Metro Bank is a challenger bank that offers current accounts, savings accounts, loans, mortgages, credit cards and business banking.

Metro Bank is a good option for people who want a friendly and convenient account experience in the UK. I’ve broken down the process of opening a bank account into six main steps.

What do you need?

To open a bank account with Metro Bank in the UK, you need to meet the following requirements:

- be at least 18 years old.

- live in the UK or have a UK address.

- have a valid form of identification

- passport

- driving licence

- National ID card.

- You must have proof of address

- utility bill

- bank statement

- council tax bill.

1. Choose your account type

Metro Bank offers various types of accounts, such as:

Current Account

A current account that lets you manage your money online, by phone, by app, or in a branch. It has no monthly fee and comes with a contactless debit card. It also gives you access to free cash withdrawals abroad and free text alerts.

Cash Account

A current account that lets you manage your money online, by phone, by app, or in a branch. It has no monthly fee and comes with a contactless debit card. It also gives you access to free cash withdrawals abroad and free text alerts. However, it does not offer overdrafts or chequebooks.

Savings Account

A savings account that lets you save any amount at any time at a variable interest rate of 0.05%. It has no monthly fee and requires you to have a current account with Metro Bank.

Compare the features and benefits of each account type here.

2. Apply online

Apply online by filling out the application form on their website. You will need to provide your details, contact details, income details, and preferred account type.

If you want to apply at your nearest Metro Bank branch, you will need to bring your identification and proof of address documents with you.

3. Verify your identity and address

During the application process, you will need to verify your identity and address. Do this by uploading your documents when prompted on the website. Make sure that your documents are valid and clear.

4. Receive your account details and debit card

Once you have verified your identity and address, you will receive your account details via email – this includes your account number, sort code and online banking details.

You will also receive your contactless debit card instantly if you apply in a branch or by post within 5 working days if you apply online. You will need to activate your card before using it by following the instructions on the letter that comes with it. The new card needs to be activated before you can use it for contactless purchases.

5. Set up your online banking

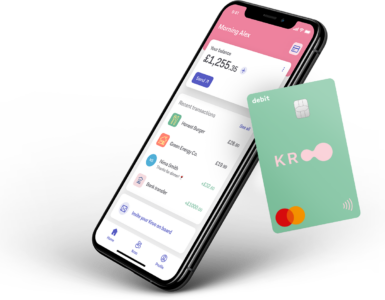

Now you may set up your online banking. Download the Metro Bank app or go to their online banking portal and log into your account using the details that you received in Step 4.

The app lets you track your money on the go, make payments and view statements.

6. Start using your Metro Bank account

Start using your account for your everyday needs and you can also access additional products, such as:

- Overdrafts: You can apply for an overdraft of up to £3,000 with interest and fees depending on your circumstances.

- Credit Cards: You can apply for a credit card with a 0% interest rate on purchases and balance transfers for up to 12 months and no annual fee.

- Business Banking: You can open a business account with no monthly fee, free cash deposits/withdrawals and free card transactions. You can also access business loans, overdrafts and invoice finance.

You can get even more out of your new Metro Bank account by linking it to the Emma app. Connect all your current accounts, savings accounts, investments and digital wallets in one beautiful place to easily keep track of your outgoings.

Emma uses powerful tools to track your money, save with goals in-mind and organise your transactions in order to set budgets. You can also create unlimited savings pots to separate your money, build your credit history without credit cards or loans and edit transactions from your Metro Bank account for better organisation.

Use both for the ultimate personal finance experience.