FEATURED ARTICLE

Is there a UK alternative to Yolt?

Giuliano Fabbri

February 3, 2025 •2 min read

TABLE OF CONTENTS

The best alternative apps in the UK

Why is Emma the best alternative to Yolt?

Conclusion: Emma as the Optimal Yolt Alternative

We're sorry to hear that Yolt has announced they'll be shutting up shop on Saturday, December 4 2021. This means all accounts, profiles, and prepaid cards will be stopped.

While they didn't go in-depth about this decision, they shared that they will be closing their consumer-facing business to focus on Yolt Technology Services - their business proposition.

Yolt has been a staple for many people wanting to take control of their finances and was a big name in the UK money management space. We'll miss their push for innovation which has kept us on our toes!

There are several money management apps in the UK, but not all will be the right fit for you.

The best alternative apps in the UK

If you're looking to continue your money management journey and you haven't found an alternative to Yolt just yet, Emma may just be what you're looking for.

We built Emma because we wanted to change our relationship with money. Taking control of your finances shouldn't have to be an intimidating prospect.

Like Yolt, you can combine all your accounts in one place using the Open Banking system. Emma, however, takes things one step further. Our crafty tech team has taught Emma to take the same Open Banking information and transform it into truly useful information using AI.

Emma works with all major banks operating in the UK, USA and Canada and best of all, it is free to use.

Why is Emma the best alternative to Yolt?

We get it - breaking up with Yolt and moving on when there are several money management apps to choose from is daunting. Here's why we think Emma is the right pick.

- It's familiar - Emma has all the features you know and love from Yolt: Payday budgeting, cashback, account aggregation, bill comparison services and more!

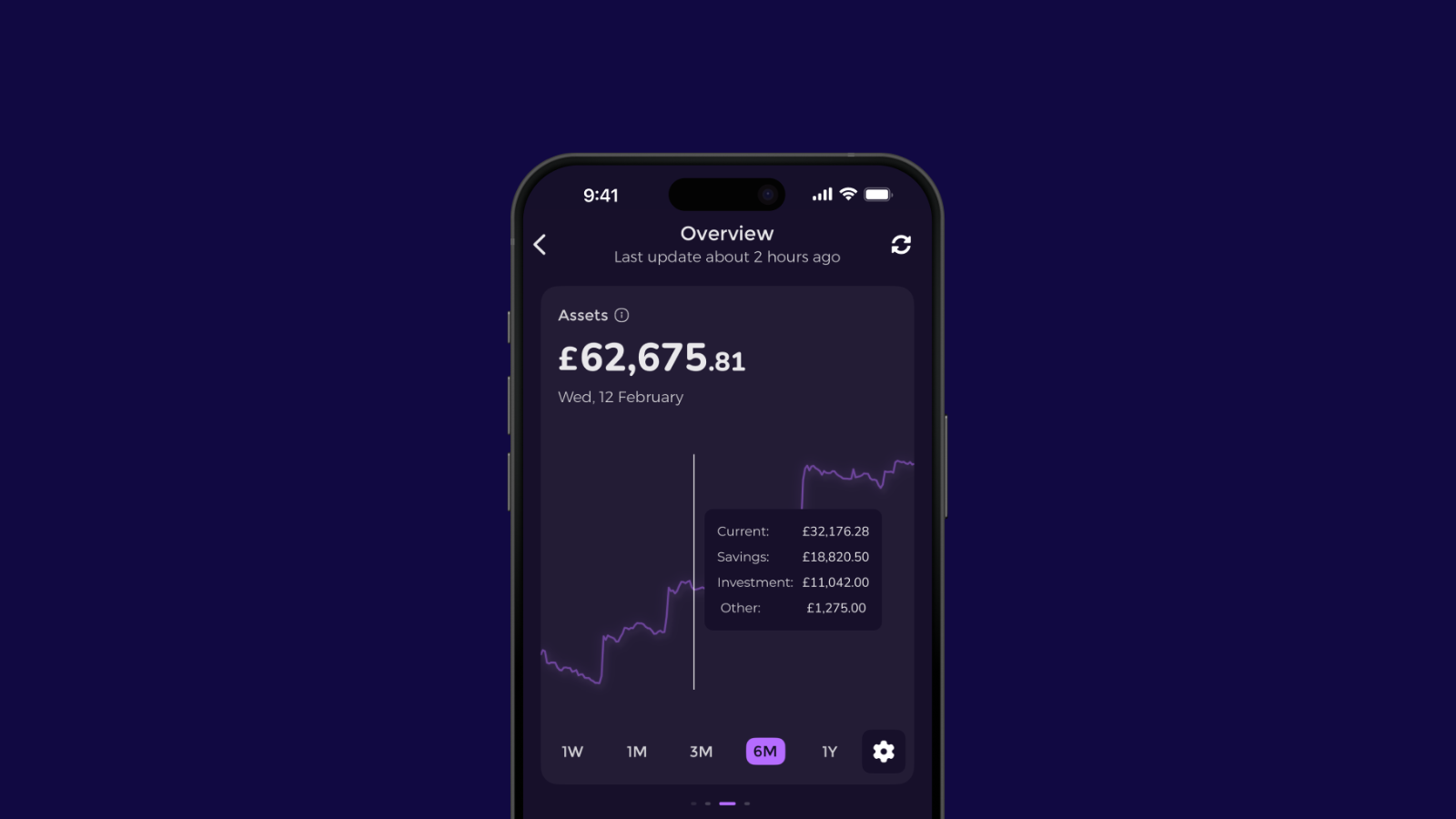

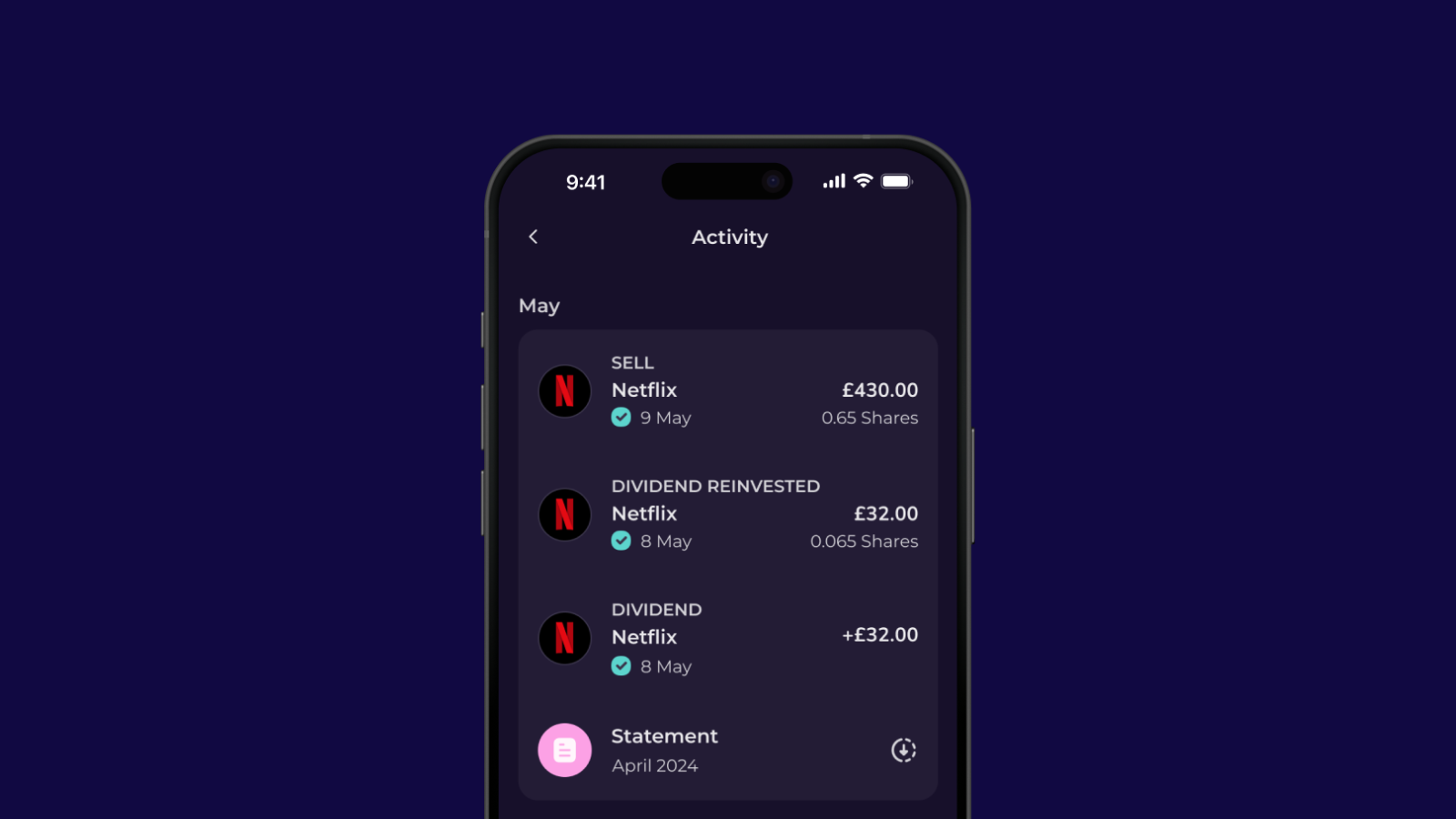

- It’s upgradable - Get access to even more helpful features such as the ability to create custom budgeting buckets, set specific savings goals, rename transactions, compute your accurate net worth and earn cashback with an Emma Plus or Emma Pro subscription.

- It’s always improving - The smart cookies here at team Emma are always working to release new and useful features to make Emma even better. We also take feedback from our users very seriously and work closely with our users to find areas to improve. With new features released every other week, you can be sure Emma is your go-to financial tool.

Emma helps with your everyday money needs - letting you know when you're spending too fast, notifying you when you get paid, and enabling you to stay on track with your budgets with weekly reports, alerts, and budgeting tips. Think of a financial advisor, but a fun version.

Conclusion: Emma as the Optimal Yolt Alternative

With Yolt's impending shutdown, transitioning to a comprehensive financial management app is crucial. Emma not only replicates Yolt's functionalities but also introduces enhanced features that cater to modern financial needs. From budgeting and expense tracking to investment insights and subscription management, Emma serves as your all-in-one financial companion.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.