FEATURED ARTICLE

Emma Launches Open Banking Integration with Chip

Edoardo Moreni

April 9, 2019 •2 min read

FinTech challenger app’s partner to drive Open Banking’s potential.

- Automatic saving app (Chip) and money management app (Emma) team up

- First collaboration of its kind in the UK FinTech market, both powered by Open Banking

Open Banking apps Emma and Chip have partnered up to allow customers to track their automatic savings and savings goals within Emma’s dashboard.

Both Emma and Chip offer customers a unique experience by leveraging Open Banking. With hundreds of thousands of people in the UK now connecting to the apps and using them on a daily basis, FinTech collaborations like this could bring some real disruption to the UK’s consumer finance market.

Edoardo Moreni, Emma CEO said:

“Emma was built to empower millions of individuals to live a better and more fulfilling financial life. Chip is the next emerging FinTech and we are thrilled to welcome them as an integration.

“Our users can now manage and track their Chip savings alongside more traditional finances to make wiser and more transparent decisions.”

Open Banking regulation launched in January 2018, and a year on momentum is building within the UK consumer market.

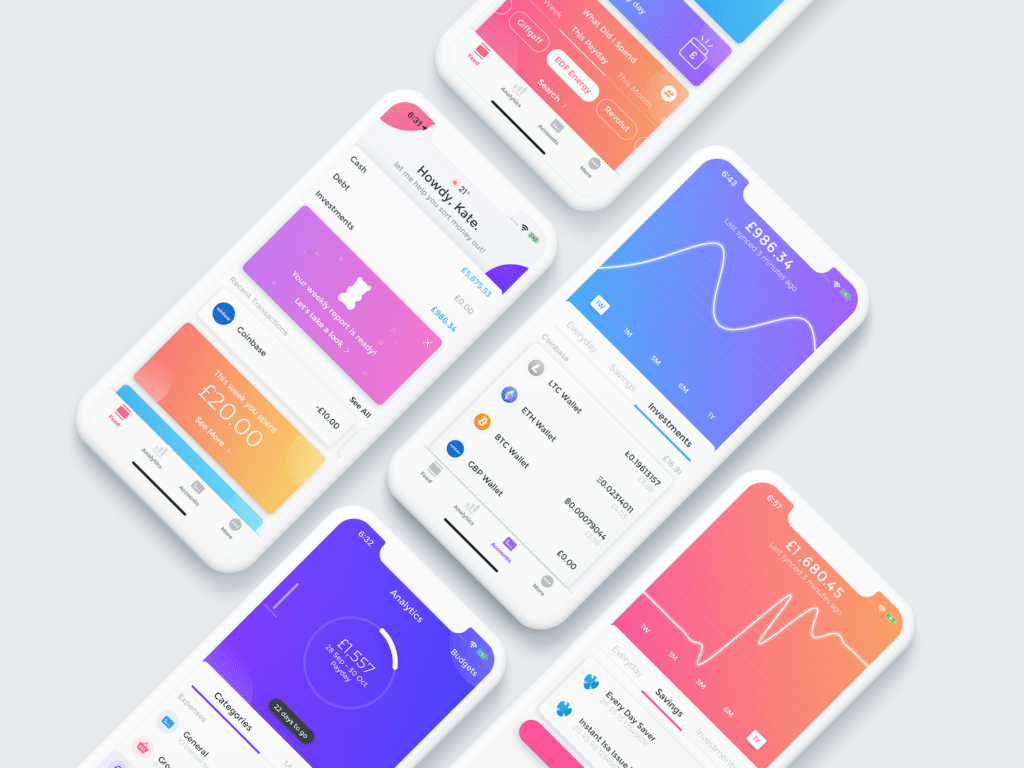

Emma gives customers a simple and clear dashboard to easily analyse their money and spending habits. By analysing customers spending patterns, Emma also offers a host of useful features, like the ability to predict when users are about to hit their overdraft.

If Emma gives customers oversight of their finances, Chip optimises and automates them.

By connecting Chip to your current account, Chip analyses your spending behaviour and automatically saves money, without you feeling it. Chip’s AI-powered algorithm intelligently analyses your life to make the decisions you should make, automatically.

Chip customers are now saving £7million every month and last year the business carried out the largest crowdfund in UK history.

About Emma

Emma is currently building the banking app for millennials (iOS and Android), a mobile only solution that helps consumers avoid overdrafts, find and cancel subscriptions, track debt and save money. The product aims at providing a consumer focused banking experience, with the goal to improve the financial lives of its users.

Based in London, Emma launched in January 2018 with a team of finance and technology experts. The company raised a seed round of £500k in July 2018 led by Kima Ventures, one of the first investors in Transferwise, and Aglaé Ventures, the early stage program of the Groupe Arnault, investor in Netflix and Airbnb.

** Please note, our connection to Chip is no longer live. You can find out more information about this on the Emma Community, here.

You may also like

Check out these related blog posts for more tips

© 2026 Emma Technologies Ltd. All Rights Reserved.

Emma is registered and incorporated in England and Wales.

Emma Technologies Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority (FRN 775330).

Payment services (Non MIFID or Deposit related products) for Emma Technologies Ltd are provided by The Currency Cloud Limited. Registered in England No. 06323311. Registered Office: Stewardship Building 1st Floor, 12 Steward Street London E1 6FQ. The Currency Cloud Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money (FRN: 900199). For more detail on how your money is protected please see here. You can also find Currency Cloud's Terms of Use here.

Emma Technologies is an Introducer Appointed Representative of Quint Group Limited and not a lender. Quint Group Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 669450). Monevo Limited is an Appointed Representative of TransUnion International UK Limited. TransUnion is authorised and regulated by the Financial Conduct Authority (Firm Reference Number 737740). Emma Technologies introduces customers first to Quint Group Limited, as a licensed credit broker, who then refers on to Monevo Limited.

Emma is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services.

Financial Conduct Authority Reg Nr: 794952.

Company Registration Number: 10578464.

Data Protection Registration Number: ZA241546.

All testimonials, reviews, opinions or case studies presented on our website may not be indicative of all customers. Results may vary and customers agree to proceed at their own risk.

Resources: Cancel subscriptions, Cashback offers, Who charged me, Rent Reporting, Budgeting, Investment universe, Emma vs Moneyhub.

Featured cashback offers: Samsung, SimplyCook, NordVPN, Audible, M&S Homeware.