If you’re looking to improve your finances, then creating a personal budget is a good idea. There are lots of budgeting methods you can use, but it’s important that you pick a budgeting technique that suits you.

Budgets take time to get right, and they will make you think long and hard about how you spend your money. But having one is an important step in creating a good financial routine.

Here we discuss the four budgeting methods that really work.

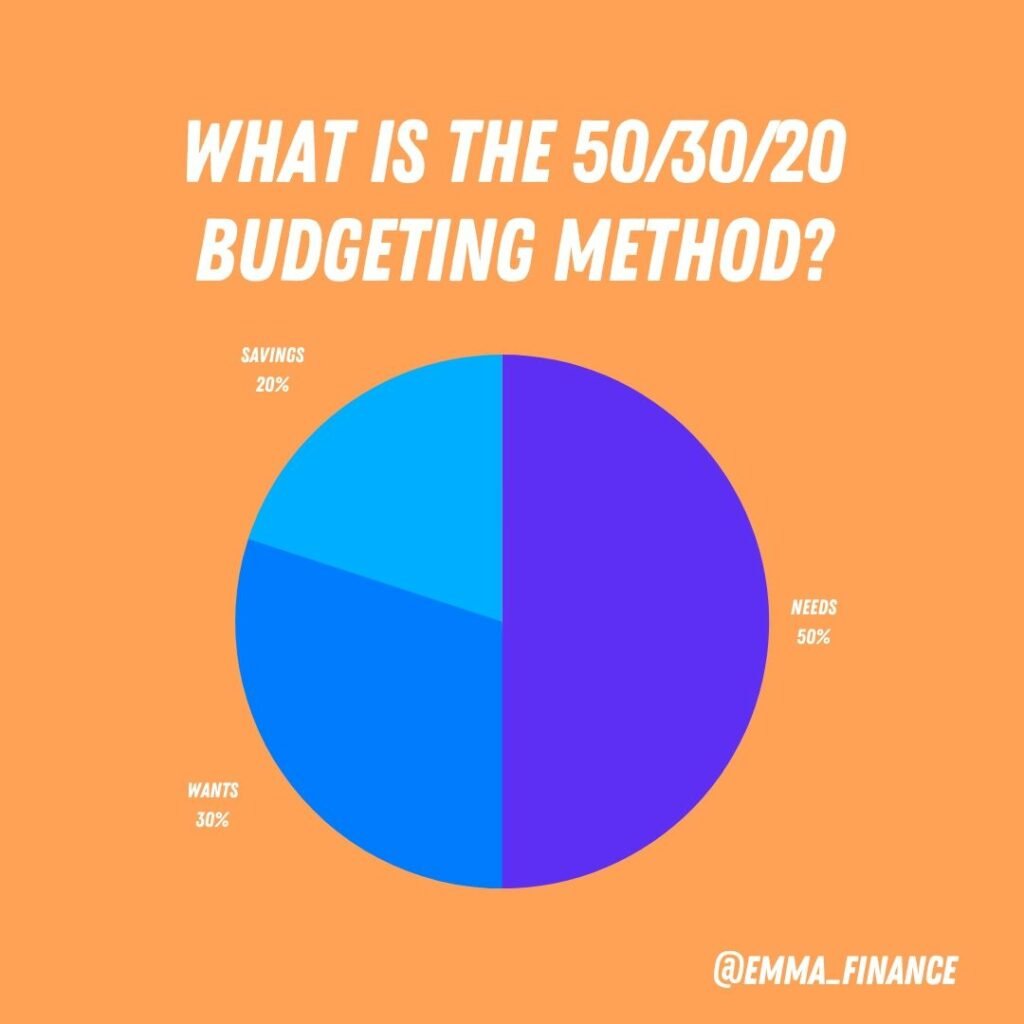

1) The 50/30/20 Budgeting Method

This is perhaps one of the most famous budgeting methods. The idea behind this method is that you split your monthly income into three sections. Needs, wants, and savings. 50% of your income should be spent on needs, 30% should be spent on wants and 20% should be spent on savings or debt repayments.

When setting this budget, you’ll first need to understand what your monthly take-home pay is. Look at your most recent payslip, or your bank account to check how much money you receive after tax. Then do some basic sums, noting down what 50/30/20% of your take-home pay equates to.

For example, if your take-home pay is £1,800 per month, with this method you should be spending £900 on “needs”, £540 on “wants”, and £360 on savings/debt.

Now take a look at last month’s bank statement and see how much you actually spent on each of these areas. You may find that the amount you’ve spent is different from what the 50/30/20 method is suggesting (I know I did!), but don’t be disheartened by this.

Use the method more as a guide to help you evaluate your spending. If 50% of your salary is being spent on needs (such as a mortgage, rent, bills) and 40% is being spent on wants (clothes, eating out) this only leaves 10% left to spend on any financial goals like saving or debt reduction. Think about your priorities, and if necessary make changes to your spending.

2) The Detailed Method

Moving on from the 50/30/20 budgeting method, we have a more detailed approach to budgeting. Here we allocate a specific amount of money to every area of our spending. Each month you’ll know exactly how much money you have to spend on groceries, eating out, clothes, travel… you name it.

As before, the first step is to understand how much money you have coming in each month. You then divide this amount by each category, allocating every pound.

For example, your take-home pay is £1,800. You know your monthly fixed expenses are £900, which leaves you with £900 left to play. You would then decide to budget £200 on groceries, £200 on clothes, £100 on eating out, £100 on travel and £300 on your savings. That’s the whole £900 now allocated for.

The idea behind this budgeting method is that you are in complete control of your finances. However, it does require a lot of trial and error (as well as discipline!).

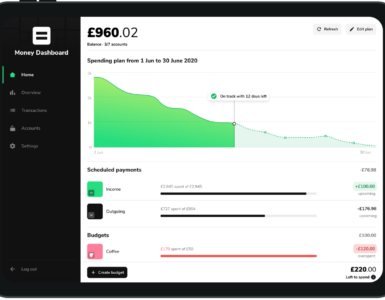

One thing that makes this method easier to follow is a budgeting app, like Emma. Every time you spend money Emma will allocate that spend to a set category. Once you’ve set the budgets in the app, you can then see how much of your budget you’ve spent, as well as how much you have left.

3) The Backwards Budgeting Method

As the name suggests, this budgeting technique is a lil’ different. The aim of this method isn’t to think about how much you want to spend, but rather how much you want to save!

Start by writing down some of your financial goals. It could be anything from saving for a house deposit to saving for a new phone. Work out when you want to hit this savings goal, and divide the amount by how long you have left to save.

For example, if you need to save £2K by Christmas you would need to base your budget around adding £330 each month to your savings (330 x 6 months = £2K). If your take-home pay is £1,800, you then have £1470 each month to spend as you wish. If you have a range of smaller items you’re saving up for, you could even open multiple savings accounts – each one dedicated to a different savings goal.

This method of budgeting is a great way to focus on hitting some serious savings goals! However, you do need to be realistic. There’s no point allocating a huge proportion of your income to saving if it means you can’t afford to eat!

4) The Barely There Method

This is the most relaxed of the budgeting methods on our list and perhaps the most suitable for first-time budgeters. This method isn’t about sticking to a set budget. It focuses more on automating your important spends.

Organize for your bills and fixed expenses to be paid by direct debit at the start of the month, then work on automating any money that you want to add to a savings account.

Once this has been done, the remaining money in your account is free to spend however you wish. All you need to do is keep one eye on your remaining balance to make sure you’re not forced to dip into any savings.

Once again the Emma app can help you budget in this way. Our notifications alert you to any changes in your bank balance, highlighting when funds are running low.

Summary

We hope you’ve found this post on the four different budgeting methods useful. Everyone likes to budget in their own ways, so we hope we’ve helped you identify the method that suits you best.

Let us know which of these budgeting methods you’re most likely to use, and how you’re getting on with the whole budgeting process, by dropping us a message on Twitter, or through our community page here.

[…] a budgeting method like 50/30/20 can help you combat lifestyle inflation. Allocating 50% of your salary to needs, 30% of your salary […]

[…] If you need help with sticking to your savings goals, make sure you check out Four Budgeting Methods That Really Work! […]

[…] budget, where the amount you spend matches exactly how much is coming into your account, or a 50/30/20 budget, where you allocate 50% of income towards needs, 30% to wants and 20% to savings – budgets are […]

[…] I know you know what a budget is, but they’re too vital not to talk about. Budgets are financial plans which give us greater […]

[…] then need to spend less than or equal to this amount. Having a budget can help you do this. If you find that you’re struggling to spend less than you earn, consider if […]

[…] all these figures down is the starting point of creating a budget. You know how much money is coming in. How much money is going out. And you’ll be able to […]

[…] It’s very easy to incorrectly estimate how much money you’re spending, so it’s important that you don’t miss this step. Keep on doing this until all your recent transactions are accounted for in a category. This exercise might take a while, but knowing how much you’ve spent over the past couple of months will help you set a realistic and achievable budget. […]

[…] budget takes time and a little trial and error, but the benefits are huge. There are a couple of budgeting methods you can use, so take the time to explore which method suits you […]

[…] to the 50/30/20 rule, 20% of your after-tax income should be spent on your financial […]