Are bad money habits stopping you from reaching your financial goals? We’ve listed 7 examples of good money habits that’ll help you be better with your finances. Follow each of these tips and tricks and you’ll be able to boost your savings, take control of your money, and become a super successful saver.

What is a money habit?

The definition of a habit is a behaviour that is followed so regularly that it almost becomes automatic. A money habit therefore is an action associated with your money that you regularly follow without much thought – for example, spending large sums of money as soon as you’ve been paid.

These habits can often get in the way of you reaching your financial goals, can disrupt your financial security, and in some cases can lead you to believe that you’re just ‘not very good’ with your money.

But, the good thing about habits is that with a little planning, patience and determination you can turn bad habits into very good habits. Here are our favourite examples of good money habits.

1. Live within your means:

Living within your means is the simple idea that you should not spend more money than you earn. Credit cards, loans and overdrafts may tempt you into spending more money than you have, but these options should be taken with caution. After all, they only delay the payment and might end up costing you more money.

To live within your means you first need to understand how much money you make each month. This the amount of money you’re left with after any tax deductions. Your payslip or a recent bank statement can help you find this information.

You then need to spend less than or equal to this amount. Having a budget can help you do this. If you find that you’re struggling to spend less than you earn, consider if you can boost your income with a side hustle, reduce any regular expenses, or cut back on your spending.

2. Set financial goals:

Setting financial goals helps give your money a plan. Your financial goal might be to pay off outstanding debts, save money for retirement, or even save enough for your first home.

Having a goal in mind, and an action plan to go with it means you’re more likely to put your money to better use. If you know you need to save £5,000 by the end of the year, you’re going to think twice about spending on miscellaneous items that you don’t (really) need.

We’ve written a whole article on setting financial goals, covering the benefits of setting goals, how to set goals, and what can help you reach these goals. Read the article here.

3. Plan how you want to spend your money:

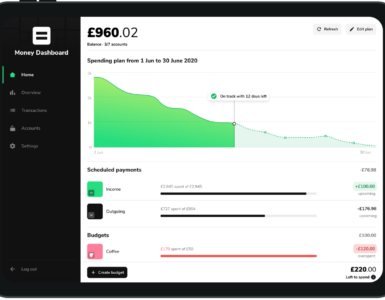

Yep, we’re talking about budgets. Creating a budget is an excellent way of assessing how you want to spend your money.

Start by finding out how much money you have coming in each month. This is your net income or amount after tax has been deducted. Next, add up how much money you need to spend each month. This is your utility bills, your rent or mortgage, travel expenses, and so on. Then, consider the amount of money you want to add to your savings, investments, or debt repayments. Lastly, work out how much money you have left for things you want to spend. Use this money for the more optional items, like new clothes, entertainment, or days out.

For example, you take home £1,500 a month. £750 is allocated toward things you need to spend. £300 is for savings. And, £450 is left for things you want to spend.

If you aren’t able to balance the numbers so that they add up to your take-home pay, think about which areas you could spend less money on.

4. Automate your savings:

One of our favourite tips for building your savings is to open a Emma Pot. Once you’ve opened a Pot, and have checked your budget to see how much you can save each month, think about automating the process. This means setting up an automatic transfer of money from one account to another.

Paying yourself first like this makes saving money a priority. It also makes saving money a hella lot easier – you won’t forget to add into your savings one month, and you won’t be tempted to spend the money on other things.

5. Track your spending:

Tracking how you spend your money helps make sure you stick to your budget. After all, how do you know how much money you have left to spend if you don’t know how much you’ve already spent?

There are lots of ways you can track your spending, but one of the easiest ways is to use an app like Emma. Emma lets you connect all your current accounts to one app, and then tracks how you’re spending your money. You’ll easily be able to see how much you’ve spent, when you spent it, and at which retailers. If it looks like you’re going to go over your budget, we’ll even drop you a friendly reminder to review your spending.

6. Make your money work for you:

When people talk about making their money work for them, they’re referring to the process where their money makes them more money.

If you’re in debt, your money isn’t working for you. That’s because the interest you’re paying on your loans is costing you more money than it is making you.

In contrast to this, one way your money could work hard for you is if you invest it. When you put money into an investment, it has the potential to increase in value. The thing you invested in could increase in value, but the value can also increase due to interest. Over time this interest will help your money compound, and you’ll be able to build greater wealth.

7. Negotiate your bills:

Negotiating might make you feel a little uncomfortable, but it’s one of the best money habits you can have. If you’re thinking “I don’t have the courage to do that” it might help to remember that everything in life can be negotiated and the process is a lot more common than you think. The price of your phone bill, your utility bills, the price of your car, even the price you pay for a new TV or laptop can be negotiated.

There are multiple ways to negotiate the cost of a bill. You could negotiate with your existing provider, asking them to offer a better price for your continued loyalty. Or, you could negotiate by switching to a new provider.

There are even apps that can help do the hard negotiating for you. Emma lets you compare deals on your energy, broadband, and sim bills, and in some cases can even help you reduce your monthly payments by hundreds of pounds.

Summary

Here are seven good money habits that’ll help you improve your finances. Follow these steps and you’ll find that you’ve stopped spending on a whim, can save like a pro, and will soon be on your way to financial freedom.

If you’re interested in downloading Emma, head to Google Play or the App Store where you can access our app for free. We’ll help you set budgets, track your spending, and ultimately, save money!

Add comment