Opening a bank account in the UK is a fundamental step in managing your finances efficiently and securely. Whether you are a UK resident or an international student or worker, the process is relatively straightforward.

In this comprehensive guide, we’ll walk you through the steps of opening a bank account in the UK, ensuring you have all the necessary information and documentation to make the process seamless.

1) Determine the Type of Account You Need

Before diving into the process, consider your banking needs and requirements. Determine whether you need a current account for day-to-day transactions, a savings account to grow your money, or a joint account with a partner or family member.

2) Research Different Banks and Their Offerings

The UK has a plethora of banks, each offering a range of account options. Research various banks and compare their features, services, fees, and interest rates. Look for banks that align with your needs and provide the necessary conveniences, such as online banking, mobile apps, and ATM access.

3) Check Eligibility and Documentation Requirements

Ensure you meet the eligibility criteria set by the bank of your choice. Typically, to open a personal bank account in the UK, you must be at least 18 years old and a UK resident.

If you are an international student or worker, some banks may offer specific accounts designed for non-UK residents. Gather the required documents, which typically include:

- Proof of identity: Passport, national ID card, or driver’s license.

- Proof of address: Utility bill, bank statement, or rental agreement.

- Proof of income: Payslips, employment contract, or a letter from your employer (for certain account types).

4) Decide on Branch or Online Application

Many UK banks offer the convenience of online account opening. However, if you prefer face-to-face interaction or have specific queries, you can visit a local branch to apply in person.

5) Complete the Application Form

Whether you apply online or in person, you’ll need to fill out an application form. Provide accurate information and double-check all details before submission.

6) Verification Process

Once your application is submitted, the bank will initiate a verification process. They will check your identity and address using the documents you provided. This step ensures the security of your account and may take a few days to complete.

7) Await Approval

After the verification process, the bank will review your application. Generally, approval is swift, but it may take some time during peak periods.

8) Receive Your Account Details

Upon approval, the bank will provide you with your account details, including the account number and sort code. Keep this information safe and confidential.

9) Activate Your Account

Before using your new bank account, follow any activation instructions provided by the bank. This could involve setting up online banking, obtaining your debit card, or creating a PIN.

Opening a bank account in the UK is a vital step in securing your financial future. By understanding the type of account you need, researching different banks, and preparing the necessary documents, you can streamline the process.

With the convenience of online applications and the vast range of banking services available, you’ll be well-equipped to choose a bank that aligns with your needs and provides the essential tools to manage your money effectively. So, take the leap and open your UK bank account today for a smoother financial journey ahead.

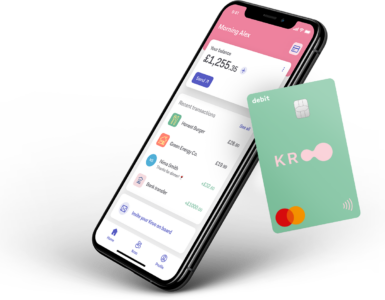

Once your bank account is up and running, you’ll have access to a plethora of financial management tools, making it easier to stay on top of your finances. One such tool is the Emma app, which provides a comprehensive and user-friendly platform to track your spending, budget effectively, and set financial goals.

With the Emma app, you can link multiple accounts from various banks, enabling you to view all your financial information in one place. It analyses your transactions, categorizes your spending, and even offers personalised insights to help you make informed financial decisions.

The app’s intuitive interface and real-time notifications make it an invaluable companion for managing your money with ease and efficiency. Whether you’re looking to save for a specific goal, keep an eye on your expenses, or simply gain better control over your finances, integrating the Emma app with your newly opened UK bank account can be a game-changer in your financial journey.

By utilising the Emma app, account holders can maximise their financial awareness and take charge of their money management, enjoying a more organised and stress-free approach to personal finances.

Add comment