Buy Black & Decker

Amount

Latest price

$75.19

(£1.00 = $1.348)

Number of shares (est.)

0

Metrics

Market Cap

$11.639B

P/E ratio

23.81

EPS

$3.158

Beta

1.16

Dividend rate

$3.28

Dividend yield

4.36%

About

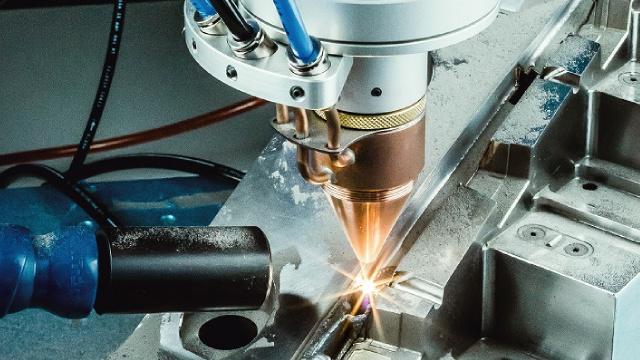

Stanley Black & Decker, Inc. is a global provider of hand tools, power tools, outdoor products and related accessories, as well as a provider of engineered fastening solutions. The Company’s segments include Tools & Outdoor and Industrial. The Tools & Outdoor segment consists of the Power Tools Group (PTG), Hand Tools, Accessories & Storage (HTAS), and Outdoor Power Equipment (Outdoor) product lines. The PTG product line includes both professional and consumer products. The HTAS product line sells hand tools, power tool accessories and storage products. The Outdoor product line primarily sells corded and cordless electric lawn and garden products. The Industrial segment consists of the Engineered Fastening business. The Engineered Fastening business primarily sells highly engineered components, such as fasteners, fittings and various engineered products, which are designed for specific applications across multiple verticals. Its brands include BLACK+DECKER, CRAFTSMAN, and others.

CEO

Mr. Christopher J. Nelson

Employees

48,500

Sector

Construction

Company HQ

NEW BRITAIN, United States of America

Website

News

100 Sustainable Dividend Dogs: 47 "Safer", 3 Ideal August Buys, And 7 To Watch

I analyze Barron's top 100 sustainable companies, focusing on dividend payers and using the dogcatcher yield-based strategy to identify value opportunities. Seven out of 83 dividend-paying sustainable stocks currently meet the ideal of annual dividends from a $1K investment exceeding their share price, signaling potential buys. Analyst targets project 20.21% to 45.71% net gains for the top ten ESG dividend stocks by August 2026, with average risk below the market.

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.