If you’ve been able to save money during the lockdown, (see also: haven’t spent all your extra cash on online shopping) then find out which lockdown money-saving habits you’ll want to stick to when “this” is all over.

1. Nights In Are The New Nights Out

You might think we’re crazy for suggesting more nights in, but if lockdown has taught us anything it’s that you can still have plenty of fun by staying at home.

Use your imagination, and instead of heading straight to the pub, organise fun home-events with your friends and family. Whether that’s a themed takeaway evening, a movie night, or a house party, you’ll save money by staying out of those pricey pub rounds.

Plus, you’ll still get to enjoy each other’s company. Win-win.

2. Carry On Cancelling

When we first went into lockdown, there was tonnes of advice suggesting that everyone should review their outgoings, cancelling any subscriptions they no longer used. This made perfect sense – why spend your hard earned money on something that you don’t really need?

When lockdown eases, take the time to review which subscriptions you really want to set up again. If you’re getting on fine without your gym memberships, every single streaming service on offer, and all your other regular payments, then consider whether you actually needed these in the first place.

Cancelling any monthly outgoings and only paying for what you truly need is one lockdown money-saving habit you really should stick to.

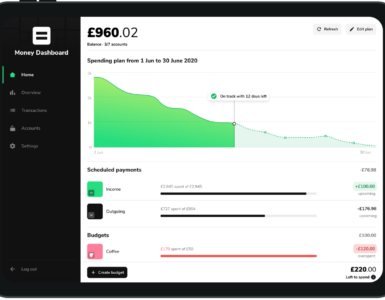

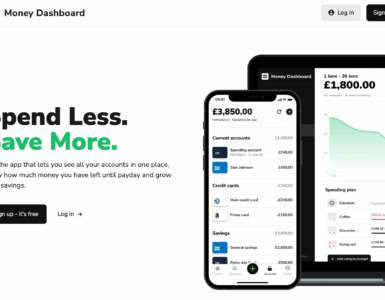

Emma’s recurring payments section is the perfect tool to help you do this. We’re able to detect any recurring payments or subscriptions that you might have, from direct debits to standing orders to normal purchases. We then summarise this in the app to help you easily spot what’s going out of your account every month.

3. Do It Yourself

With a lot of the beauty industry being forced to close during lockdown, you might have found yourself learning the tricks of the beauty trade.

While it’s nice to occasionally treat yourself to professional beauty care, consider whether you can continue doing it yourself for a fraction of the price.

Lots of beauty brands have great at-home alternatives that allow you to pamper yourself, on a budget. The Body Shop, LookFantastic, Beauty Expert, and Glossy Box are just a few examples. Head to the Emma app to see how you can get discounts on all of these brands.

4. Continue Comparing Deals

Comparison websites and apps were extremely popular during lockdown. Everyone had more time to spare and generally were a little more aware of their monthly outgoings.

When life returns to more normality, don’t let this lockdown money-saving habit slip away.

Taking the time to regularly review if you’re getting the best deals for your energy, broadband, phone bill and so on can save you hundreds of pounds a year. And really, only takes up a few minutes of your time.

You can even do this straight through the Emma app. Visit our Save Money tab and you’ll find lots of ways you can start saving.

5. Make The Most Of Cashback

Cashback is a fantastic way to save money on items you’re already planning on buying. Most of the biggest names in fashion, food, and tech can be found on cashback websites. They work by paying customers a small percentage of the purchase price, in return for shopping through their site.

There are lots of great cashback sites you can use, however, this is something you can easily continue doing straight through Emma. Our Save tab includes lots of popular brands, with some of our favourites including:

- A £3 reward when you sign up to Audible.

- A Simply Cook trial box for only £1.

- 3% cashback at Miss Selfridge when you shop through Emma.

- And, 1% cashback off your Iceland shopping.

6. Carry On Being Creative

We wonder how many people would have learned how to cook, mastered DIY, or taken up at-home exercise if it weren’t for lockdown?

All of these activities are excellent ways to save money – cooking is cheaper than eating out, doing your own home maintenance costs less than paying someone else to do it, and exercising in your living room means you’re not paying for hefty gym memberships.

When this is all over, you might not want to continue doing all of these things yourself, but just remember doing so can be a great way to save money.

7. Keep On Walking

When the government advised everyone to avoid public transport, a lot of us started walking more than we ever had before.

Not only was walking good for our body, our mind, and the environment, it was also good for our wallet, with transport costs dropping dramatically. We also saw a rise in people investing in bikes -both new and secondhand.

When it’s safer to return to public transport, consider whether this lockdown money-saving habit is something you should be continuing with. And if you need a little motivation, just think how much you’ve saved so far on transport fees or petrol!

Summary

If you’re reading this and it’s highlighted that there are more ways you could be saving money in lockdown, then don’t worry. It’s never too late to start creating new habits.

Do you have any lockdown money-saving habits that you’d like to share with us? Drop us a message on Twitter, Instagram, or share your ideas on the Emma Community. We’d love to hear them!

And if you want more lockdown money-saving tips, head to our Instagram account for daily tips on saving, budgeting, investing, pensions and more! It’s also the best place to be kept up to date with the latest Emma news and features.

Emma is a money management app that connects all your bank accounts to track your monthly spending and subscriptions. Emma will help you visualise and take control of your finances. Make sure you aren’t overspending and show you practical steps to start budgeting effectively. Download Emma today.

Add comment