FEATURED ARTICLE

Eight Reasons You Need Emma Pro

Rebekah May

July 29, 2020 •5 min read

TABLE OF CONTENTS

1. Report Rent to Improve Your Credit History

2. Organize your life with Savings Pots

3. Earn Cashback

4. Lower FX Fees on Trades

5. Fraud Detection

6. Unlimited Bank Logins & Offline Accounts

7. Custom Categories

8. Networth

Summary

Emma Pro is one of our premium versions of Emma.

For a small monthly (or yearly) fee, you’ll have access to a whole bunch of new and exciting features. All of which have been set up to give you greater control of your finances!

So what are these great features we speak of?

1. Report Rent to Improve Your Credit History

You don’t want to miss out on rent reporting, one of our favorite new Pro features in the app!

Rent reporting allows you to improve your credit position by simply reporting your rent payments to major credit bureaus. For many people, their rent is their largest expense and rent reporting allows you to make the most of this payment to count towards your credit report!

Simply turn on rent reporting in the app directly from your feed, select your rent payment from your transactions and Emma will start reporting your rent payment to major credit bureaus such as Equifax and Experian every month! It’s that easy!

2. Organize your life with Savings Pots

Grow your savings and reach your financial goals with Emma’s high-interest easy-access or instant access savings pots!

Set up as many pots as you want for each of your goals and set a target amount and date to have it saved by. Having different savings pots for each of your financial goals like an upcoming holiday or emergency fund helps you stay motivated and to keep track of your progress for each!

Emma Pro users can create as many pots as they want and have access to higher interest rates than free customers so you can reach your financial goals faster with Emma’s savings pots!

3. Earn Cashback

Emma Pro users have access to our best cashback offers which are a great way to save and make a bit of extra money when you shop!

Emma offers hundreds of amazing cashback and exclusive savings offers in the app! With tons of amazing brands you know and love, Emma can help you make a little extra money when you shop through the app!

Whether that be 5% cash back at Boots, 4% at Nike, or 2% at Apple. Simply head over to the save tab and click cashback at the top of the page to get started!

4. Lower FX Fees on Trades

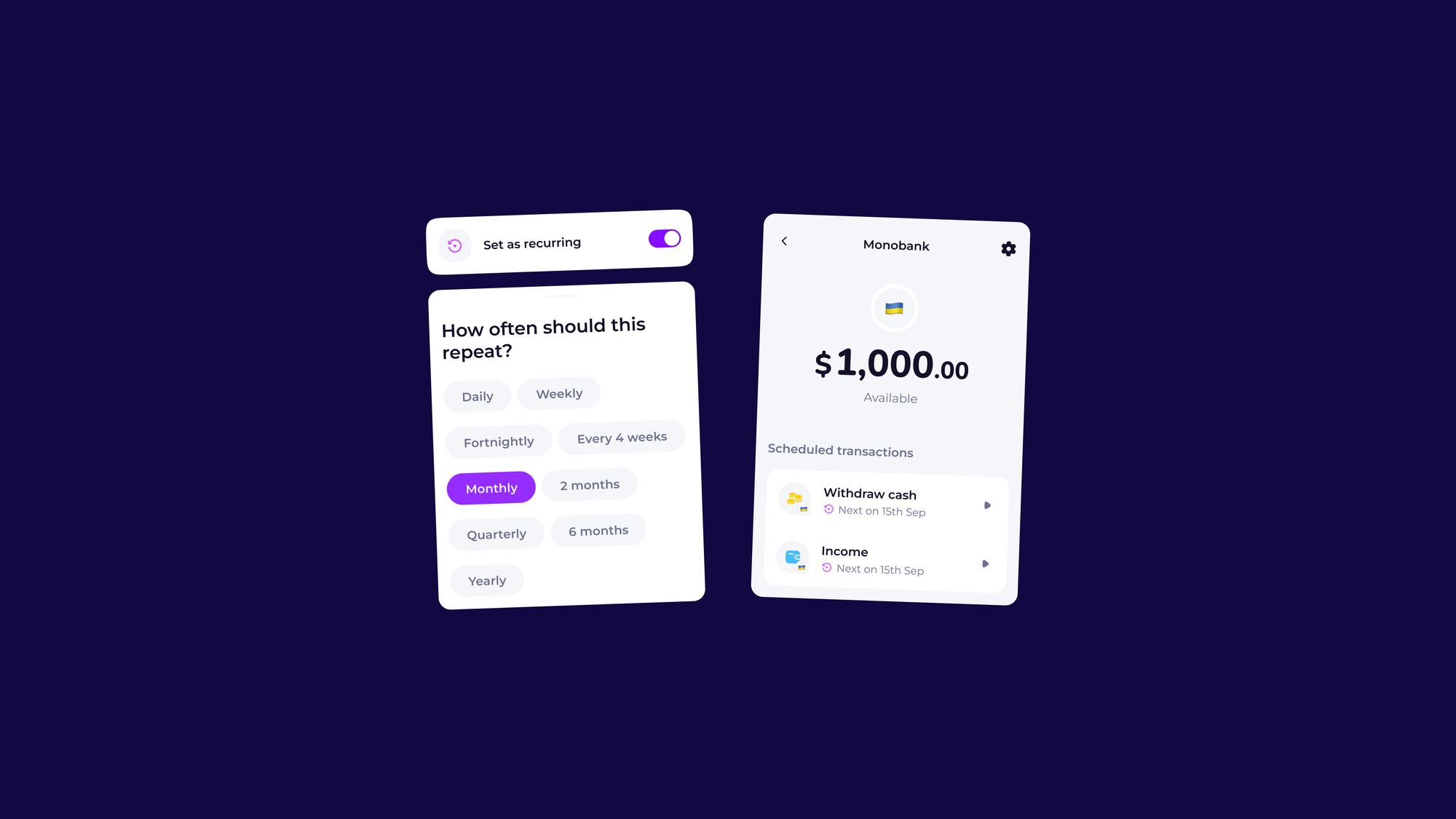

Emma Invest offers more than 2,000+ US stocks to invest in!

You can easily get started investing with as little as £1. As an Emma Pro customers get access to our reduced FX fee so you can save more. Whether you want to make a one-off purchase or set a recurring order you can find the investments that work for you and start building your portfolio today!

Remember, when investing, your capital is at risk.

5. Fraud Detection

Protect your online identity with Emma!

Emma diligently scans the web for any data breaches and shares of your personal information so you can protect yourself from fraud! Emma will cross-check the email address and phone number you have provided with a comprehensive database of previously reported data breaches.

If there is a match found, the details of the breach will be displayed under the corresponding phone number or email address, so that you can take necessary actions to secure your account.

6. Unlimited Bank Logins & Offline Accounts

With Emma Pro you can have unlimited bank connections and refresh your feed on demand to stay up to date with your finances in real time!

Unlike free users who are limited to 2 bank logins, Pro customers can connect all of their bank accounts, credit cards, loans and assets directly to their Emma account and see everything in one place!

Any other accounts you may have that are not directly supported in Emma you can add in as an offline account! This is particularly useful to retain a full overview of your finances. Offline accounts behave in the same way as your other bank account, except the information is not automatically received.

With offline accounts, you can create manual transactions to track your spending and update any account balances. Any manual transactions you create will then show up in your transaction history and spending analysis. This feature, therefore, helps you create an even more accurate picture of your spending history and habits.

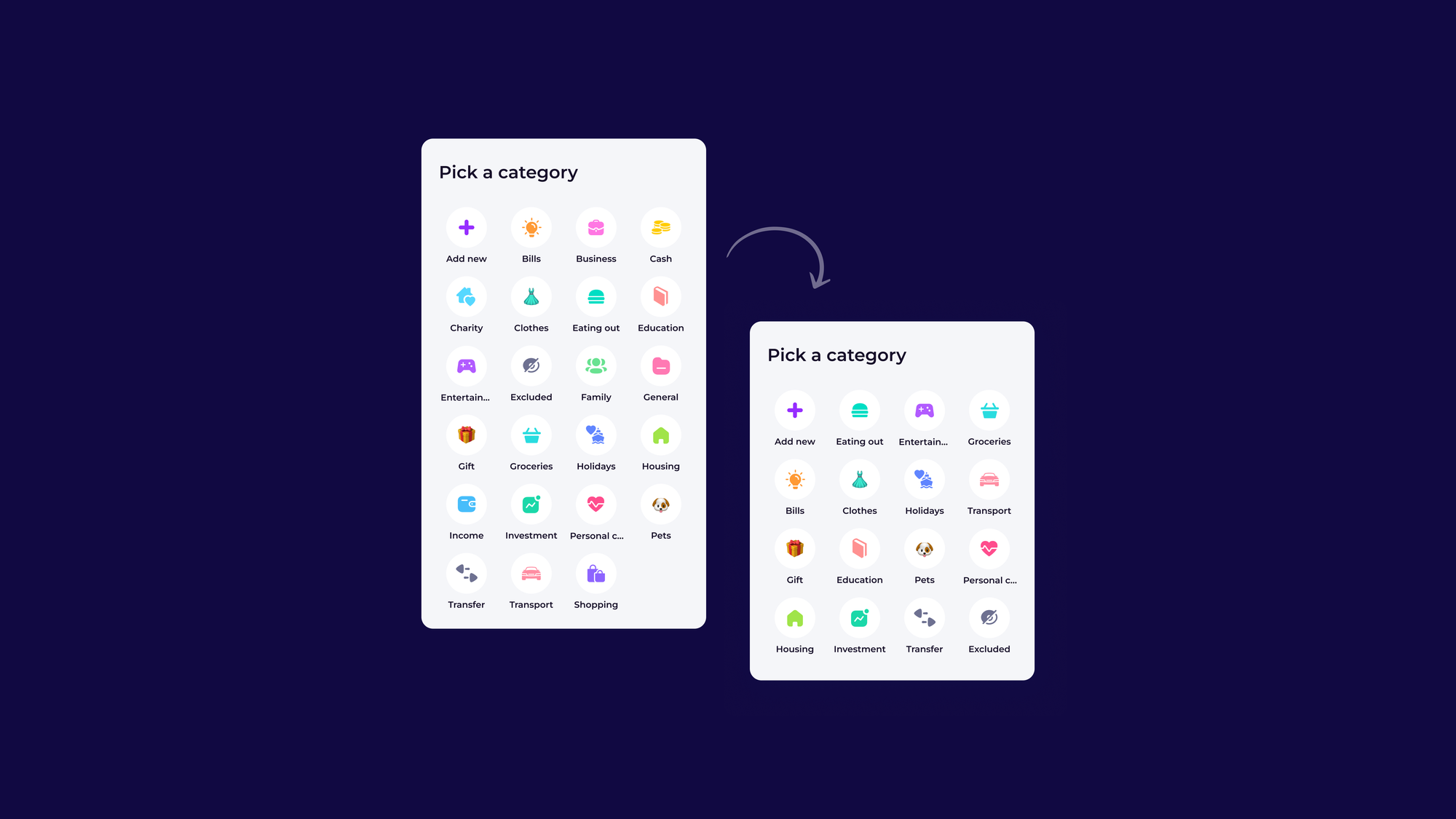

7. Custom Categories

Custom categories are a great way to track all your spending however you want. If Emma's default categories don't fit your lifestyle, you can simply create new ones to better match your day-to-day needs.

They allow you to personalise your budgets to fit your exact needs. Whether that be a category for your pet-related expenses or for a favourite hobby, no matter what the needs of your budget, custom categories allow you to tailor Emma experience to your needs.

Custom categories are also helpful to separate occasional expenses like birthday gifts for friends from your monthly budget. Create as many custom categories as you like to make the most of Emma's money management.

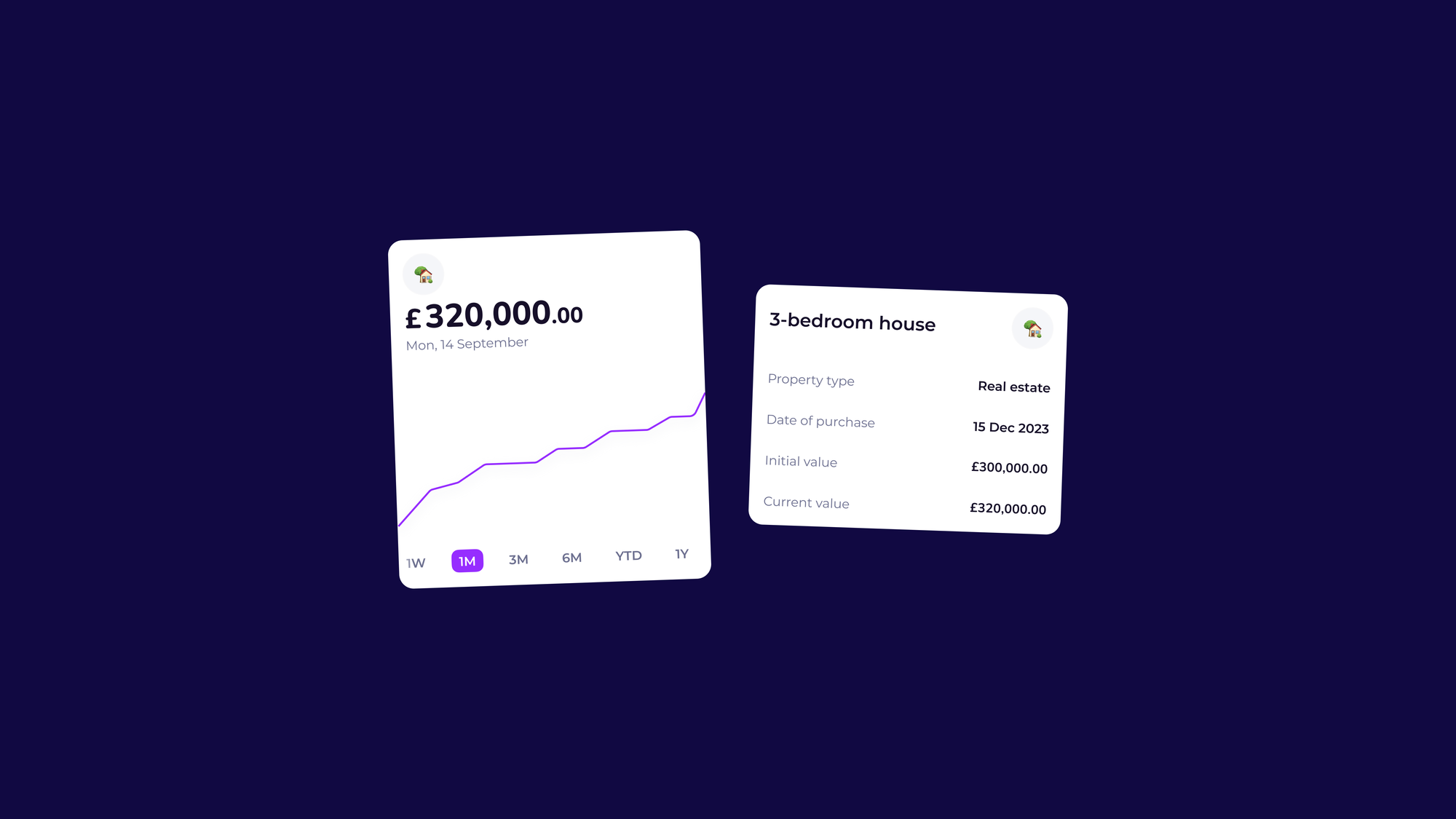

8. Networth

Monitor your net worth by connecting your accounts to Emma and adding in any unlisted assets, savings, or loans like your home or car. From here Emma tracks and updates your net worth so you can have a full overview of your financial health.

It is important to track your net worth to make informed financial decisions, set & achieve financial goals and to have a better understanding of your financial health.

Summary

Looking to learn more? Visit our FAQ page to find out everything you need to know about Emma Pro.

Got any more questions? Feel free to drop us a message on Instagram, Twitter, Facebook, or start a new topic on the Emma Community!

You may also like

Check out these related blog posts for more tips

© 2026 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd (Company Registration Number 10578464). Registered office: Verse Building, 1st Floor, 18 Brunswick Place, London, N1 6DZ, United Kingdom.

Emma Technologies Ltd is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 (FRN 794952). Emma Technologies Ltd is authorised and regulated by the Financial Conduct Authority (FRN 1042167) for investment services and consumer credit activities, including credit broking and credit information services. Emma Technologies Ltd acts as a credit broker, not a lender, and may receive a commission from lenders for introducing you to them.

Payment and e-money services (Non MIFID related products) are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: 1 Sheldon Square, London, W2 6TT, United Kingdom. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199).

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.