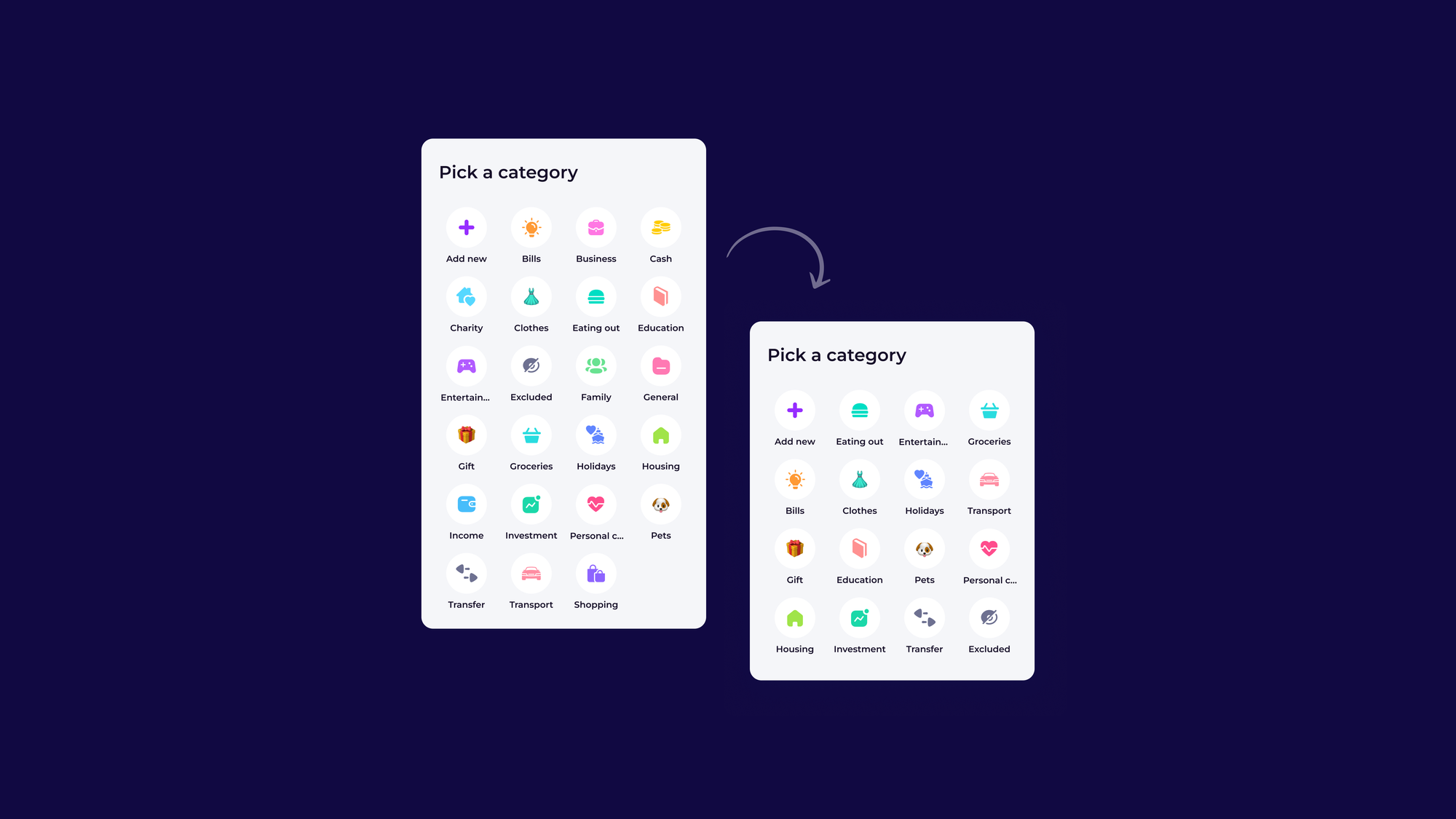

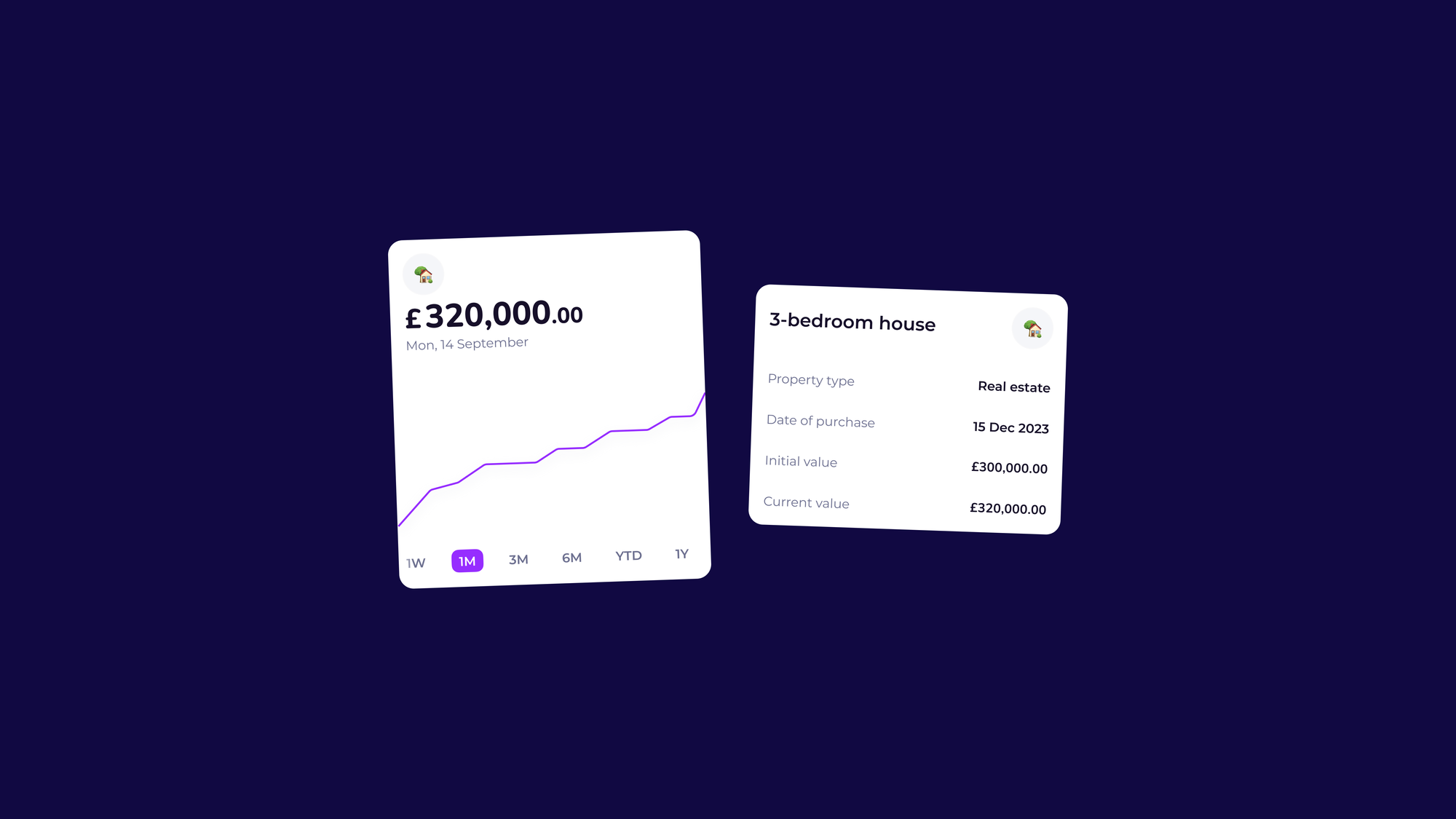

As well as the features mentioned above Emma Pro users also get access to custom categories, savings goals, data exporting, advanced transaction editing, offline accounts, smart rules, rolling budgets, accurate net worth, and split transactions.

Find out more about Emma Pro here.

Why Are We Releasing A New Subscription Plan?

We’ve already brought a premium banking experience to everyone with Emma Pro, but we now want to introduce a beginner plan to anyone that's interested in using extra features.

Subscriptions are also a great source of revenue for Emma. We currently have 17% of our active users signed up to Emma Pro. We’re hoping that the introduction of a new subscription plan can increase this to 30%.

For more information about our plans to release this new subscription service head to the Emma Community, or Twitter and Instagram. We’ll use these platforms to let everyone know when the new plans are ready to use.

You may also like

Check out these related blog posts for more tips

© 2026 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.