Buy Carlisle Companies

Amount

Latest price

$318.07

(£1.00 = $1.325)

Number of shares (est.)

0

Metrics

Market Cap

$13.291B

P/E ratio

17.90

EPS

$17.772

Beta

0.96

Dividend rate

$4.10

Dividend yield

1.29%

About

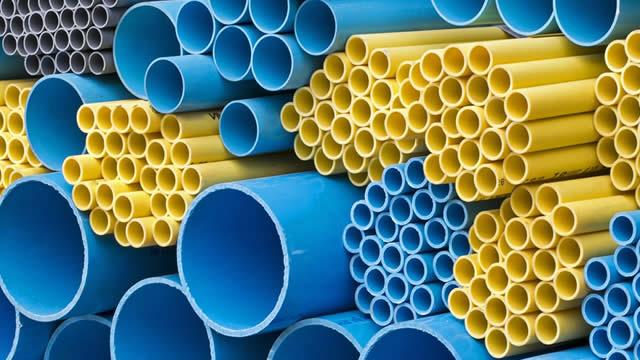

Carlisle Companies Incorporated is a manufacturer and supplier of building envelope products and solutions that enable energy efficiency in buildings. Its segments include Carlisle Construction Materials (CCM) and Carlisle Weatherproofing Technologies (CWT). The CCM segment produces a complete line of energy-efficient single-ply roofing products and warranted roof systems and accessories for the commercial building industry, including ethylene propylene diene monomer (EPDM), thermoplastic polyolefin (TPO) and polyvinyl chloride (PVC) membrane, polyisocyanurate (polyiso) insulation, and engineered metal roofing and wall panel systems for commercial and residential buildings. CWT segment produces building envelope solutions that drive energy efficiency and sustainability in commercial and residential applications. Its products include waterproofing and moisture protection products, protective roofing underlayments, fully integrated liquid and sheet applied air/vapor barriers and others.

CEO

Mr. Dale Christian (Chris) Koch

Employees

5,500

Sector

Industrials

Company HQ

SCOTTSDALE, United States of America

Website

News

The Most Important Investment Lessons I've Ever Shared

My investment strategy centers on concentrated positions in high-quality, dividend-growing companies within energy, defense, logistics, and construction, favoring long-term value over short-term trends. I embrace the 'equity yield curve' approach, seeking alpha by buying top-tier businesses when they're out of favor, accepting cyclical risk for superior long-term returns. Recent reader feedback highlighted the need for clearer communication of risks, especially for retirees, and the importance of distinguishing my conviction from others' allocation needs.

Carlisle: Mixed Q3, Undervalued Ahead Of Policy Easing

Carlisle Companies remains a Buy, with a target price lowered to $358 (10% upside) due to more conservative financial assumptions. CSL's Q3 results were mixed, with stable revenue supported by acquisitions and re-roofing, but margins declined more than expected. Aggressive share buybacks and dividend hikes signal management's confidence in CSL's undervaluation and strong capital return commitment.

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.