FEATURED ARTICLE

The Ultimate Guide to Family Plans: How Shared Subscriptions Help You Save Money

Giuliano Fabbri

September 19, 2025 •4 min read

TABLE OF CONTENTS

What is a Family Plan?

The Threat to Family Plans and How to Solve It

When a Family Plan is a Good Deal

When a Family Plan Isn't Worth It

The Final Verdict: Shared Plans are the Smartest Way to Save

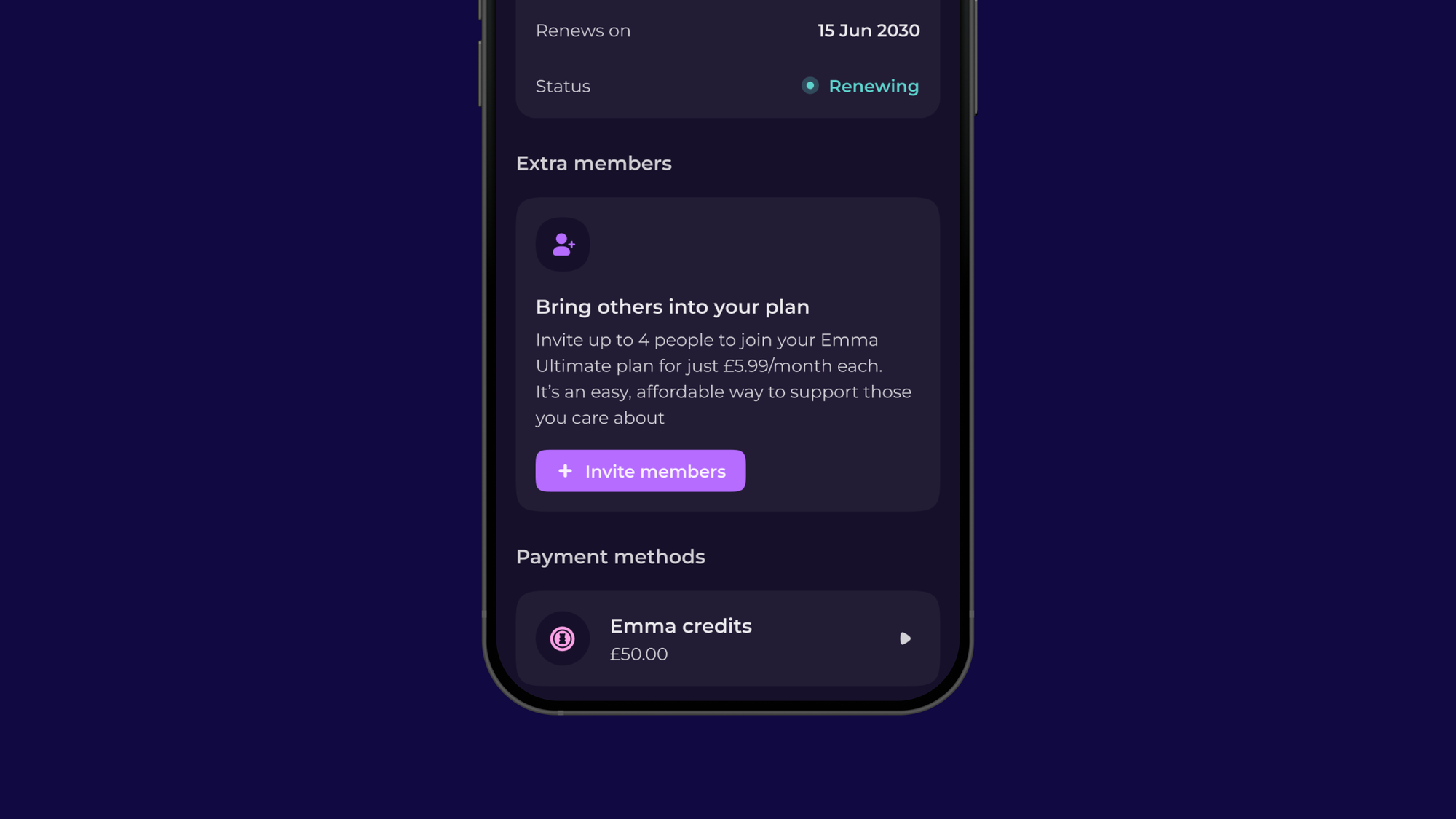

We believe that managing money is a team sport, and that's why we've introduced our new Emma Family plan. Sharing a financial tool with your loved ones fosters clarity and collaboration. We're not alone in this philosophy. For years, the world's most popular subscription services have proven that sharing benefits is the best way to save money and add value.

We've put the most popular shared plans under the microscope to show you exactly what they offer, how much you can save, and why they're almost always a smart financial move.

What is a Family Plan?

A family plan is a subscription tier that allows multiple users to access a service for a single, consolidated payment. While the total price is higher than an individual plan, the cost per person is significantly lower, making it a fantastic way to save.

The Threat to Family Plans and How to Solve It

The convenience of family plans comes with its own set of financial challenges, and that's where a financial tool can be a game-changer.

The Problem of Shared Expenses

When a single person pays for a shared plan, it can be difficult to track who owes what. This leads to awkward conversations and can disrupt cash flow.

The Threat of Rising Costs

Subscription services are famous for raising their prices. It can be hard to spot a price hike, and even harder to manage it, when you're the one paying the bill for multiple people.

This is where a financial app can help. By using features like Emma's Groups and Split Payments, you can easily manage shared subscriptions. You can track who has paid and who hasn't, ensuring that everyone contributes their fair share. With a financial tool, you can also easily identify recurring payments, giving you an early warning of any rising costs. This allows you to either absorb the cost or let your group know about it in advance.

When a Family Plan is a Good Deal

These subscriptions offer undeniable value, especially for families and households with multiple users. The cost-per-person is significantly lower than individual plans, making them a savvy financial move.

Service | Category | Users | Key Features | Price (UK) | Verdict |

|---|---|---|---|---|---|

Netflix | Streaming | Up to 4 simultaneous streams | 4K streaming, downloads on multiple devices, individual profiles | £18.99/mo | Good Deal |

Spotify | Music | Up to 6 separate accounts | Individual accounts, ad-free listening, offline downloads, Family Mix playlist | £19.99/mo | Great Value |

Disney+ | Streaming | Up to 4 simultaneous streams | 4K streaming, unlimited downloads, individual profiles | £12.99/mo | Good Deal |

Amazon Prime | Retail & Streaming | 2 adults, up to 4 teens & 4 children | Shared fast delivery, Prime Video, Prime Reading, exclusive deals | £95/year | Great Value |

Nintendo Switch Online | Gaming | Up to 8 accounts | Online multiplayer, cloud saves, access to classic NES & SNES games | £31.49/year | Great Value |

Xbox Game Pass | Gaming | Up to 5 people | Access to hundreds of games on console, PC & cloud, day-one releases | £21.99/mo | Great Value |

Google One | Cloud Storage | Up to 6 family members | 2TB storage, Google AI access, VPN, exclusive perks | £7.99/mo | Great Value |

Apple iCloud+ | Cloud Storage | Up to 6 family members | Shared storage (2TB), iCloud Private Relay, Hide My Email | £8.99/mo | Great Value |

Strava | Fitness | Up to 4 people | Advanced activity analysis, personalized goal setting, and route planning | £139.99/year | Good Deal |

When a Family Plan Isn't Worth It

While family plans are a great way to save, their value is not universal. The decision to sign up for one should be based on your specific needs and household size. The key is to check the fine print and do the math.

Service | Category | When It’s Not a Good Deal | Reasoning |

|---|---|---|---|

YouTube Premium | Streaming | When family members live at different addresses. | The terms of service require all members to reside at the same address. The service has been known to flag and restrict accounts that violate this rule. |

Spotify | Music | If you are primarily interested in audiobooks. | The main account holder gets 15 hours of audiobook listening time per month, but this feature is not extended to the other family members on the plan. |

Microsoft 365 | Productivity | For a group of just two people. | An individual subscription is cheaper than half of the family plan. Two individual plans cost £59.99/year each, while a family plan for two would be £40 per person. However, you also get double the storage. |

Major Mobile Providers | Telecom | If you are only getting a discount on your SIM cards. | You can often find cheaper SIM-only deals from smaller providers that use the same network infrastructure as a major provider, but without the high price tag. |

The Final Verdict: Shared Plans are the Smartest Way to Save

When you look at the most popular subscription services, a clear trend emerges: family and shared plans offer incredible value. They are not just about convenience; they're a deliberate way to help customers get more for their money.

Like these services, our Emma Family plan is built on the same principle: that a single subscription can benefit more than one person, allowing everyone to achieve their financial goals together.

By using a shared Emma plan, you and your loved ones can get on the same page about money, track shared expenses, and work towards a more secure financial future. It's the ultimate combination of savings, convenience, and peace of mind.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.