Buy Lithium Americas

Amount

Latest price

$5.59

(£1.00 = $1.346)

Number of shares (est.)

0

Metrics

Market Cap

$1.671B

P/E ratio

-5.04

EPS

-$1.081

Beta

N/A

Dividend rate

N/A

Dividend yield

N/A

About

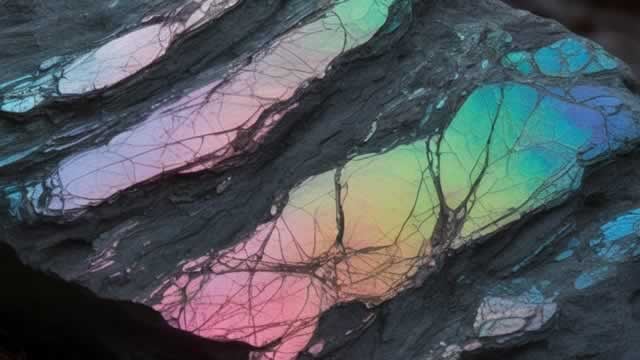

Lithium Americas Corp. is a Canada-based lithium company. The Company focused on developing, building, and operating lithium deposits and chemical processing facilities. The Company’s flagship asset is Thacker Pass, a sedimentary-based lithium deposit located in the McDermitt Caldera in Humboldt County, in northern Nevada. The Company is focused on developing the 100%-owned Thacker Pass lithium project in northern Nevada, the United States of America. Thacker Pass is approximately 100 kilometers (km) north-northwest of Winnemucca, Nevada, approximately 33 km west-northwest of Orovada, Nevada, and 33 km due south of the Oregon border. The Thacker Pass area encompasses approximately 7,900 hectares (ha) and lies within and is surrounded by public lands. The Company's subsidiaries are LAC Management LLC, Lithium Nevada Ventures LLC, KV Project LLC and others.

CEO

Mr. Jonathan David Evans

Employees

N/A

Sector

Mining

Company HQ

VANCOUVER, Canada

Website

News

Lithium Americas to Join the S&P/TSX Composite Index

VANCOUVER, British Columbia--(BUSINESS WIRE)---- $LAC #Nevada--Lithium Americas Corp. (TSX: LAC) (NYSE: LAC) (“Lithium Americas” or the “Company”) announced that, as disclosed by S&P Dow Jones Indices on December 5, 2025, the Company's common shares will be added to the S&P/TSX Composite Index, effective prior to the open of trading on Monday, December 22, 2025. The S&P/TSX Composite Index is Canada's premier equity benchmark and includes the largest and most actively traded companies on the Toronto.

© 2026 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.