FEATURED ARTICLE

An Alternative to CreditLadder for Building Your Credit History

Edoardo Moreni

March 17, 2025 •3 min read

TABLE OF CONTENTS

Understanding the Importance of Credit History

Introducing Emma

Key Features of Emma

Advantages of Choosing Emma over CreditLadder

Final Thoughts

Building a solid credit history is crucial for securing better financial opportunities. While traditional methods of establishing credit often revolve around loans and credit cards, innovative fintech solutions are emerging to cater to various needs.

One such alternative to consider is Emma, a platform that offers similar functionality to CreditLadder, helping renters enhance their credit profiles through on-time rent payments.

Understanding the Importance of Credit History

A good credit history opens doors to favourable interest rates, easier loan approvals, and better financial terms. It reflects your ability to manage debt responsibly and is a significant factor in decisions made by lenders, landlords, and even potential employers.

Establishing a positive credit history can be especially challenging for individuals who don't have credit cards or loans, which is where alternative methods like Emma come into play.

Introducing Emma

Emma is a fintech company that has taken a page from CreditLadder's playbook by offering a unique service tailored to renters. Just like CreditLadder, Emma's platform allows users to report their rent payments to credit reference agencies, thus boosting their credit scores over time.

By transforming a regular monthly expense into a valuable credit-building opportunity, Emma empowers individuals to take control of their financial futures.

Key Features of Emma

Rent Reporting

Emma enables users to report their rent payments to major credit bureaus, giving them the chance to showcase their responsible financial behaviour. Each on-time payment contributes to a positive credit history, potentially opening doors to better financial products and opportunities. By reporting to all three major credit bureaus Experian, Equifax and TransUnion rent reporting with Emma enables you to make the most of your rent payments.

User-Friendly Interface

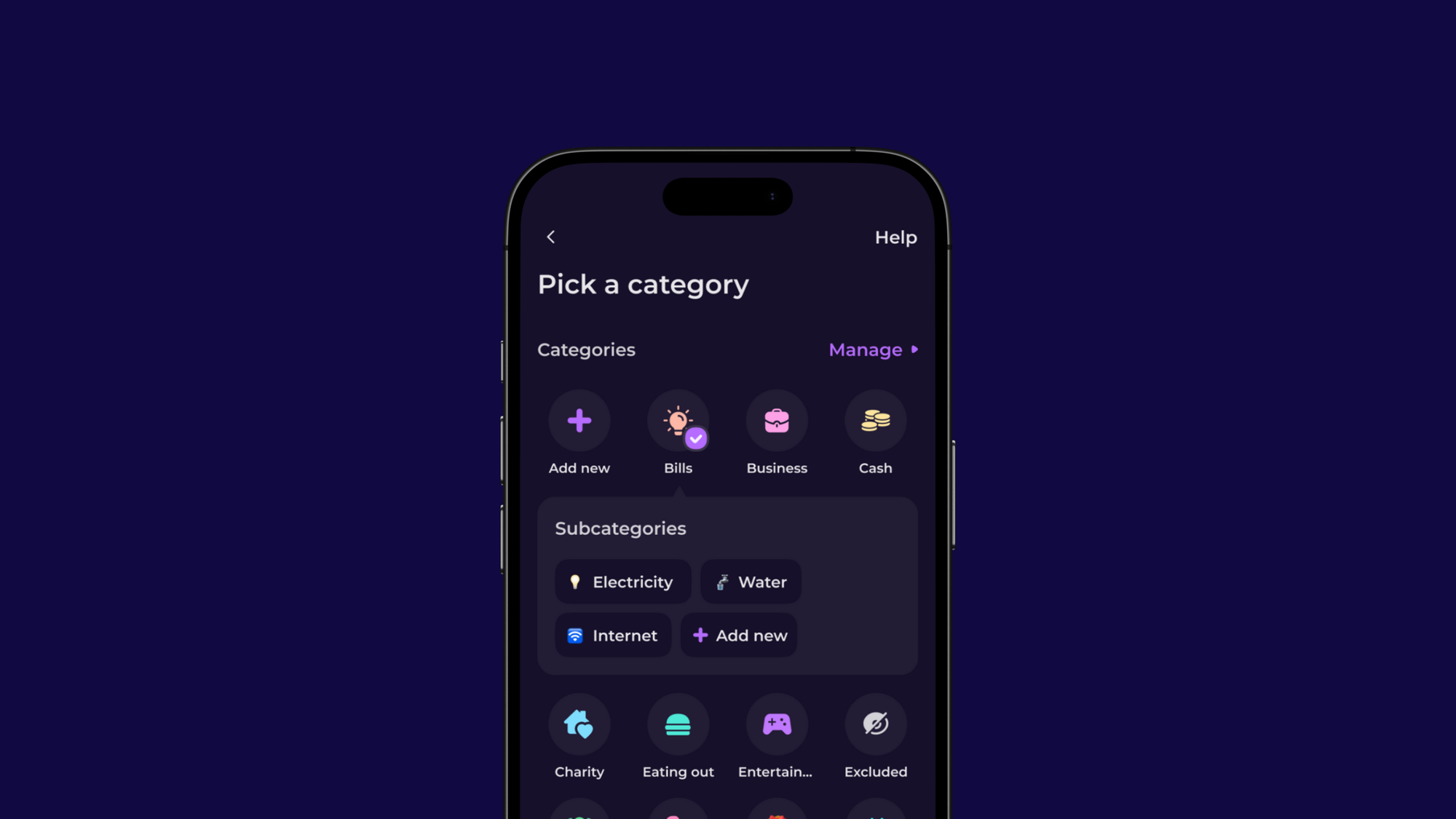

Emma boasts a user-friendly app interface that makes it easy for renters to connect their rent payments and track their credit-building progress. The platform's intuitive design ensures a seamless experience for users of all tech-savviness levels.

Financial Insights

Beyond rent reporting, Emma provides users with valuable financial insights and tools to manage their money effectively. This holistic approach helps renters not only improve their credit scores but also develop healthier financial habits.

Security and Privacy

Just like any reputable fintech company, Emma prioritizes the security and privacy of its users' data. Robust encryption and stringent security measures are in place to safeguard sensitive information.

Advantages of Choosing Emma over CreditLadder

| Feature | Emma | Credit Ladder |

|---|---|---|

| Reports to Multiple Bureaus | ✅ Yes | ✅ Yes |

| Budgeting Tools | ✅ Yes | ❌ No |

| Expense Analytics | ✅ Yes | ❌ No |

| Subscription Tracking | ✅ Yes | ❌ No |

| Group Finances (Shared Spaces) | ✅ Yes | ❌ No |

| Net Worth Tracking | ✅ Yes | ❌ No |

| Bank Connections | ✅ 60+ Banks | ❌ Limited |

Enhanced Financial Management

While both Emma and CreditLadder focus on rent reporting, Emma goes the extra mile by offering comprehensive financial insights and budgeting tools. This broader approach can empower users to improve their financial well-being on multiple fronts.

User-Centric Experience

Emma's user-friendly interface and accessible tools make it an excellent choice for individuals who are new to credit-building or financial management. The platform's simplicity can help users take proactive steps toward achieving their financial goals.

Holistic Credit Building

Emma's credit-building strategy extends beyond rent reporting, providing a more holistic approach to improving credit scores. By combining rent reporting with financial education and management tools, Emma equips users with a comprehensive toolkit for long-term success.

Final Thoughts

In an era where digital solutions are transforming the way we manage our finances, Emma stands out as a viable alternative to CreditLadder for individuals looking to boost their credit scores through rent payments.

By offering a user-friendly interface, valuable financial insights, and a holistic approach to credit building, Emma empowers renters to take control of their financial destinies.

Whether you're a first-time renter or someone aiming to enhance your credit profile, Emma offers a compelling alternative that warrants serious consideration.

You may also like

Check out these related blog posts for more tips

© 2025 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.