Buy Honeywell

Amount

Latest price

$202.06

(£1.00 = $1.335)

Number of shares (est.)

0

Metrics

Market Cap

$129.665B

P/E ratio

23.23

EPS

$8.79

Beta

1.06

Dividend rate

$4.47

Dividend yield

2.19%

About

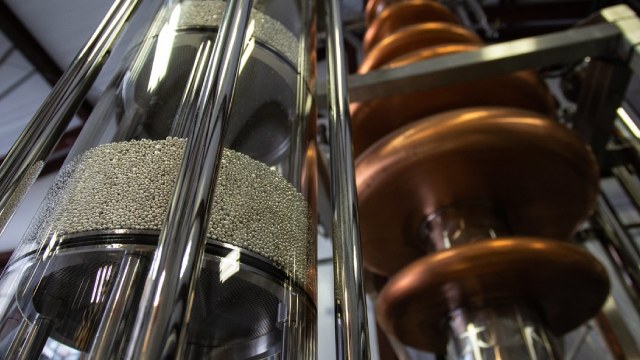

Honeywell International Inc. is an integrated operating company. Its Aerospace Technologies segment supplies products, software, and services for aircraft that it sells to original equipment manufacturers and other customers in a variety of end markets, including air transport, business and general aviation aircraft. Its Industrial Automation segment is a provider of industrial automation solutions that deliver intelligent, sustainable, and secure operations for customers in refining/petrochemicals and life sciences. Its Building Automation segment is a provider of products, software, solutions, and technologies that enable building owners and occupants to ensure their facilities are safe, energy efficient, sustainable, and productive. It also offers an off-gas detection solution for lithium-ion batteries. Its Energy and Sustainability Solutions segment is a provider of technology, processing, and licensing capabilities combined with material science and capabilities and chemistry.

CEO

Mr. Ken West

Employees

102,000

Sector

Travel

Company HQ

CHARLOTTE, United States of America

Website

News

MARUY or HON: Which Is the Better Value Stock Right Now?

Investors with an interest in Diversified Operations stocks have likely encountered both Marubeni Corp. (MARUY) and Honeywell International Inc. (HON). But which of these two companies is the best option for those looking for undervalued stocks?

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.